- LOGIN

- MemberShip

- 2026-03-09 20:47:42

- Company

- Wegovy and Mounjaro reshape Korea’s obesity drug market

- by Chon, Seung-Hyun Feb 26, 2026 07:48am

- Following the market impact of the obesity treatment Wegovy, Mounjaro has now begun its full-scale expansion in the domestic market. Wegovy exceeded KRW 100 billion in sales for three consecutive quarters, with annual sales nearing KRW 500 billion. Mounjaro nearly reached KRW 200 billion in sales within just 3 months, significantly disrupting the obesity drug landscape. Previously dominant treatments such as Saxenda and Qsymia have seen their market influence sharply decline.According to market research institution IQVIA, Novo Nordisk’s Wegovy recorded annual sales of KRW 467 billion last year.Wegovy, which was approved by the Ministry of Food and Drug Safety in April 2023, is a glucagon-like peptide-1 (GLP-1) receptor agonist containing semaglutide. Novo Nordisk developed Wegovy after identifying weight loss effects during clinical trials of GLP-1 diabetes candidates, ultimately advancing semaglutide into a once-weekly treatment for obesity.Wegovy gained explosive popularity immediately after its domestic launch in October 2024. It rapidly ascended to the top of the obesity drug market, generating KRW 60.3 billion in sales in Q4 2024.Wegovy surpassed KRW 100 billion in quarterly sales just 9 months after launch, reaching KRW 133.8 billion in Q2 last year. It recorded KRW 137 billion and KRW 116.7 billion in Q3 and Q4, respectively, achieving quarterly sales exceeding KRW 100 billion for 3 consecutive quarters. Novo Nordisk strengthened its commercial presence by signing a co-promotion agreement with Chong Kun Dang for Wegovy in September last year.Even before its domestic launch, Wegovy gained global notoriety through word of mouth as the weight-loss secret of overseas celebrities, such as Tesla CEO Elon Musk, leading to worldwide shortages. Despite its high price, Wegovy garnered explosive interest immediately after its domestic release, causing initial shortages.Wegovy's sales in the Q4 last year decreased by 14.9% compared to the previous quarter, analyzed to be due to the impact of price reductions and the emergence of the new product Mounjaro. Following Mounjaro’s launch in August, Novo Nordisk reduced Wegovy’s supply price by approximately 40%.Eli Lilly’s Mounjaro, which was launched domestically in August, generated KRW 215.5 billion in sales during the second half of the year alone.Mounjaro acts on both the glucagon-like peptide-1 (GLP-1) receptor and the glucagon-like peptide-1 (GLP-1) receptor, enhancing insulin secretion, improving insulin resistance, and reducing glucagon secretion. This induces reductions in both pre- and post-meal blood glucose levels. In Korea, Mounjaro was initially approved as a diabetes treatment in June 2023 and later secured an additional obesity indication in August 2024.Mounjaro generated its first sales of KRW 28.4 billion in Q3 last year and significantly outpaced Wegovy with KRW 187.1 billion in Q4. In Q4 last year, Wegovy and Mounjaro combined reached KRW 303.8 billion in sales, marking a historic milestone in Korea’s obesity treatment market.Mounjaro also surpassed Wegovy in the global market. Last year, Mounjaro sales reached USD 23.065 billion (approximately KRW 33 trillion), substantially exceeding Wegovy’s sales of DKK 79.1 billion (approximately KRW 18 trillion).Saxenda and Qsymia, which previously led the obesity drug market before Wegovy's arrival, have seen their market positions significantly eroded.Novo Nordisk's Saxenda saw its sales shrink by 84.4% in just one year, plummeting from KRW 65.6 billion in 2024 to KRW 10.2 billion last year. Saxenda had dominated the obesity treatment market since its launch in 2019, achieving sales of KRW 42.6 billion that year and maintaining its leading position for 5 consecutive years until 2023. Saxenda's sales reached KRW 66.8 billion in 2023, but dropped significantly after Wegovy's launch.Launched domestically in 2018, Saxenda was the world’s first GLP-1 analogue approved for obesity treatment. It shares the same active ingredient (liraglutide) as Victoza, differing only in dosing regimen. The arrival of Wegovy, another GLP-1 agonist like Saxenda, has further eroded Saxenda's market share.Alvogen Korea’s Qsymia recorded annual sales of KRW 35.6 billion, reflecting an 8.8% year-on-year decline. Qsymia, a combination of phentermine and topiramate, entered the Korean market in late 2019. While Qsymia experienced a smaller sales decline compared with Saxenda, its revenue remained below 10% of Wegovy’s, indicating a substantial contraction in market presence.

