- LOGIN

- MemberShip

- 2026-03-09 20:47:41

- Policy

- Alfacalcidol approvals increase with expansion of Prolia biosimilars

- by Lee, Tak-Sun Feb 11, 2026 08:09am

- AI-generated imageAs biosimilars for the osteoporosis treatment ‘Prolia (denosumab)’ continue to emerge, products containing the active ingredient alfacalcidol are also increasing.Denosumab-based osteoporosis therapies have effectively dominated the market due to their strong bone mineral density–enhancing effects and patient convenience, as they are administered via subcutaneous injection once every six months.However, because denosumab carries a risk of hypocalcemia, patients are required to take calcium and vitamin D supplements. As a result, the value of alfacalcidol, an “active form of vitamin D,” has also been increasing.According to the Ministry of Food and Drug Safety (MFDS), seven alfacalcidol products have been approved so far in 2026. As of February 9, a total of 42 alfacalcidol products have been approved, with 27 products (over 60%) receiving approval since 2025.Yuyu Pharma has emerged as a major contract manufacturer for alfacalcidol products. Meanwhile, YS Life Science, which has developed tablet formulations that are easier to swallow than capsules, is also expanding its contract manufacturing business. Notably, all three recently approved products are tablet formulations manufactured by YS Life Science.The recent increase in alfacalcidol product development is closely linked to the expansion of the denosumab biosimilar market. The compound patent for Prolia, which accounts for approximately KRW 1.7 trillion in annual market size in Korea, expired in March 2025.Following the patent expiration, Celltrion and Samsung Bioepis launched biosimilar products last year, and on February 4, HK inno.N received approval for its denosumab biosimilar, Izambia Prefilled Syringe. With the entry of additional biosimilars, the overall market size is expected to continue growing further.Denosumab inhibits osteoclast activity, thereby preventing bone destruction and increasing bone mineral density. It offers improved convenience in administration with a single subcutaneous injection every six months.However, because it strongly suppresses bone resorption, there is concern that it may increase the risk of hypocalcemia, particularly in patients with chronic kidney disease or those undergoing dialysis.In 2024, the U.S. Food and Drug Administration (FDA) added a boxed warning to the Prolia label regarding the increased risk of severe hypocalcemia in patients with advanced chronic kidney disease. This update, based on clinical data, has also been reflected in Korea’s label and indication as well.Accordingly, healthcare providers are advised to monitor patients for signs of hypocalcemia after Prolia administration and to prescribe calcium and vitamin D supplements concurrently.Alfacalcidol is an active form of vitamin D that does not require renal activation, offering the advantage of reduced burden on the kidneys. For this reason, it has been gaining attention as a complementary therapy to Prolia. The indications for alfacalcidol are: ▲ Improvement of symptoms associated with vitamin D metabolism disorders in chronic renal failure, hypoparathyroidism, and vitamin D-resistant rickets/osteomalacia; ▲ Osteoporosis.Looking ahead, alfacalcidol product development is expected to continue increasing through expanded contract manufacturing. An industry source commented, “As an over-the-counter drug, alfacalcidol faces no bioequivalence regulations, making contract manufacturing easy and straightforward. Coupled with the anticipated market expansion due to the emergence of denosumab biosimilars, it is expected to remain popular in the product development market for the foreseeable future.”

