- LOGIN

- MemberShip

- 2026-03-09 20:47:41

- Policy

- Regulations on INN prescribing·warehouse pharmacies

- by Lee, Jeong-Hwan Feb 20, 2026 10:04am

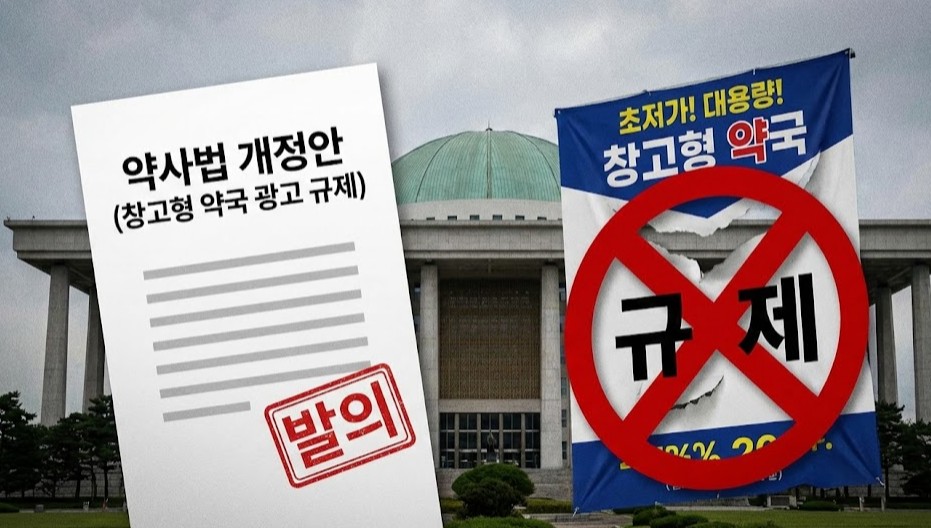

- It is highly likely that bills to mandate International Nonproprietary Names (INN) prescribing limited to supply-unstable drugs designated by the government, as well as bills to strengthen regulations on the signage, advertising, and opening scale standards of warehouse-type pharmacies, will be considered at the National Assembly Health and Welfare Committee's Legislation Subcommittee scheduled for the end of this month.This is because the decision by the lawmakers who proposed the relevant legislation to request the ruling and opposition party leadership of the Health and Welfare Committee to prioritize the review of the limited generic prescribing bill and the bill aimed at resolving drug misuse and abuse caused by the opening of warehouse-type pharmacies.On the 13th, the Health and Welfare Committee requested that ruling and opposition members submit the agenda for the First Legislation Subcommittee, which is expected to be held on the 26th.However, sources report that since the February subcommittee schedule falls immediately after the Lunar New Year holiday, and the leadership has agreed to the March plenary session, the New Year's business reports from relevant ministries, and the holding of the subcommittee, each lawmaker's office has been advised to submit only one agenda item.Despite this limitation, the bill to strengthen the supply chain for supply-unstable drugs and mandate limited generic prescribing, along with the bill to regulate the signage, advertising, and opening scale of warehouse-style pharmacies, are expected to be the top priority for the February subcommittee.Both bills are considered bills affecting daily lives, and resolving the drug supply instability issue is a national task of the new administration. Furthermore, the bill to strengthen regulations on warehouse-type pharmacies has gained urgency as large-scale warehouse-type pharmacies have recently opened in Seoul and other parts of the country, intensifying the debate between proponents and opponents and increasing the need to address potential side effects through legislative review.The bill details to resolve the drug supply instability crisis allows the Minister of Health and Welfare to designate supply-unstable drugs through the deliberation of the Drug Supply Management Committee. Among these, for drugs designated for emergency production or import, the bill permits pharmaceutical companies (manufacturers and importers) to place emergency production or import orders.Notably, the bill mandates that physicians write the generic name rather than the brand name on prescriptions for supply-unstable drugs, with penalties for violations. This provision aims to support the safe supply of medicines to patients by mandating limited generic prescribing.Representative Jang Jong-tae, who proposed the bill to resolve the drug supply instability issue, stated his legislative intent: "Recently, drug supply instability has been occurring frequently due to reasons such as temporary surges in demand, suspension of supply, and difficulties in securing raw materials," added, "Despite being a problem that threatens the public's right to health and causes confusion in the healthcare field, the current law lacks provisions regarding the response to drug supply instability."The bill to regulate warehouse-type pharmacies primarily prohibits the use of terms such as 'warehouse,' 'plant,' or 'factory' on pharmacy signs or promotional materials. It also mandates a preliminary review by the Pharmacy Opening Committee under the provincial governor or metropolitan mayor when an individual intends to register the opening of a pharmacy above a certain scale.The legislative goal is to prevent the incitement of excessive drug consumption and misuse among consumers and to strengthen the preliminary review authority of local governments and pharmacist associations regarding the opening of deformed pharmacies.Democratic Party Representatives Seo Young-seok, Nam In-soon, Kim Yun, Jeon Hyun-hee, and Jang Jong-tae have each proposed related legislation.An official from a ruling party member’s office on the Health and Welfare Committee explained, "We plan to submit the agenda items for the February subcommittee within the deadline," added, "The bill to resolve the drug supply instability crisis has high necessity and urgency for discussion, so we plan to request it as a first-priority bill for tabling."Another official from a ruling party member’s office stated, "As warehouse-type pharmacies have opened in several locations, it has become a national interest. The Ministry of Health and Welfare has also begun drafting regulations to prevent side effects, such as drug misuse, at warehouse-type pharmacies," and concluded, "It is necessary to accelerate the legislative review."