- Policy

- Opposition boycott puts pharmacy and drug bills on hold

- by Lee, Jeong-Hwan Feb 26, 2026 07:48am

- On the 24th, the main opposition party, the People Power Party, decided to launch a filibuster on all bills submitted for consideration, along with a full boycott of standing committee proceedings, in response to the Democratic Party’s unilateral push to proceed with a plenary session.As a result, the meetings of the 1st and 2nd Subcommittees of the Legislation and Judiciary Committee of the National Assembly’s Health and Welfare Committee, originally scheduled for the 25th and 26th this week, now face uncertainty regarding whether they will convene.Particularly for Subcommittee 1, chaired by People Power Party lawmaker Miae Kim, the atmosphere suggests it is highly unlikely to convene.While some within the ruling party have suggested holding a plenary session alone to review Subcommittee 1's bills, unilaterally reviewing and passing livelihood bills would inevitably invite criticism for bypassing established inter-party consensus procedures.If Subcommittee 1 fails to convene, bills expected to be tabled, including legislation on limited international nonproprietary name (INN) prescribing for drugs facing supply instability or designated as nationally essential medicines, as well as bills regulating the labeling, advertising, promotion, and establishment scale of warehouse-style pharmacies, would lose their opportunity for review.This would effectively delay the examination of livelihood-related legislation within the Health and Welfare Committee due to ongoing partisan conflict.Meanwhile, the 2nd Subcommittee of the Legislation and Judiciary Committee, chaired by Democratic Party lawmaker Sujin Lee, could theoretically proceed without participation from the People Power Party. Among its jurisdiction is the bill proposing the establishment of a public medical school, a key component of the Lee Jae-myung administration’s policy agenda to strengthen regional, essential, and public healthcare.However, even this remains uncertain. Holding a subcommittee meeting solely by the ruling party to review and pass bills could face opposition from the opposition party later and could escalate conflict between the ruling and opposition parties within the Welfare Committee.As a result, the schedule for the Welfare Committee's bill subcommittees has been disrupted due to clashes between the ruling and opposition parties over the third amendment to the Commercial Act, which primarily concerns mandatory retirement of treasury shares, judicial reform bills, and the Special Act on Administrative Integration.An official from the Democratic Party's Welfare Committee office said, “While the Subcommittee 2 (chaired by the Democratic Party) might be able to convene with the ruling party alone, Subcommittee 1 appears difficult to hold. There have been suggestions to conduct an article-by-article review of Subcommittee 1 bills at the plenary session level, but the political burden is considerable.”

- Policy

- DPK moves to hold Welfare Committee plenary session unilaterally

- by Lee, Jeong-Hwan Feb 26, 2026 07:47am

- The Democratic Party of Korea has decided to convene a plenary session of the National Assembly's Health and Welfare Committee on the 26th, solely with its own members, to receive a report from the Ministry of Health and Welfare on current issues, including medical school enrollment expansion and regional, essential, and public healthcare policies.This move comes in response to the main opposition party, the People Power Party, conducting a filibuster (unlimited debate) and deciding to boycott all standing committee proceedings, citing the Democratic Party's unilateral handling of the plenary session agenda.Notably, some Democratic Party members of the committee have also raised the need to review and pass bills assigned to the first Subcommittee of the Legislation and Judiciary Committee during the plenary session.However, such a move is expected to trigger significant friction with the People Power Party over future standing committee operations and bill deliberations.According to a Democratic Party official on the 25th, the Health and Welfare Committee (Chair Jumin Park) has tentatively decided to hold a plenary session on the afternoon of the 26th. During the session, the Ministry of Health and Welfare will present reports on key pending issues, including medical school quota expansion, emergency medical care, and the regional physician initiative, and adopt the plan for a public hearing on the Patient Basic Act bill.The second Subcommittee of the Legislation and Judiciary Committee will convene as scheduled at 10 a.m. on the 27th.This decision to proceed with the Welfare Committee plenary session and the second Subcommittee of the Legislation and Judiciary Committee's meeting was made solely by the Democratic Party, without involvement from the People Power Party.It is reported that the decision to hold the plenary session solely by the Democratic Party came after the first Subcommittee of the Legislation and Judiciary Committee meeting, originally scheduled for the 26th, could not be held due to a boycott by the People Power Party.A key point of attention is whether the Democratic Party will attempt to deliberate and pass bills assigned to the first Subcommittee of the Legislation and Judiciary Committee during the plenary session.This necessity arose because some ruling party welfare committee members have strongly criticized the fact that the subcommittee has not convened for several months and argued that it may now be necessary to process pending legislation at the plenary level.The problem is that if the Democratic Party reviews and votes on bills under the jurisdiction of the first subcommittee at the plenary session without the opposition parties, including the People Power Party, the Welfare Committee could face disruptions in its normal operations due to clashes between the ruling and opposition parties.A Democratic Party welfare committee official hinted, “Due to the opposition party's lack of cooperation, bill subcommittee meetings failed to take place in December and January, and there is now a risk that February will follow the same pattern. There are strong voices from some lawmakers stating the necessity to review past livelihood-related bills during the plenary session.”