- Policy

- Concerns mount over push for 100-day listing of rare disease drugs

- by Jung, Heung-Jun Feb 11, 2026 08:08am

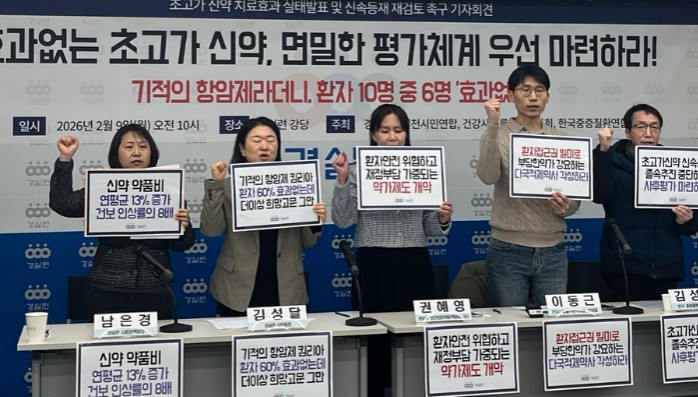

- Concerns are mounting over the government’s plan to list rare disease therapies within 100 days, with critics warning that the absence of concrete post-marketing evaluation measures could ultimately undermine the national health insurance system.Some point to the lack of sufficient social consensus in the drug pricing reform as the fundamental issue, arguing that a formal discussion body involving civil society groups, patient advocacy groups, and experts should be established before it is too late.On the 9th, the Citizens’ Coalition for Economic Justice (CCEJ), the Korean Pharmaceutical Association for a Healthy Society, and the Korea Severe Disease Association held a joint press conference to express their opposition to the fast-track listing of rare disease treatments.Even after the event, Dong-geun Lee, Vice President of the Korean Pharmacists' Association for Healthy Society, repeatedly stressed the problems inherent in pursuing fast-track listing without post-marketing evaluation measures.Lee emphasized, “It makes no sense to push ahead with the fast-track listing without a post-marketing evaluation plan in place. We have already conveyed our concerns, but the Ministry of Health and Welfare appears intent on proceeding according to a predetermined schedule.” He emphasized that post-marketing evaluation measures must be established first before any fast-track listing is pursued.The Korean Pharmacists' Association for a Healthy Society maintains that even if the timing of the drug pricing system reform plan, including expedited listing, is delayed, the potential side effects of the policy must be thoroughly examined.Lee said, “The February Health Insurance Policy Deliberation Committee (HIPDC) decision timeline was also arbitrarily set by the Ministry. Even if the schedule is pushed back, sufficient discussion is necessary. If there is even a draft plan for post-marketing evaluation, it should be disclosed so that meaningful dialogue can take place.”Lee also warned, “To make listing within 100 days possible, verification would have to be bypassed and prices approved as requested. That kind of timeline is only feasible for drugs exempt from negotiation or for generics. But based on what has been announced so far, rare disease therapies would effectively be eligible for listing without any additional hurdles.”Given that rare disease treatments often cost tens to hundreds of millions of won, critics argue that if a large number of previously unlisted products are approved, the additional financial burden could exceed one trillion won. Despite this, they say, the government has yet to present any clear plan for securing the necessary funding.The groups also insist that the results of performance-based evaluations for high-priced drugs should be transparently disclosed to patients. Some rare disease therapies already listed have failed to deliver the expected outcomes, and groups argue that this information must be transparently provided to patients.Lee said, “Although the ministry has met with patient groups, it appears to be merely notifying them of decisions already made and pushing the policy through. More discussion is needed with citizens, patient groups, and experts. Above all, the government must disclose its basic plans for post-marketing evaluation and funding.”The Korean Pharmacists' Association for Healthy Society, CCEJ, and patient groups are also continuing discussions on the effectiveness and potential problems surrounding the reform of the generic drug pricing system, suggesting that criticism of the broader drug pricing overhaul is likely to intensify further.

- Company

- Vanflyta wins nod in KOR…expanded AML targeted therapy options

- by Son, Hyung Min Feb 11, 2026 08:08am

- Vanflyta (quizartinib), a new targeted therapy for acute myeloid leukemia (AML), has officially been added to first-line treatment options in South Korea, intensifying market competition.Until now, Vanflyta has faced significant hurdles, including rejections from global regulatory bodies due to safety concerns. However, it has been reevaluated based on survival benefits, signaling a potential shift in the FLT3 inhibitor market, currently dominated by Rydapt (midostaurin) and Xospata (gilteritinib).A key factor in this market restructuring is Vanflyta's comprehensive treatment model, which includes maintenance therapy for patients with the high-risk FLT3-ITD mutation.Strategy for targeting FLT3-ITD has been clarifiedAccording to industry sources on February 11, Daiichi Sankyo Korea announced that Vanflyta (quizartinib) obtained approval in Korea.AML therapy 'Vanflyta'With this approval, Vanflyta can now be used in combination with standard cytarabine and anthracycline induction therapy and standard cytarabine consolidation therapy for newly diagnosed adult patients with FLT3-ITD mutation–positive AML. It is also approved as a maintenance monotherapy.Up to 37% of newly diagnosed AML patients carry the FLT3 mutation, with approximately 80% specifically possessing the FLT3-ITD variant. This mutation is known to drive cancer growth, increase recurrence risk, and shorten overall survival. The five-year survival rate for these patients has been reported at about 20%.The approval is based on the Phase 3 QuANTUM-First study, which involved 539 treatment-naive FLT3-ITD-positive AML patients.In this study, the Vanflyta group showed a 22% reduction in mortality risk compared with the placebo group. At a median follow-up of 39.2 months, the median overall survival (OS) in the Vanflyta group was 31.9 months, more than double the 15.1 months observed in the placebo group.In terms of safety, addverse events were similar to those of the placebo group, with common observations including febrile neutropenia, hypokalemia, and pneumonia.In particular, patients who participated in the study received induction, consolidation, and maintenance for up to 3 years, regardless of whether they unwent allogeneic hematopoietic stem cell transplantation (HSCT). Therefore, it is a distinct advantage of Vanflyta in the clincial field.Expected to bring a shift to the market centered around Xospata·RydaptThe FLT3 inhibitor market has been led by Novartis's first-generation Rydapt and Astellas's second-generation Xospata.While Rydapt reduced mortality by 23% in the RATIFY study when combined with standard therapy, it lacks strong evidence for maintenance therapy post-transplant and has relatively lower selectivity for FLT3-ITD.(from left) Novartis 'Rydapt', Astellas 'Xospata'Xospata was commercialized as the first once-daily oral monotherapy for relapsed or refractory AML, with response rates better than those with Rydapt.However, Xospata failed to demonstrate sufficient clinical benefit in trials for first-line induction or post-transplant maintenance. Because of this, it is firmly established in the market. analysis suggests that this drug has limitations in obtaining an expanded indication spectrum.Medical experts are focusing on Vanflyta's inclusion of maintenance therapy. While previous inhibitors lacked clear strategies for consolidation, Vanflyta's effectiveness was demonstrated in extending complete remission (CR) and safety through long-term follow-up of over 5 years.There have been various hurdles for Vanflyta until it was approved in Korea. This drug was originally developed by Ambit Biosciences, which was acquired by Daiichi Sankyo in 2014.Vanflyta faced a major roadblock in 2019 when the U.S. FDA denied approval. The FDA cited risks of QT interval prolongation and inadequate cardiac toxicity management plans.The QT interval is measured from the beginning of the Q wave to the end of the T wave on an electrocardiogram (ECG). It represents the total time required for the heart's ventricles to undergo depolarization and repolarization. Abnormally long or short QT interval is linked to the increased risks of abnormal heart rhythm or occurrence eof sudden death.In the case of Vanflyta, Daiichi Sankyo addressed these risks by enhancing its Risk Evaluation and Mitigation Strategy (REMS) and safety protocols. However, in 2023, the FDA issued a 3-month extension for an additional safety review.After that, the FDA approved the drug following the Phase 3 QuANTUM-First study, which demonstrated significant benefits in overall survival (OS) for AML patients. This led to Vanflyta's subsequent approvals in Europe and South Korea, and Vanflyta succeeded in entering the global market.