- Company

- BeOne Medicine’s ‘Tevimbra’ moves closer to reimb expansion

- by Eo, Yun-Ho Feb 20, 2026 10:04am

- Attention is focused on whether progress will be made in the insurance reimbursement process for the immuno-oncology drug ‘Tevimbra.Having passed the final Cancer Disease Deliberation Committee meeting of 2025, it remains to be seen whether it will complete evaluation stages like this year's Drug Reimbursement Evaluation Committee and expand the cost-effective immunotherapy treatment landscape.BeOne Medicine’s PD-1 inhibitor Tevimbra (tislelizumab) is currently undergoing discussions for reimbursement expansion across five indications.Following its success last April as the first immunotherapy to gain coverage for esophageal cancer, Tevimbra added five additional indications for solid tumors, including esophageal cancer, gastric cancer, and non-small cell lung cancer. BeOne Medicine simultaneously submitted reimbursement applications alongside the indication expansions.The specific indications include ▲ First-line combination therapy for patients with unresectable, locally advanced, or metastatic esophageal cancer; ▲ First-line combination therapy for patients with unresectable or metastatic HER2-negative gastric or gastroesophageal junction adenocarcinoma; and ▲ Two first-line combination regimens and one second-line monotherapy indication in NSCLC.With reimbursement procedures for additional indications progressing rapidly, Tevimbra’s role is expected to expand across multiple cancer types in Korea.Notably, BeOne Medicine previously reached an agreement with authorities while emphasizing a “reasonable pricing” strategy at the time of initial listing. This precedent has contributed to expectations surrounding the ongoing reimbursement discussions.Whether the company can maintain its stated philosophy of ‘providing innovative therapies at sustainable prices while improving patient access’ will serve as an essential factor.Meanwhile, Tevimbra has demonstrated efficacy and safety across multiple tumor types through the RATIONALE clinical trial program (RATIONALE-303, 304, 305, 306, 307).Notably, it demonstrated clinical benefit across the entire patient population for esophageal squamous cell carcinoma and gastric or gastroesophageal junction adenocarcinoma, showing consistent results even in pre-specified subgroups based on PD-L1 expression.