- InterView

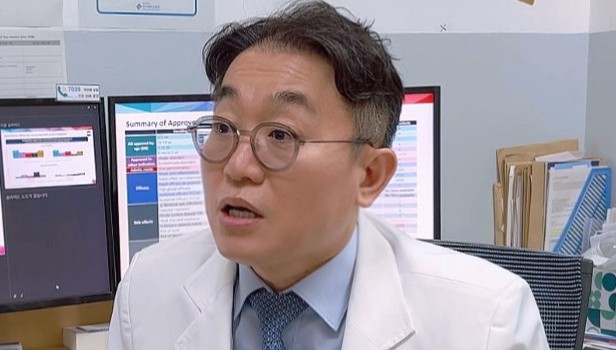

- "Precision medicines accelerate for treating atopic dermatitis"

- by Son, Hyung Min Feb 26, 2026 07:47am

- Korea's treatment landscape for atopic dermatitis is facing a clear turning point. For the past 10 years, treatment strategies have centered on moisturizers, topical therapies, and immunosuppressants, which have remained the standard of care. The rapid introduction of new drugs, such as biologics and JAK inhibitors, is fundamentally changing the management of moderate-to-severe patients.Professor Yang-Won Lee of the Department of Dermatology at Konkuk University Medical CenterProfessor Yang-Won Lee of the Department of Dermatology at Konkuk University Medical Center, recently appointed as the President of the Korean Atopic Dermatitis Association, emphasized, "We have entered an era where the paradigm of atopic treatment is shifting," adding, "Insurance, policy, and clinical applications must be adjusted by reflecting the changes in patient groups and waves of new drug introductions."The patient population for atopic dermatitis in Korea has changed significantly compared to the past. The prevalence has increased, and in particular, the proportion of adult atopic patients has expanded greatly, making a realignment of treatment strategies inevitable. Adult patients face long disease courses and a high proportion of chronic cases, creating a need for long-term treatment options that satisfy both safety and efficacy.Related to this, the successive launches of biologics have provided a new alternative. Following the introduction of 'Dupixent (dupilumab, an IL-4/IL-13 inhibitor)' as the first interleukin agent in 2018, various biologics, including LEO Pharma's 'Adtralza (tralokinumab, an IL-13 inhibitor)', have emerged, expanding treatment options incomparably compared to the past.With the addition of new drugs that are Janus kinase (JAK) inhibitors, the field of systemic treatment for moderate-to-severe patients has effectively entered a new phase.However, despite the expanded treatment options, the common consensus in the field is that patient accessibility remains limited.Professor Lee identified the 'restriction on switching therapies' as an area for improvement. While switching between biologics and JAK inhibitors has been permitted under certain conditions, switching within the same class remains prohibited, which is pointed out as narrowing the range of choices for patients.Professor Lee expressed his concerns, stating, "Given the characteristics of atopic dermatitis patients who have complex pathophysiology, there seem to be many constraints on tailored treatment. This is an area that requires improvement."Q. How do you feel about starting your term as the new President, and what is your opinion?I have been active in the Korean Atopic Dermatitis Association for a long time. In particular, I participated from the very beginning in the process of creating a diagnostic code for severe atopic dermatitis in Korea, as none had existed previously. I also remember making my best efforts to ensure that severe atopic dermatitis could be covered under the 'Special Case Medical Expense Coverage System' system.It feels like those events were just yesterday, and I am honored to be serving as President. Iplant to improve the rights and interests of patients with atopic dermatitis, the treatments they desire, and research into the disease.Q. What are the primary goals or tasks that the Association will focus on during this term?There are largely two main goals. The first is improving the rights and interests of patients with atopic dermatitis. Recently, many new atopic dermatitis drugs, such as biologics and JAK inhibitors, have been launched. However, due to high costs, many patients suffering from the disease are unable to receive treatment with these new drugs.The Association will make every effort to ensure that health insurance and the 'Special Case Medical Expense Coverage System' system are applied to new drugs as quickly as possible.The other goal is to promote research on atopic dermatitis. As the Korean Atopic Dermatitis Association is an academic organization, I intend to fulfill my responsibilities, including supporting researchers dedicated to identifying the causes of atopy and developing treatments, and conducting collaborative research.Q. How do you think the patient population and disease patterns of atopic dermatitis in Korea have changed compared to the past? How do you think these changes have influenced the treatment paradigm?The first change is that the prevalence has increased. This is partly due to more patients proactively visiting dermatology clinics as the medical environment has developed, but environmental changes driven by industrialization and other factors also play a role.Another point is the increase in the number of adult patients with atopic dermatitis. As prevalence has increased and adult patients have become more numerous, the treatment paradigm has required new drugs that can ensure efficacy and safety for long-term treatment. In this context, the recently launched new drugs are playing a significant role.Atopic dermatitis can be divided into mild, moderate, and severe stages. Mild patients are treated proactively with moisturizers and topical treatments. For moderate-to-severe cases, topical treatments and systemic treatments are used together.Recently, new drugs such as biologics and JAK inhibitors have emerged, providing significant therapeutic benefit.Q. While treating moderate-to-severe atopic dermatitis patients, what are the limitations of existing treatment strategies. What are unresolved unmet needs?The biggest concern is the safety of existing conventional treatments.In many cases, moderate-to-severe patients become chronic and require long-term treatment. However, there are safety concerns regarding the long-term use of conventional therapies such as existing immunomodulators.Most of these issues are being addressed by new drugs such as biologics and JAK inhibitors. However, while the side effects of these new drugs are not severe, it seems necessary to be well-informed about the specific side effects of each drug to select the appropriate medication.Currently, many atopic dermatitis treatments are being developed, and clinical trials are underway. The main direction is the development of targeted therapies that can secure higher safety and efficacy. In my opinion, the treatment of atopic dermatitis will evolve toward reducing side effects and increasing therapeutic effects through the development of targeted therapies that precisely target its pathophysiology.Q. How can IL-13 single-target drugs change patient management?Atopic dermatitis is a complex disease involving multiple immune pathways, but at its core, IL-13 plays a critical role in inflammation and skin barrier dysfunction.Single-target IL-13 therapy, such as Adtralza, specialized for the pathophysiology, has the advantage of precisely regulating the core inflammatory pathway while minimizing unnecessary immunosuppression. In particular, with Adtralza, the physician can adjust the administration cycle after 16 weeks of treatment, providing advantages in terms of patient convenience and economic factors.Q. Is there anything that needs to be improved in terms of treatment accessibility, insurance policy, or education?I would like to speak about the issue of switching therapies. Since December 2024, switching between biologics and JAK inhibitors has been permitted under certain conditions, expanding the range of treatment options.However, switching between a biologic and another biologic, or between JAK inhibitors, is still not allowed, and I hope this part will be improved. Regrettably, this seems to limit the tailored treatment of patients with atopic dermatitis who have complex pathophysiologies.Q. Do you have any hope or advice you would like to send to patients and families suffering from atopic dermatitis?Many patients and guardians still have much distrust, believing that atopic dermatitis treatments are toxic or that only corticosteroids are used.With the recent development and launch of new drugs such as biologics and JAK inhibitors, the paradigm of atopic dermatitis treatment has changed and advanced. That progress is continuing today.I hope that patients suffering from atopic dermatitis do not hesitate due to negative experiences from the past and instead visit a nearby dermatologist to receive proactive treatment.