- Company

- Will Ofev be reimbursed for idiopathic pulmonary fibrosis in Korea?

- by Eo, Yun-Ho Feb 11, 2026 08:08am

- Attention is once again focused on whether reimbursement coverage for Ofev (nintedanib) can be expanded to include idiopathic pulmonary fibrosis (IPF) in Korea. Despite being approved a decade ago, the drug has remained non-reimbursed for this indication.According to Dailypharm coverage, Boehringer Ingelheim Korea submitted an application in the second half of last year to expand reimbursement coverage for idiopathic pulmonary fibrosis (IPF) following the drug’s successful listing for progressive pulmonary fibrosis in May last year.This time, the company is reported to have additionally submitted real-world data (RWD) on patients who failed first-line treatment with Pirespa (pirfenidone), including those who discontinued therapy due to adverse events.Ofev was approved in Korea in October 2016, but reimbursement discussions have been delayed due to disagreements between the government and the manufacturer over pricing. The drug’s patent has since expired domestically, and multiple generic versions have entered the market.Nevertheless, a significant unmet medical need has persisted even after Ofev’s initial reimbursement listing. At the time, the government deemed reimbursement inadequate for the IPF indication, citing insufficient cost-effectiveness data.As a result, attention is now turning to whether IPF patients could use Ofev with reimbursement within the year.Meanwhile, idiopathic pulmonary fibrosis is the leading cause of death among rare diseases in Korea. It is a rare, intractable condition where the interstitial tissue between the alveoli becomes fibrotic and progressively hardens without an identifiable cause. As the lung structure responsible for oxygen exchange is destroyed, chronic cough and shortness of breath occur, ultimately progressing to respiratory failure.Disease progression is also rapid. While normal adults experience an annual decline in lung function of approximately 10–20 cc, patients with IPF lose 150–250 cc per year, corresponding to roughly 10% of lung function annually.Acute exacerbations, which occur in about 10% of patients each year, are particularly fatal. When this state occurs, causing the lungs to rapidly deteriorate within weeks, approximately half of the patients die. The risk of developing lung cancer is 5 to 7 times higher than in the general population, and serious comorbidities such as cardiovascular disease, stroke, and depression are also common.

- Company

- Hanmi's new drug licensed to MSD, greenlight for entering Phase 3 trial?

- by Chon, Seung-Hyun Feb 10, 2026 08:14am

- It is likely that 'efinopegdutide,' a novel treatment for metabolic dysfunction-associated steatohepatitis (MASH) licensed from Hanmi Pharmaceutical to MSD, would proceed to Phase 3 clinical trials. MSD concluded Phase 2 clinical trials at the end of last year and has significantly expanded its supply of clinical samples from Hanmi to prepare for Phase 3 studies. Improvements in export performance contributed to Hanmi Pharmaceutical recording an operating profit margin of nearly 20% in Q4 of last year.According to Hanmi Pharmaceutical, on the 6th, the company's Q4 exports last year reached KRW 54.2 billion, a 15.3% year-on-year increase. This represents an 83.0% jump from the KRW 29.6 billion recorded in Q3. While Hanmi's export volume had declined for two consecutive quarters after reaching KRW 68.2 billion in Q1 of last year, it rebounded sharply in Q4.Hanmi Pharmaceutical's Quarterly Export Performance (unit: KRW 1 million, source: Hanmi Pharmaceutical)The company explained that the export expansion was driven by a significant increase in the supply of efinopegdutide clinical samples to MSD, produced at Hanmi's Pyeongtaek Bio Plant.Efinopegdutide is a MASH treatment candidate that Hanmi Pharmaceutical licensed to MSD in August 2020. The deal was valued at up to $870 million, including a $10 million upfront payment.The drug is a dual agonist that simultaneously activates GLP-1, which aids insulin secretion and appetite suppression, and glucagon, which increases energy metabolism. It utilizes Hanmi's proprietary LAPSCOVERY technology to extend the drug's half-life.A Hanmi Pharmaceutical official stated, "Export volumes grew in Q4 as clinical samples were supplied to prepare for MSD's Phase 3 clinical trials."Following the licensing of efinopegdutide, MSD conducted Phase 2 trials comparing efinopegdutide with Novo Nordisk's semaglutide and a placebo. Results from a Phase 2a analysis presented at the 2023 European Association for the Study of the Liver (EASL) in Vienna showed that efinopegdutide reduced liver fat content by 72.7% relative to baseline at week 24. This significantly outperformed semaglutide, which showed a 42.3% reduction over the same period. Industry experts interpret MSD's purchase of clinical samples as a "green light" to enter Phase 3, suggesting that MSD is preparing for the next stage as positive outlooks were shown for Phase 2 results.MSD completed the Phase 2b trial for efinopegdutide in December last year and is expected to announce the results this year.According to ClinicalTrials.gov, the Phase 2b study began on June 23, 2023, and concluded on December 29, 2024, with 381 participants enrolled. MSD completed the Phase 2b trial for efinopegdutide in December 29 of last year. (source: ClinicalTrials.gov)In its recent Q4 earnings report, MSD listed efinopegdutide in its Phase 2 pipeline for cardiovascular, metabolic, and respiratory diseases. This report indicates that efinopegdutide is categorized as a core pipeline.Hanmi Pharmaceutical is showing a recurring pattern of surging exports tied to the supply of clinical samples of efinopegdutide. In Q1 of last year, exports rose 45.1% compared to the previous quarter. At that time, Hanmi announced that "Increased revenue from clinical samples delivered to MSD contributed to 'etc. regional volume' increases."Meanwhile, efinopegdutide is a candidate that was previously licensed to Janssen in December 2015 (as JNJ-64565111). The total contract volume amounted to $915 million with an upfront payment of $105 million. After Janssen returned the rights of JNJ-64565111 in 2019, Hanmi re-licensed it to MSD for NASH (now MASH) treatment within a year.The increase in exports of clinical samples significantly improved Hanmi's overall financial performance. In Q4 of last year, operating profit reached KRW 83.3 billion, up 173.4% year-on-year, while revenue grew 23.1% to KRW 433 billion. The operating profit margin for the quarter hit 19.2%, the highest in ten years since the 29.1% recorded in Q4 of 2015, when Hanmi secured a blockbuster licensing deals. In Q4 of 2015, Hanmi recorded sales of KRW 589.9 billion and an operating profit of KRW 171.5 billion.