- Policy

- Weighted average price of apixaban falls 24%

- by Jung, Heung-Jun Feb 20, 2026 10:04am

- The weighted average price of apixaban declined by 24% last year, driven by increasing market penetration of generic products competing with the original anticoagulant Eliquis (apixaban) and reductions in reimbursement ceiling prices.Further declines are expected this year as generic competition intensifies, with products such as Chong Kun Dang’s Liquisia and Samjin Pharmaceutical’s Elxaban expanding their market presence.According to the Health Insurance Review & Assessment Service (HIRA)’s 2025 annual weighted average prices by active ingredient data, apixaban’s weighted average price fell from KRW 744 to KRW 566 year-over-year.BMS Pharmaceutical Korea’s Eliquis has been engaged in market share competition with generics since the year before last. Pharmaceutical companies that had withdrawn from the market after losing patent lawsuits relaunched their generics, and last year they launched aggressive market penetration efforts, including voluntary price reductions.Chong Kun Dang’s Liquisia reduced its reimbursement ceiling price from KRW 570 to KRW 567 through a voluntary price cut in October last year. Samjin Pharmaceutical’s Elxaban, expanding its presence in tertiary hospitals, is priced at KRW 550. Boryung’s BRapix also voluntarily reduced its ceiling price from KRW 724 to KRW 549 starting last November.Eliquis itself saw its ceiling price reduced from KRW 745 to KRW 570 last September following the reentry of its generic versions. All in all, the weighted average price of apixaban declined sharply within a single year due to generic relaunches and price adjustments.Despite this decline, apixaban’s weighted average price remains close to Eliquis’s ceiling price. This may indicate that generic penetration, while increasing, is not yet dominant enough to drive deeper price erosion.It also indicates that aggressive low-price bidding to enter tertiary hospitals has not yet occurred. Price management is being well-executed even amid market competition.The extent of further declines in the weighted average price for both the first and second halves of this year will likely be determined by the expansion of generics' market share. The key factor will be changes in market share held by Samjin and Boryung, which are expanding prescriptions using price competitiveness as their weapon.According to pharmaceutical market research firm UBIST, Eliquis sales declined from KRW 77.3 billion in 2023 to KRW 74.2 billion in 2024, representing a 3.9% decrease. The impact of generic re-entry is expected to continue to grow.Prior to market withdrawal following patent litigation losses, apixaban generics held a 24% market share. As of the third quarter of last year, their share stood at around 13% post-relaunch. Therefore, even considering only the previous market share, there remains potential for approximately 11% growth.

- Policy

- Takhzyro to be reimbursed from next month

- by Lee, Jeong-Hwan Feb 20, 2026 10:04am

- Takeda Korea’s hereditary angioedema treatment Takhzyro (lanadelumab) will be newly added to the National Health Insurance reimbursement list starting next month, approximately 5 years after receiving domestic marketing approval.Yuhan’s allergic rhinitis therapy Ryaltris Nasal Spray will also see an expansion of its reimbursement criteria.Currently reimbursed only for adolescents aged 12 and older and adults, Ryaltris’s coverage will be extended to pediatric patients aged 6 to 11.In addition, the reimbursement scope for the rare autoinflammatory disease treatment Kineret Inj (anakinra) will be explicitly revised to include treatment of macrophage activation syndrome (MAS).On the 19th, the Ministry of Health and Welfare (MOHW) issued a pre-announcement of a partial revision to the notification detailing reimbursement standards and application methods for pharmaceutical benefits.Under the revision, the Takhzyro Prefilled Syringe will be newly reimbursed effective March 1.Eligible patients include adolescents aged 12 and older and adults diagnosed with hereditary angioedema (Type 1 or Type 2), confirmed via serum testing for C1-esterase inhibitor deficiency or dysfunction (quantitative or functional), who meet the following conditions.Either they must have experienced attacks requiring emergency treatment (icatibant injection) at least 3 times per month on average over the previous 6 months, despite receiving oral danazol for at least 6 months, or they must have experienced a similar frequency of attacks if danazol could not be administered due to contraindications or adverse effects.After using Takhzyro for 6 months, if the average monthly number of episodes requiring emergency treatment (icatibant injection) has decreased by at least 50% compared to the initial treatment period, an additional 6 months of administration is approved.Subsequent reimbursement will require reassessment every six months, with continued coverage contingent upon maintaining the initial 6-month response level.However, after 6 months from the initial administration date, for patients showing stable disease activity and no adverse effects, self-administration is permitted following appropriate education on the administration method, based on the physician's judgment. Self-injection can be prescribed for up to a 2-month supply.Patients must complete a ‘patient medication diary’ to verify the medication administration period, with healthcare institutions responsible for its oversight.Takhzyro must be prescribed by a specialist with experience treating patients with hereditary angioedema. Objective documentation (medical records, test results, etc.) regarding the patient's eligibility for initial administration and response evaluation for continued administration must be submitted.In the case of the ENT medication Ryaltris Nasal Spray, its reimbursement, which was previously limited to patients aged 12 and older, will be expanded, effective March 1, to include children aged 6 to 11. However, the administration must strictly follow the indicated dosage and administration guidelines.Meanwhile, the reimbursement scope for Kineret Inj will be clarified in accordance with the approval conditions set by the Minister of Food and Drug Safety.Coverage will now include treatment for chronic infantile neurologic cutaneous and articular syndrome (CINCA), cytokine release syndrome (CRS) potentially occurring after CAR-T cell therapy, neurotoxicity syndrome, hemophagocytic lymphohistiocytosis (HLH) following CAR-T cell therapy, Schnitzler syndrome, and macrophage activation syndrome (MAS).