- Policy

- Expanded reimb for Imfinzi will be available next month

- by Jung, Heung-Jun Feb 25, 2026 05:46pm

- AstraZeneca Korea's Imfinzi New reimbursement criteria for anticancer drugs will be established ahead of the expanded insurance coverage for AstraZeneca Korea's Imfinzi (durvalumab), an immunotherapy used to treat cancer.Starting in March, Imfinzi combination therapy will be added for both liver cancer and biliary tract cancer. Notably, in liver cancer, the drug achieved dual success by simultaneously proving its combination therapy with Imjudo (tremelimumab).On the 23rd, the Health Insurance Review and Assessment Service (HIRA) announced that it is currently conducting an opinion survey regarding the revision of the "Application criteria for National Health Insurance reimbursement for drugs prescribed and administered to cancer patients." After the survey ends on the 25th, the revised contents will be applied starting in March.For liver cancer, the combination therapy with Imjudo will be newly established. Reimbursement is limited to patients with advanced hepatocellular carcinoma who are ineligible for surgery or local treatment and who meet specific criteria.The reimbursement criteria are appliable up to 1 year of treatment. However, if clinical results for the administration period within that year have not been published, reimbursement will be automatically extended for up to 2 years.For biliary tract cancer, the combination therapy of Imfinzi (durvalumab) + gemcitabine + cisplatin will be newly established. Insurance coverage will apply to patients with unresectable locally advanced or metastatic biliary tract cancer. This is limited to adenocarcinoma and excludes ampullary Vater carcinoma.Gemcitabine and cisplatin will not be administered after the initial 8 cycles of combination therapy. The reimbursement period is the same as that for the liver cancer combination therapy.Imfinzi is becoming reimbursed for two combination therapies. Consequently, Imfinzi prescriptions, which had been concentrated on lung cancer, are expected to expand into liver cancer and biliary tract cancer.In particular, it will emerge as a new treatment option for biliary tract cancer. Imfinzi is the second drug to receive a flexible Incremental Cost-Effectiveness Ratio (ICER) for an innovative new drug.In this revision, Janssen Korea's Balversa (erdafitinib) monotherapy for urothelial carcinoma was also newly established. It is indicated for second-line or later use, and the target population is "patients with unresectable locally advanced or metastatic urothelial carcinoma with FGFR3 genetic alterations whose disease has progressed during or following at least one prior systemic therapy, including a PD-1 or PD-L1 inhibitor."For multiple myeloma, a second-line or later combination therapy of Antengene's Xpovio (selinexor) + bortezomib + dexamethasone was newly established. It can be administered to patients with multiple myeloma who have failed previous treatments.Xpovio received a decision on reimbursement expansion conditions from the Drug Benefit Evaluation Committee meeting last November, which required the company to accept a price below the evaluated amount.