- Policy

- Opdivo voluntarily recalled due to metal particle contamination concern

- by Lee, Tak-Sun Feb 10, 2026 08:14am

- Opdivo (nivolumab, Ono Pharmaceutical Korea), an immuno-oncology drug used across multiple cancer indications, is being voluntarily recalled due to concerns over potential metallic particle contamination.The recall raises concerns over possible treatment disruptions for cancer patients.According to the Ministry of Food and Drug Safety (MFDS), as of the 6th, Opdivo Inj 20 mg, 100 mg, and 240 mg strengths are being voluntarily recalled after information indicating a risk of foreign matter contamination was identified.The recall was initiated after reports suggested the possible presence of fine metal particles attached to the inner surface of the rubber stopper on Opdivo vials.The company stated, “Opdivo is administered using an in-line filter (0.2–1.2 μm). While the potential for inflammation or metal hypersensitivity reactions is considered limited, we have requested that relevant wholesalers, hospitals, and clinics suspend use of the affected products.”MFDS reported the voluntary recall of the following lots: 8 lots of Opdivo Inj 20 mg (2341FA [2026-02-09], 2342FA [2026-03-15], 2342FB [2026-03-16], 2349FA [2026-10-12], 2448FA [2027-09-25], 2542FA [2028-03-03], 2542FB [2028-03-04], 2542FC [2028-03-04]); 13 lots of Opdivo Inj 100 mg (2342FA [2026-03-09], 2343FA [2026-04-24], 2343FB [2026-04-25], 2345FA [2026-06-08], 2345FB [2026-06-08], 2345FC [2026-06-11], 2443FA [2027-04-21], 2443FB [2027-04-22], 2450FA [2027-11-04], 2450FB [2027-11-04], 2542FA [2028-03-26], 2542FB [2028-03-27], 2545FA [2028-06-01]); and 6 lots of Opdivo Inj 240 mg (2343FA [2026-04-16], 2343FB [2026-04-17], 2343FC [2026-04-18], 2349FA [2026-10-23], 2349FB [2026-10-24], 2544FA [2028-05-21])Opdivo is an immune checkpoint inhibitor (PD-1 inhibitor) that prevents cancer cells from evading immune cells (T cells). It works by binding to the PD-1 receptor on the surface of T cells, blocking its interaction with the PD-L1/L2 ligands on cancer cells. This activates the T cells to attack the cancer cells. It is a fully human IgG4 monoclonal antibody.In Korea, Opdivo is reimbursed for indications including first-line gastric cancer, head and neck cancer, third-line or later relapsed/refractory Hodgkin lymphoma after autologous stem cell transplantation, and renal cell carcinoma in combination with Yervoy (ipilimumab). Reimbursement expansion is also being pursued for first-line non-small cell lung cancer and hepatocellular carcinoma.With increasing clinical use, Opdivo’s annual domestic sales are reported to exceed KRW 100 billion.Given that Opdivo is administered to cancer patients, concerns have been raised that the recall could lead to supply disruptions and treatment gaps. The incident is also expected to impact product trust.

- Company

- HanAll’s development of Imeroprubart on track

- by Choi Da Eun Feb 10, 2026 08:14am

- Clinical development of Imeroprubart, HanAll Biopharma’s autoimmune disease drug candidate, is progressing smoothly.Roivant Sciences, the parent company of HanAll’s partner Immunovant, disclosed the latest development updates on Imeroprubart (Immunovant development code IMVT-1402) during its earnings call on the 6th (U.S. time).Imeroprubart is one of the FcRn inhibitor candidates that HanAll Biopharma licensed to Roivant in 2017. Clinical programs are currently underway across six autoimmune indications: Graves’ disease (GD), difficult-to-treat rheumatoid arthritis (D2T RA), myasthenia gravis (MG), chronic inflammatory demyelinating polyneuropathy (CIDP), Sjögren’s disease (SjD), and cutaneous lupus erythematosus (CLE). The company estimates that the drug could offer a new treatment option to more than 600,000 patients in the U.S. alone.Notably, enrollment in the registrational trial for D2T RA progressed faster than anticipated, exceeding initial targets with 170 patients enrolled. Top-line results are expected in the second half of this year, and no major safety concerns have been reported to date.A proof-of-concept (PoC) trial in cutaneous lupus erythematosus (CLE) is also ongoing, with top-line data anticipated later this year. The upcoming clinical readouts are viewed as critical indicators of whether Imerofravat can establish itself as a first-in-class and best-in-class therapy.Roivant also outlined its future development timeline. It plans to sequentially release topline results from pivotal trials for Graves' disease and myasthenia gravis in 2027, followed by commercialization starting with the Graves' disease indication in 2028.In addition, Immunovant disclosed a single-patient case from an ongoing open-label study within the CLE PoC trial. CLE is an autoimmune condition characterized by chronic skin inflammation, presenting with erythema, pain, pruritus, burning sensations, and alopecia. In severe cases, it can lead to irreversible damage such as scarring, pigmentary changes, and permanent hair loss.According to the IR materials disclosed by Immunovant, a patient who received high-dose Imeroprubart (600 mg) for 12 weeks showed a greater than 60% reduction in the CLASI-A score (from 36 to 13), which measures the severity of skin inflammation. Clinically meaningful improvements were also observed in hair loss and skin lesions. Antibody (IgG) levels in the blood at week 12 showed a 78% reduction from baseline.Seungwon Jeong, President and CEO of HanAll Biopharma, said, “We are pleased to see Imeroprubart’s clinical development progressing faster than planned. We expect the data to be released in the second half of this year to more clearly demonstrate Imeroprubart’s differentiated therapeutic efficacy and competitiveness.”