- Company

- Tariff risk again…pharma closely watches exports to the US

- by Kim, Jin-Gu Feb 25, 2026 05:46pm

- The US Supreme Court's ruling that reciprocal tariffs are unconstitutional, and President Trump's new 15% reciprocal tariff, come into effect at 2 PM on the 24th. The pharmaceutical and biotech industries are closely monitoring the situation as the risk of US tariffs may reignite.Currently, many view the impact of the new 15% tariff as limited. Major pharmaceutical and biotech companies that export have already prepared countermeasures by securing sufficient local inventory and expanding local production through manufacturing facilities in the United States. Some observers also predict that export performance, which surged significantly last year during the process of securing local inventory, may decrease to typical levels this year due to a base effect.New '15%' tariff takes effect…Prospects↑ for "Limited impact on Korean drug exports to the US"According to pharmaceutical industry sources on the 24th, the new 15% tariff imposed by US President Donald Trump on imports from all countries worldwide takes effect today (the 24th).Immediately following the US Supreme Court's ruling on the unconstitutionality of reciprocal tariffs on the 20th, President Trump announced that he had signed an executive order imposing a new 10% tariff. The following day, President Trump adjusted the tariff upward to 15%. According to the White House, the new tariff takes effect at 12:00 AM on the 24th, Eastern Time, which corresponds to 2 PM on the 24th, Korean Time.The new 15% tariff is based on 'Section 122 of the Trade Act.' This clause focuses on responding to serious international balance of payment deficits or a decline in the value of the dollar. It allows for the imposition of emergency tariffs of up to 15% for 150 days, which can be extended with congressional approval.Regarding the Supreme Court's ruling and President Trump's 15% tariff, the pharmaceutical industry is keeping a close watch, keeping in mind the possibility that US export risks could reignite.However, many view that the impact will be limited even if a 10% (or 15%) tariff is imposed. Indeed, during an emergency meeting immediately after President Trump's announcement, the Ministry of Trade, Industry and Energy explained, "While export uncertainty to the US has risen slightly, the export conditions for the US secured through the Korea-US tariff agreement will largely be maintained."An official from the domestic pharmaceutical and biotech industry also stated, "As a result, a new 15% tariff replaces the 15% reciprocal tariff. The key is whether the Most Favored Nation (MFN) status for medicines will be maintained following the conclusion of Korea-US tariff negotiations; however, regardless of MFN status, we have prepared measures, such as securing inventory in the US and acquiring local production facilities. Even if new tariffs are applied, we expect the impact to be minimal."Securing local stock + acquiring US manufacturing plants…Major pharmaceutical and biotech firms complete countermeasuresThe domestic pharmaceutical and biotech industry secured sufficient local inventory last year as a short-term measure ahead of the Trump administration's tariff imposition. Using Celltrion as an example, the company has preemptively secured two years' worth of inventory for products exported to the US as of early this year.In the mid- to long-term, measures have been put in place to minimize risk by acquiring local production facilities.Celltrion will engage in local production through Eli Lilly’s biologic manufacturing plant in Branchburg, New Jersey, which it acquired last year. In September last year, Celltrion acquired the Branchburg plant, with a production capacity of 66,000 liters, for KRW 460 billion (approximately USD 330 million). The acquisition process was finalized last month, and the facility reportedly began full-scale operations this month.Samsung Biologics plans to commence local production after finalizing the acquisition of a biologic manufacturing plant in Maryland, purchased in December last year, by next month. This plant has a production capacity of 60,000 liters, and the company is considering expanding to 40,000 liters.Preemptive export↑ last year for inventory accumulation…Export sales may decrease this year due to base effectSome in the pharmaceutical industry suggest that the export performance of Korean medicines to the US this year may appear to decrease on the surface compared to last year.This prospect suggests that while major companies preemptively increased export volumes last year to secure local inventory, leading to a significant spike in export performance, this year will see a decrease due to the resulting base effect.Sales performance of Korea's domestic medicines exported to the US (unit: USD 1 million; source: Korea Customs Service)According to the Korea Customs Service, the value of Korean medicines exported to the US reached USD 1.76 billion last year, the highest on record. Exports to the US have increased significantly over the past four years. Drug exports to the US, which were USD 843.94 million in 2022, grew by 7% to USD 903.3 million in 2023, and increased by approximately 50% to USD 1.358 billion in 2024. Building on this, high growth of nearly 30% continued last year, driving record-breaking performance for Korean medicines.However, this year is slightly different. In January of this year, the export value of Korean medicines to the US was USD 76.42 million, which is less than half of the USD 176.3 million recorded in January last year. This figure is also more than 25% lower than the USD 103.07 million recorded in January 2024.

- Policy

- GC Biopharma expands lineup to target antihistamine market

- by Jung, Heung-Jun Feb 25, 2026 05:45pm

- GC Biopharma is expanding its reimbursed lineup of its fexofenadine-based Neofexo Tablets this year to strengthen its position in the prescription market for allergic rhinitis.By increasing the number of reimbursed items, it is entering the antihistamine prescription market as a latecomer, where companies like Handok, Hanmi, and Yuyu are competing.According to industry sources on the 24th, following the listing of Neofexo Tab 120mg (fexofenadine hydrochloride) in January, GC Biopharma will add Neofexo Tab 180mg to the reimbursement list in March.GC Biopharma plans to list Neofexo Tab 180mg for reimbursement in March. AI-generated image.The reimbursement ceiling price for Neofexo Tab 180mg has been set at KRW 267. Neofexo Tab 120mg, listed in January, previously received a ceiling price of KRW 220.Fexofenadine, a third-generation antihistamine, is marketed as both an over-the-counter (OTC) and prescription drug. The 120mg formulation is available in both categories, while the 180mg strength is prescribed exclusively.OTC formulations are indicated solely for the relief of seasonal allergic rhinitis, whereas prescription products carry broader indications, including symptom relief in chronic idiopathic urticaria.Neofexo Tab 120mg was approved as an OTC product, while the newly listed Neofexo Tab 180mg can only be sold as a prescription drug.A review of previously reimbursed products shows that companies including Handok, Hanmi Pharm, Yuyu Pharma, Chong Kun Dang, Il-Yang Pharm, and Hutecs Korea are actively competing in the prescription segment.Meanwhile, Allegra Tab, the original fexofenadine product, continues to demonstrate steady sales growth. According to UBIST, Allegra recorded sales of KRW 7.9 billion last year, marking a 9% increase year-on-year. Hanmi Pharm’s Fexonadine Tab also posted modest growth, rising 2% to KRW 3.3 billion.GC Biopharma already markets Allerjet Soft Cap, a 60mg OTC fexofenadine hydrochloride product approved in 2023.With reimbursement coverage now for Neofexo Tab, the company is expected to accelerate its strategic push into the allergic rhinitis market.

- Company

- Will Retevmo finally be reimbursed 5yrs post-approval?

- by Eo, Yun-Ho Feb 25, 2026 05:45pm

- Attention is once again turning to whether the RET-targeted anticancer therapy Retevmo can finally conclude its reimbursement listing process.Despite domestic regulatory approval, reimbursement coverage has yet to be granted nearly 5 years later, extending the wait for eligible patients.According to industry sources, Eli Lilly Korea resubmitted its reimbursement application for Retevmo (selpercatinib), indicated for RET-mutated non-small cell lung cancer (NSCLC), in April of last year. The therapy subsequently passed the Health Insurance Review and Assessment Service (HIRA) Cancer Disease Review Committee again in September. Follow-up procedures, including pharmacoeconomic evaluation, are reportedly in progress.The company has already submitted the required documentation, including the pharmacoeconomic evaluation data. However, specific timelines for review or details regarding price negotiations remain difficult to ascertain at this stage.Retevmo endured a truly arduous journey through the listing process. The drug received approval from the Ministry of Food and Drug Safety in March 2022. Subsequently, reimbursement criteria were established by the Health Insurance Review and Assessment Service in November 2022, and it passed the Drug Reimbursement Evaluation Committee in May 2023, gaining recognition for its cost-effectiveness.However, its listing fell through in August 2023 when price negotiations with the National Health Insurance Service broke down. Then, in October 2023, Phase III clinical trial data showing improved overall survival (OS) were announced, prompting the company to reapply based on this evidence.RET mutations represent rare genetic alterations identified in approximately 1–2% of NSCLC patients.Currently, Retevmo remains the only RET-targeted therapy approved in Korea. Conventional chemotherapy and immunotherapy have historically shown limitations in response rates and durability within this patient population.Meanwhile, the US National Comprehensive Cancer Network (NCCN) Guidelines recommend Retevmo as a Preferred Category 1 option for first-line treatment of RET-mutated metastatic NSCLC. This is the highest level of evidence and expert consensus. While it is considered a treatment option immediately upon diagnosis in global standards, it remains non-reimbursed in Korea.Of course, many anticancer drugs designated as global standard treatments remain non-covered in Korea. However, Retevmo differs in that, despite having already been recognized for cost-effectiveness once and securing additional clinical evidence after negotiations stalled, discussions for its coverage have been prolonged.Among the A7 reference pricing countries, Retevmo is reimbursed and actively used in clinical practice across six nations (the United States, Germany, Italy, the United Kingdom, Switzerland, and Japan), with France being the sole exception.