- Opinion

- ‘Elahere demonstrates OS benefit in ovarian cancer’

- by Son, Hyung Min Feb 10, 2026 08:14am

- The treatment landscape for platinum-resistant ovarian cancer (PROC), which is characterized by high relapse rates and limited effectiveness of standard therapies, is showing signs of change.Elahere (mirvetuximab soravtansine), the first folate receptor alpha (FRα)-targeted antibody–drug conjugate (ADC) approved for ovarian cancer, has demonstrated improved overall survival (OS) in a global Phase III clinical trial and obtained regulatory approval in Korea.Kidong Kim, Department of Obstetrics and Gynecology, Seoul National University Bundang HospitalProfessor Kidong Kim from the Department of Obstetrics and Gynecology at Seoul National University Bundang Hospital said, “Ovarian cancer relapses frequently, and once it progresses to platinum resistance, median survival is often less than one year. With the advent of Elahere, identifying FRα expression earlier during diagnosis is becoming increasingly important in establishing individualized treatment strategies.”Ovarian cancer is a gynecological cancer originating in the ovaries, fallopian tubes, or primary peritoneum. Approximately 3,000 to 3,500 new cases are diagnosed annually in Korea. Due to accumulated risk factors such as reduced childbirth rates, early menarche, and late menopause, the number of patients is on the rise. Notably, as more than two-thirds of patients are in their 40s to 60s, the age group most active in family and social life , diagnosis is particularly impactful on patients, families, as well as society as a whole.Upon diagnosis, standard first-line treatment consists of surgery followed by platinum-based chemotherapy. While many patients respond to first-line therapy, approximately 80% eventually experience recurrence.With each recurrence, the tumor acquires resistance to platinum-based anticancer drugs, eventually progressing to the stage of platinum-resistant ovarian cancer, where this treatment becomes largely ineffective. Patients who relapse within six months of initial treatment are classified as having typical platinum-resistant ovarian cancer. By this stage, the patient's overall health is often significantly compromised, and available subsequent treatment options are extremely limited.Elahere, which was approved in Korea in December last year, is the first novel mechanism therapy introduced for ovarian cancer in nearly a decade. Elahere is an FRα-targeted ADC expressed on the surface of cancer cells, enabling a form of precision therapy distinct from conventional cytotoxic chemotherapy.FRα is minimally expressed in normal tissues but is highly overexpressed in ovarian cancer cells. Studies indicate that approximately 35–40% of ovarian cancer patients are FRα-positive and meet Elahere’s treatment criteria. More importantly, FRα expression tends to remain relatively consistent from diagnosis through recurrence, making it a useful biomarker throughout the disease course.Elahere consists of an FRα-targeting antibody linked to a cytotoxic payload. Upon administration, the antibody selectively binds to FRα on tumor cells, is internalized, and releases the payload to induce cancer cell death while exerting a bystander effect on neighboring tumor cells. This mechanism enables a precision anticancer strategy that minimizes damage to normal tissue with potent antitumor activity.Professor Kim explained, “While there have been various attempts to develop new drugs in the field of platinum-resistant ovarian cancer in the past, few have achieved clinically significant success. With the broader adoption of the ADC platform, some drugs have begun to show meaningful results, and Elahere is one drug that represents this trend.”Q. How were platinum-resistant ovarian cancer patients who do not respond to platinum-based therapy treated in the past?First-line treatment typically involves platinum-based chemotherapy. Upon relapse, platinum-based chemotherapy may be reused depending on the relapse interval, but for patients who relapse shortly after platinum-based therapy, other drugs are used, excluding platinum-based agents. Recurrence within 6 months after platinum-based therapy is termed platinum-resistant ovarian cancer, which has limited treatment response and a very poor prognosis, with survival typically under 1 year.Currently approved options include pegylated liposomal doxorubicin and topotecan (as non-platinum-based regimens for platinum-resistant ovarian cancer). The overall efficacy of these agents is similar, and there have been challenges in practice due to their limited efficacy and response rates.While study results vary, some report objective response rates as low as 5%. This means only about 5 out of 100 patients show tumor size reduction. Failure of such treatment typically leads to a cycle of switching to different anticancer drugs and continuing treatment with diminishing benefit.Q. Could you explain the MIRASOL trial that supported Elahere’s approval? What were the characteristics of the patients enrolled, and what were the study results?MIRASOL was a randomized clinical trial in platinum-resistant ovarian cancer patients. The experimental arm received Elahere monotherapy, while the control arm received standard non-platinum chemotherapy (paclitaxel, pegylated liposomal doxorubicin, or topotecan). Approximately half of the participants had received three or more prior lines of therapy, and some had prior exposure to bevacizumab or PARP inhibitors.The study results confirmed a statistically significant improvement in progression-free survival (PFS) in the Elahere treatment group compared to the control group. However, Elahere garnered even more attention because it demonstrated a difference in overall survival (OS). While drugs showing PFS improvement had existed before, a drug proving a statistically significant improvement in overall survival had been absent for a long time. In this context, Elahere became the first drug to demonstrate an OS improvement of approximately 