- Policy

- MFDS offering regulatory support for orphan drug discovery

- by Lee, Tak-Sun Feb 25, 2026 05:45pm

- The Ministry of Food and Drug Safety (MFDS) plans to accelerate the commercialization of government-led orphan drug (treating rare diseases) development by providing regulatory support from the early stages of development.The MFDS has initiated support for the orphan drug sector through the "Overcoming Unconquered Diseases" project, the Korean ARPA-H initiative led by the government.Through this support, the MFDS aims to accelerate the commercialization of orphan drugs and improve patient access to treatment for ultra-rare diseases.In observance of "Overcoming Rare Disease Day" on the 28th, the MFDS held a briefing for the medical and pharmaceutical press to explain the current status of support and policies for rare disease treatments.In observance of "Overcoming Rare Disease Day" on the 28th, the MFDS held a briefing for the medical and pharmaceutical press. (from left) Project Manager Misun Park of the Korea Health Industry Development Institute (KHIDI); Hyeon Jin Yim, Head of the Regulatory Science Policy Promotion Division; and Division Heads Chun-rae Kim, Jae-hyun Park, and Mi-ryeong Ahn."World Rare Disease Day" falls on February 29th, the rarest day of the year that occurs once every four years. Under the Rare Disease Management Act, the Korean government commemorates the last day of February each year (typically February 28th or 29th) as Rare Disease Day. The goal is to enhance public understanding of rare diseases and improve access to treatment and medical support for patients and their families.While South Korea has designated 1,380 rare diseases, drug development remains challenging due to the small patient population and the difficulty of attracting corporate investment.The government began treatment development through the Korean-style ARPA-H project. Benchmarked after the U.S. "ARPA-H (Advanced Research Projects Agency for Health)," this project is a "high-risk, high-return" national R&D initiative that began last year.In the field of rare diseases, projects currently underway include the development of a tailored, innovative treatment platform for pediatric rare disease patients, the N-of-1 (single-patient) clinical trial project (HEART), and patient-customized gene therapy to overcome visual impairment in hereditary eye diseases (BEACON). A national budget of KRW 17.5 billion is allocated for investment over 4.5 years.Typically, national R&D projects often conclude with researchers registering papers or patents. However, this project aims for commercialization. Consequently, regulatory support from the MFDS is considered crucial.Misun Park, Project Manager of the K-Health Future Promotion Division at KHIDI, explained, "To meet regulatory requirements after development has significantly progressed can lead to irreversible losses in time and cost. It is essential to communicate with the MFDS from the early stages of development to collaborate on clinical trial design and the direction of data preparation."Furthermore, due to the nature of rare diseases, patient administration cannot be cancelled even if any issues arise during the Investigational New Drug (IND) process. Therefore, the aim is to minimize trial-and-error by consulting with the MFDS from the start of development.The MFDS provides early-stage regulatory support through the "Regulatory Adequacy Review System," which has been in place since last year. This system analyzes and supports regulatory requirements during the initial stages of national R&D projects.The system reviews how products under development are classified and which laws apply to them, and provides consultations on evaluation criteria and methods for demonstrating safety and efficacy. Through this, regulatory response strategies and the necessity of joint research with the MFDS are also reviewed.Last year, the system supported commercialization by classifying stem-cell-based artificial blood projects as advanced biopharmaceuticals and recommending GRADE changes for digital therapeutic development projects for developmental disabilities.Hyeon Jin Yim, Head of the Regulatory Science Policy Division at the MFDS, stated regarding the system, "Researchers often develop innovative technologies but face difficulties at the commercialization stage because they do not fully understand regulatory procedures. The Ministry provides guidance from the beginning on which laws apply, what data needs to be prepared, and what strategies are necessary to increase the likelihood of approval."Yim added, "Preventing delays in commercialization is possible if the time required for supplementation is shortened by analyzing regulatory targets in advance. We are currently in discussions regarding eight projects under the ARPA program."The MFDS is also working to improve accessibility by easing designation requirements for orphan drugs and implementing expedited reviews. Starting this year, drugs can receive orphan drug designation (ODD) even without submitting data demonstrating significantly improved safety or efficacy compared to existing alternatives.Chun-rae Kim, Head of the Pharmaceutical Policy Division at the MFDS, explained, "Previously, for rare disease drugs announced by the Korea Disease Control and Prevention Agency (KDCA), data proving improved safety and efficacy had to be submitted. However, through consultations with the pharmaceutical industry last year, we decided to omit this regulatory requirement."This year, the Ministry plans to discuss with the industry measures to ease regulations on orphan drug designation cancellations.When designated as an orphan drug, rapid approval can be expected through expedited regulatory reviews. The MFDS selects drugs for expedited review through the "GIFT" (Global Innovative products on Fast Track) system. Currently, of the 50 items approved as GIFT products, 42 are orphan drugs.Jae-hyun Park, Head of the Expedited Review Division at the MFDS, stated, "According to the disease groups of treatments designated as GIFT, half are recurrent or intractable cancers with small patient populations. For these patients, clinical trials themselves can be a treatment opportunity. In the future, we plan to consult with the public and private sectors to ensure that patient opinions are reflected in GIFT reviews."For orphan drugs not designated under GIFT, the MFDS also offers flexibility in reviews, granting approval based on Phase 2 clinical trials, with the requirement to submit Phase 3 clinical data post-market. Mi-ryeong Ahn, Head of the Oncology and Antibiotics Division, added, "We continue to develop guidelines related to clinical trial design to increase flexibility at the approval stage."

- Company

- Imfinzi reimbursed for gastrointestinal cancer in Korea

- by Son, Hyung Min Feb 25, 2026 05:45pm

- AstraZeneca’s immuno-oncology drug Imfinzi is poised for expanded reimbursement in first-line hepatocellular carcinoma and biliary tract cancer, signaling potential shifts in gastrointestinal cancer treatment strategies.In hepatocellular carcinoma, the Imfinzi + Imjudo combination is expected to compete with the Tecentriq+Avastin regimen. In biliary tract cancer, an Imfinzi-based triplet combination will face off against Keytruda-based combination therapy. Given the characteristics of immunotherapy combinations, which carry a relatively lower bleeding risk, and the fact that reimbursement for Imfinzi is being applied first, there is an atmosphere of anticipation for a first-mover advantage in the market.AstraZeneca's immuno-oncology drug ImjudoAccording to industry sources on the 25th, the reimbursement expansion for AstraZeneca's immuno-oncology drug Imfinzi (durvalumab) is scheduled for next month.For hepatocellular carcinoma, the reimbursed regimen includes the PD-L1 inhibitor Imfinzi combined with the CTLA-4 inhibitor Imjudo (tremelimumab). Both drugs are immunotherapies, designed to enhance antitumor responses by simultaneously promoting initial T-cell activation and sustaining immune activity while blocking immune evasion mechanisms.Clinical efficacy of the Imfinzi+Imjudo combination was demonstrated in the Phase III HIMALAYA study. The trial evaluated 1,171 treatment-naïve patients aged 18 years or older with unresectable hepatocellular carcinoma, comparing Imfinzi + Imjudo versus Bayer’s Nexavar (sorafenib).Results showed that the Imfinzi+Imjudo combination therapy reduced the risk of death by 22% compared to Nexavar monotherapy. The overall survival (OS) for the Imfinzi + Ibrutinib combination therapy was 16.4 months versus 13.8 months for Nexavar monotherapy.The Imfinzi+Imjudo regimen will compete with Roche’s reimbursed Tecentriq (atezolizumab)+Avastin (bevacizumab) combination.A key advantage cited for the Imfinzi+Imjudo regimen is reduced bleeding risk. Tecentriq+Avastin is known to be associated with relatively higher bleeding incidence attributable to Avastin.Competition is expected to intensify further with the introduction of later entrants. Ono Pharmaceutical and Bristol Myers Squibb (BMS) are currently preparing reimbursement applications for the Opdivo(nivolumab)+Yervoy (ipilimumab) combination in hepatocellular carcinoma. This Opdivo(nivolumab)+Yervoy (ipilimumab) regimen is a combination of PD-1 and CTLA-4 class immuno-oncology drugs.Opdivo+Yervoy’s primary advantage lies in its OS outcomes. In the Phase III CheckMate-9DW study, median OS reached 23.6 months, exceeding the 20.6 months observed with Eisai’s Lenvima (lenvatinib) or Nexavar.Furthermore, recently released 4-year analysis results showed the overall survival rate was 31% in the Opdivo + Yervoy group, higher than the 18% in the control group.First-line coverage for biliary tract cancer...Competition with KeytrudaAstraZeneca's immuno-oncology drug ‘Imfinzi’For biliary tract cancer, coverage for the combination therapy Imfinzi+gemcitabine+cisplatin will be newly established. The specific indication is for the treatment of unresectable locally advanced or metastatic biliary tract cancer. Reimbursement is limited to adenocarcinoma and excludes ampullary carcinoma.Although biliary tract cancer affects relatively few patients, early diagnosis is difficult. Due to rapid metastasis to surrounding organs and high recurrence rates, the 5-year relative survival rate (2017-2021) is only 28.9%. Seven out of ten patients die from biliary tract cancer. It has also been a challenging field for drug development. The combination therapy of Imfinzi+gemcitabine+cisplatin demonstrated a 2-year overall survival rate of 24.9% in the TOPAZ-1 clinical trial led by Korean medical teams, confirming a survival rate more than double that of the existing standard treatment (10.4%).Furthermore, the TOURMALINE study showed that the combination of Imfinzi, gemcitabine, and cisplatin demonstrated similar efficacy compared to other gemcitabine-based chemotherapy combinations (such as oxaliplatin, paclitaxel, carboplatin, etc.). The objective response rate (ORR) for the primary combination therapy in that clinical trial was 27%.With this reimbursement, Imfinzi will directly compete with Keytruda plus gemcitabine plus cisplatin combination therapy in the first-line biliary tract cancer treatment space.Keytruda-based therapy received regulatory approval for expanded indications in April 2024. Supporting clinical data demonstrated a median OS of 12.7 months. However, the earlier reimbursement approval of the Imfinzi regimen is expected to confer market entry advantages.