4 months (mOS 16.46 vs 12.75), and these results were why Elahere received such significant attention.Q. Confirming FRα expression status is essential for Elahere treatment. When is the most appropriate time to perform the companion diagnostic testing to determine FRα positivity?Ideally, FRα expression should be assessed at initial diagnosis using tumor tissue obtained during surgery. There are two reasons for this.First, some studies indicate that FRα expression tends to remain relatively consistent both at initial diagnosis and at recurrence. While some biomarkers may show changing expression levels as the disease progresses, FRα has demonstrated consistent expression in research. This allows the results from the initial diagnostic test to be utilized for subsequent treatment decisions.Another reason lies in the nature of ovarian cancer. Ovarian cancer frequently recurs, and during recurrence, multiple drugs are selected and used sequentially. In this process, prior treatment choices often influence the treatment options available at recurrence. Determining FRα expression at the initial diagnosis stage helps establish the best overall treatment strategy for the patient.Selecting the most effective drug early on can lead to more favorable outcomes for the patient, especially in the current environment where various treatment options exist. Conversely, if FRα expression is confirmed and Elahere is used only after all other options have been exhausted, there is a possibility that a better choice could have been made at an earlier stage. For these reasons, we believe it is advantageous to perform the FRα companion diagnostic test as early as possible in the diagnostic process.Q. The MIRASOL study demonstrated PFS improvement with Elahere. However, based solely on absolute numbers, the PFS benefit may appear modest numerically. What is its clinical significance?When discussing treatment options with patients, the question inevitably arises: ‘How much tangible benefit would this drug actually provide?’ Two key points warrant consideration here.First, platinum-resistant ovarian cancer is a disease that is extremely difficult to treat. Despite the development of numerous drugs over the years, none have demonstrated sufficient clinical benefit. Therefore, the fact that a statistically significant improvement was observed, regardless of the absolute median difference, is meaningful.Moreover, while median values reflect population averages, individual patient responses may vary greatly. In MIRASOL, Elahere achieved an objective response rate of 42.3%. For example, consider a patient with two or three tumor lesions. After Elahier treatment, two lesions completely disappeared, leaving only one. In such a responding patient, the possibility of attempting a cure through additional radiotherapy or surgery, while rare, clearly exists.In other words, the finding that progression-free survival was extended by an average of about 2 months is merely the result of a group comparison. The actual benefit for individual patients could be significantly greater.Q. How do you assess Elahere’s safety profile?ADC therapies function by binding cytotoxic anticancer agents to antibodies for delivery to tumor cells, so they can be considered to have characteristics similar to traditional cytotoxic anticancer agents (chemotherapy). Therefore, while the degree and presentation may differ, adverse events seen with traditional cytotoxic anticancer agents can occur, and a similar approach to adverse event management would be necessary.Ocular adverse events are notable, and because clinical experience is still accumulating, it is important to recognize that healthcare providers are still in the process of gaining sufficient clinical experience with ocular adverse events caused by this drug. Therefore, I believe clear management guidelines and clinical consensus regarding ocular adverse events for ADC-based therapies will be established as real-world use expands.Q. I understand you have experience prescribing Elahere. Could you share your treatment experience?I have experience treating patients with Elahere through the Expanded Access Program (EAP) and clinical trials. A patient currently receiving treatment through EAP has completed approximately 5 cycles of the drug. The patient is still responding to treatment and continuing therapy without any particular adverse events.Another patient who participated in a clinical trial experienced a reduction in tumor size but also encountered ocular adverse events. While more data is being accumulated, appropriate management strategies and sufficient clinical data still need to be further established.Q. Do you have any recommendations on improving the ovarian cancer treatment environment?Ultimately, the hope of all patients and medical professionals is for the development of a treatment that can achieve a cure even in platinum-resistant ovarian cancer. While rare cases of near-complete remission have been observed with existing treatment options, the mechanisms underlying such high treatment responses remain unclear. Active research and development of various novel drugs are underway to understand these mechanisms and identify more effective treatment strategies.Alongside this, I believe that managing adverse events is just as critical as treatment efficacy in the real-world setting. It is not uncommon for patients to have poor treatment adherence due to difficulty making outpatient visits because of their circumstances. In such situations, the occurrence of adverse events can lead to rapid treatment discontinuation. Therefore, I believe that the better the drug, the more crucial adverse event management becomes in actual clinical practice.Treatment accessibility is also a crucial factor. Elahere is the first treatment to demonstrate a statistically significant improvement in overall survival (OS) in platinum-resistant ovarian cancer. If practical access improves in the future, we expect more patients will have the opportunity to receive this treatment.

- Company

- Statin + ezetimibe comb emerging as cashcows…33 over KRW 10B

- by Chon, Seung-Hyun Feb 10, 2026 08:14am

- In the Korean pharmaceutical industry, combination drugs containing statin + ezetimibe have become strong cash cows. Last year, 33 products surpassed KRW 10 billion in prescription sales, contributing to the company's firm performance. Notably, four products achieved annual prescriptions exceeding KRW 100 billion.Prescription sales of 20 combination drugs containing rosuvastatin‧ezetimibe surpassed KRW 10 billion. Hanmi Pharmaceutical, with Rosuzet as a key product, generated over KRW 200 billion in the statin + ezetimibe market, while Organon, Yuhan Corporation, and JW Pharmaceutical also gained high profits from these combinations.Last year, 33 statin+ezetimibe combination products recorded over KRW 10 billion…4 items surpassed KRW 100 billionAccording to pharmaceutical market research firm UBIST, 33 statin+ezetimibe combination products recorded over KRW 10 billion in prescriptions last year, an increase of six items from 27 in 2024.Statin + ezetimibe combination drugs exceeding KRW 10 billion in annual prescription sales (unit: KRW 100 million, source: UBIST). GRAY: simvastatin + ezetimibe, ORANGE: pitavastatin+ezetimibe, RED: atorvastatin+ezetimibe, BLUE: rosuvastatin+ezetimibeCurrently, four types of statin+ezetimibe combinations are available, ezetimibe + four tyeps of statin (simvastatin, rosuvastatin, atorvastatin, or pitavastatin). Last year, the rosuvastatin+ezetimibe market was the largest at KRW 809.6 billion, followed by atorvastatin+ezetimibe at KRW 380 billion and pitavastatin+ezetimibe at KRW 185.3 billion.Statin+ezetimibe combinations that generated over KRW 10 billion in prescription sales have tripled in five years, from 11 items in. The products in the '100 Billion KRW Club' continued to join every year, growing from 11 in 2020 to 13 in 2021, 18 in 2022, and 23 in 2023.Last year, there were four items with KRW 100 billion in prescription sales.Rosuzet by Hanmi Pharmaceutical, the first domestically developed statin + ezetimibe combination drug, recorded KRW 227.9 billion. Since its 2015 launch, Hanmi has secured an early lead by obtaining rights to ezetimibe usage from the patent holder, MSD. Currently, 50 domestic pharmaceutical companies have entered the statin + ezetimibe combination drug market.Atozet by Organon, the original atorvastatin + ezetimibe combination, reached KRW 127.3 billion in sales. This drug surpassed KRW 100 billion for the first time recording KRW 102.1 billion in 2023. It recorded sales above KRW 100 billion for three consecutive years, despite generic competition.LivaloZet by JW Pharmaceutical generated KRW 117 billion last year, becoming the second domestically developed product to join the '100 billion won club.' LivaloZet is a combination drug of pitavastatin + ezetimibe. LivaloZet achieved remarkable success in 2022, with prescription sales of KRW 31.8 billion. Sales skyrocketed to KRW 70.4 billion and KRW 93.3 billion in 2023 and 2024, respectively. LivaloZet showed notable growth last year, surpassing KRW 100 billion in sales for the first time.Yuhan Corporation's rosuvastatin + ezetimibe combination, Rosuvamibe, joined the '100 billion won club' with prescription sales of KRW 102.2 billion last year. Rosuvamibe surpassed KRW 100 billion in annual prescriptions in its 10th year since its launch in 2016. It is recording a high growth rate, expanding by 88.1% over five years from a prescription volume of KRW 54.3 billion in 2020.20 items with rosuvastatin + ezetimibe over KRW 10BLooking at the number of products with prescriptions over KRW 10 billion by ingredient for statin + ezetimibe combinations, rosuvastatin + ezetimibe accounted for more than half, with 20 items. This is more than double the nine items recorded in 2020.Following Rosuzet and Rosuvamibe, HK inno.N's Rovazet showed strength with a prescription volume of KRW 56.6 billion last year. Rovazet expanded more than twofold over five years, from KRW 27.5 billion in 2020, and last year's prescription volume increased by 19.6% compared to the previous year.Last year's prescriptions for Daewoong Pharmaceutical's Crezet reached KRW 47.7 billion, a 24.2% increase from the previous year. It has maintained a high-growth trend, more than doubling from KRW 20 billion in 2020 to KRW 45 billion over the past five years. GC Biopharma's Daviduo and Aju Pharmaceutical's Cretrol recorded prescriptions of KRW 34.4 billion and KRW 30.3 billion, respectively, last year, emerging as flagship medications for their companies.Huons, Jeil Pharmaceutical, Myungmoon Pharm, Mothers Pharmaceutical, and Abbott recorded over KRW 20 billion in prescriptions for rosuvastatin + ezetimibe combinations. Ahn-gook Pharmaceutical, Kyungdong Pharm, Dongkook Pharm, Hana Pharm, HLB Pharmaceutical, Kukje Pharma, Medica Korea, Daewoong Pharmaceutical, and Shinpoong Pharm recorded over KRW 10 billion.For atorvastatin + ezetimibe combinations, a total of 8 products recorded prescriptions totaling over KRW 10 billion last year. While five products each recorded over KRW 10 billion in 2023 and 2024, three additional products rose above KRW 10 billion last year.Jeil Pharmaceutical's Lipitor Plus recorded the highest domestic prescription volume at KRW 47.7 billion last year. Jeil Pharmaceutical is co-marketing Lipitor Plus with Viatris. Lipitor Plus grew nearly twofold from KRW 13.4 billion in 2022 to KRW 26.4 billion in 2023, and then reached KRW 38.4 billion in 2024, with an annual increase of about KRW 10 billion. Last year's prescriptions increased by 24.2% year-on-year.Yuhan Corporation's Atorvamibe surpassed KRW 20 billion last year with KRW 23.2 billion in prescriptions, a 45.2% increase from the previous year. Atorvamibe soared 157.8% in three years from KRW 9 billion in 2022. Daewoong Pharmaceutical's Litorvazet recorded KRW 20.1 billion in prescriptions last year. Both Yuhan Corporation and Daewoong Pharmaceutical achieved success in the atorvastatin + ezetimibe market, following the rosuvastatin + ezetimibe market. Ahn-gook Pharmaceutical, Boryung, HK inno.N, and KyungDong Pharm also saw their atorvastatin + ezetimibe combinations reach over KRW 10 billion in prescriptions.In the pitavastatin + ezetimibe combination market, a total of 4 products showed prescription performance of over KRW 10 billion last year.Following LivaloZet, products such as Ahn-gook Pharmaceutical's Pevarozet, Daewon Pharmaceutical's Tavalozet, Boryung's Lzerozet, Dongkwang Pharm's PZ, and Hanlim Pharm's Stazet have entered the market. Ahn-gook Pharmaceutical, along with Daewon Pharmaceutical, Boryung, DongKwang, and Hanlim Pharm, successfully invalidated the patents related to the pitavastatin + ezetimibe combination in April 2021. Following clinical trials, they obtained item approval in May 2023. Ahn-gook Pharmaceutical is responsible for the production of pitavastatin + ezetimibe combinations for all five of these companies.Ahn-gook Pharmaceutical's Pevarozet created a sensation last year, with prescription volume of KRW 29.2 billion, a 158.6% increase from the previous year. Pevarozet is aggressively targeting the market by highlighting its 46% smaller formulation size compared to LivaloZet, which significantly improves patient convenience with medication. Additionally, Daewon Pharmaceutical's Tavalozet and Boryung's Lzerozet recorded prescription performances of KRW 18.2 billion and KRW 13.4 billion, respectively, last year.In the pitavastatin + ezetimibe combination market, a total of 4 products recorded prescription sales of over KRW 10 billion last year.In the simvastatin + ezetimibe combination drug market, only one product, Organon's Vytorin, showed prescription performance of over KRW 10 billion last year.Looking at the prescription performance of statin + ezetimibe combinations by company, Hanmi Pharmaceutical maintained its lead with KRW 227.9 billion from a single item, Rosuzet. Organon, Yuhan Corporation, and JW Pharmaceutical demonstrated strength by recording sales exceeding KRW 100 billion. Jeil Pharmaceutical, HK inno.N, Daewoong Pharmaceutical, and Ahn-gook Pharmaceutical recorded over KRW 50 billion in the statin + ezetimibe market.

- Policy

- Fast-track listing of "high-priced new drugs" raises concerns

- by Jung, Heung-Jun Feb 10, 2026 08:13am

- The Citizens' Coalition for Economic Justice (CCEJ) has urged the government to reconsider the fast-track reimbursement policy for rare disease treatments.They are citing concerns that health insurance finances could be wasted on high-priced drugs with unverified efficacy.On the morning of the 9th, the CCEJ, joined by the Korean Pharmacists Associations and the Korea Severe Disease Association raised concerns about the government policy aimed at increasing treatment accessibility for rare diseases. On the 9th, the Citizens' Coalition for Economic Justice, joined by the Korean Pharmacists Associations and the Korea Severe Disease Association held a press conference to demand an immediate halt to the fast-track initiative for ultra-expensive new drugs. The groups argued that the government should prioritize establishing post-marketing evaluation measures over the hasty expansion of health insurance coverage for new drugs.These associations said, "The government announced a fast-track policy to reduce the reimbursement listing period from 240 days to 100 days to improve access," adding, "While the previous process required 150 days to review clinical utility and cost-effectiveness, the new plan bypasses these steps, completing the establishment of benefit criteria within a single month."They pointed out that this effectively eliminates the need to verify a drug’s clinical value. They also condemned the plan to reference the average listed prices of eight major countries (A8) to determine drug costs."While prices were previously negotiated over 60 days based on a drug's value, the reform aims to decide prices within a month based on overseas list prices, which are often inflated compared to actual transaction costs," they stated, "This is likely to reflect the high prices desired by pharmaceutical companies." Performance Evaluation Results (HIRA) for High-priced Medicines. 1. Evrysdi POS (risdiplam), 2. Spinraza Injection(nusinersen), 3. Luxturna injection (voretigene neparvovec), 4. Kymriah Inj (tisagenlecleucel), 5. Zolgensma injection (onasemnogene abeparvovec).Furthermore, they also raised concerns about waste of health insurance funds based on the results of survey on the status of the effectiveness of high-priced new drugs.The organizations based their criticism on HIRA's performance evaluation data for the 5 ingredients of 8 high-priced drugs under the performance-based Risk Sharing Arrangement (RSA).According to data provided by HIRA to Representative Seo Young-seok's office, even Kymriah, so-called a 'miracle' treatment, showed that 59.1% of treated patients did not achieve the expected therapeutic effect. The organizations estimated that this led to approximately KRW 76.6 billion in unnecessary health insurance drug expenditures.Additionally, Spinraza (nusinersen) and Luxturna (voretigene neparvovec) also recorded a 50% failure rate in meeting performance evaluation standards."Over half of the patients who were treated with Spinraza and Luxturna, despite being subject to a 'prior approval system' that audits patient eligibility before administration," and added, "Based on the results from the French health authorities evaluating ultra-expensive drugs on the Korean market, 54% of the list showed either no or only marginal efficacy improvements compared to existing therapies."They estimated that if 53 of the 77 rare disease drugs currently awaiting reimbursement are listed under the new 100-day 'fast-track' rule, it would require an additional KRW 1.5 trillion in insurance funding. They criticized the government for essentially 'blinding' the evaluation system by skipping clinical and economic feasibility checks and relying on the 'price bubble' of major foreign (A8) listed prices.To address these issues, the organizations demanded ▲full public disclosure of all new drug efficacy evaluations ▲establishment of a specified post-marketing evaluation measure ▲establishment of financial management for new drugs ▲establishment of a social discussion body.They stated, "Policies that subject people to potential clinical test subjects with unwarranted efficacy must be halted. We urge the government to secure justification and safety of the policy through social discussions, rather than a closed administrative action. The government must now establish a transparent and fair social discussion body."