- Opinion

- ‘LEO Pharma serves as a KOR–DEN healthcare bridge’

- by Son, Hyung Min Feb 20, 2026 10:04am

- Korea and Denmark share similarities. Both nations operate universal healthcare systems and face the dual challenges of introducing innovative treatments while maintaining fiscal sustainability. The policy environment in both countries shares the dilemma of preserving public value while promoting research and development.Building on these shared priorities, the two nations have expanded multilayered partnerships involving governments, companies, and research institutions across various healthcare fields, including infectious disease response, aging populations, digital health, and chronic disease management.Established in 2011, LEO Pharma Korea has served as a bridge within the Korea–Denmark healthcare collaboration framework, particularly in dermatology. Through close engagement with Korean clinicians and evidence-based medical research, the company has executed a patient-focused innovation strategy while functioning as a strategic hub connecting the results to the Danish market.Against this backdrop, Frederik Kier, Executive Vice President of International Operations at LEO Pharma, who was appointed in June last year, recently visited Korea. His visit focused on reviewing the Korean subsidiary's strategy and discussing the direction of Korea–Denmark pharmaceutical and biotech collaboration with Mikael Hemniti Winther, Ambassador of Denmark to the Republic of Korea.Dailypharm recently met with Ambassador Winther and Executive Vice President Kier at the Danish Ambassador's residence in Seongbuk-dong, Seoul, to discuss bilateral healthcare cooperation, Korea’s strategic role, and the practical implementation plans for patient-focused innovation.“Designing public value and innovation together”… Emphasizing Korea-Denmark healthcare cooperationMikael Hemniti Winther, Ambassador of Denmark to the Republic of Korea.Ambassador Winther identified how Korea and Denmark's commonality lies not just in systems but in values. He emphasized that both nations have democratic systems and operate their healthcare systems on the basis of social agreement on welfare and public responsibility.Ambassador Winther said, “The Danish government views patients not as customers but as individuals for whom it bears responsibility. Policies are designed around that responsibility.”Denmark established a universal healthcare system early and has operated a healthcare infrastructure centered on public hospitals. Within this structure, pharmaceutical companies have served as a vital link, acting as a critical link that translates public research outcomes into real-world therapies beyond mere supply.He explained, “Denmark has pursued a welfare society relatively early on. Health insurance and the healthcare system serve as its core pillars. The system functions only when high-quality treatments are available for the patients. To achieve this, the government and pharmaceutical companies need to collaborate toward common goals.”He added, “The welfare system entails enormous costs. The key challenge is how to design incentives that encourage innovation while maintaining competition and transparency.”He also emphasized the culture of cooperation between the government and pharmaceutical companies. In Denmark, public research institutes, universities, hospitals, and companies are organically connected, and industry opinions are partially reflected in the system design process.He explained that cooperation between Korea and Denmark can also be understood within this context. The two countries continue policy exchanges across various fields, including infectious disease response, aging populations, and digital health. The embassy regularly communicates with Danish companies operating in Korea.Ambassador Winther stated, “Currently, Danish companies are actively collaborating not only in the pharmaceutical sector but across diverse industries, sharing the fundamental values Denmark upholds. I believe there remains substantial potential for expanded collaboration going forward.”LEO Pharma's execution strategy… Securing leadership in ‘medical dermatology’Frederik Kier, Executive Vice President of International Operations at LEO PharmaEVP Kier described Korea’s importance from an industry perspective. LEO Pharma, he noted, has dedicated more than 115 years to dermatology, defining its mission as leadership in Medical Dermatology.EVP Kier stated, “LEO Pharma aims to become a global leader in dermatology and is offering a broad range of treatment options for patients with skin conditions in Korea. Our existing portfolio includes diverse product lines, from acne therapies to treatment for psoriasis and atopic dermatitis.”Marking its 15th anniversary in Korea, the company has expanded its presence in recent years. One prime example is its atopic dermatitis treatment ‘Adtralza (tralokinumab)’, which received domestic approval in 2023 and was added to the national health insurance reimbursement list in 2024.The EVP explained that Adtralza has secured differentiated data in improving lesions on exposed areas like the head and neck and hands, establishing itself as a meaningful option in clinical practice.EVP Kier said, “The Korean market already has various atopic dermatitis treatment options. Nevertheless, Adtralza deserves attention for its superior efficacy on exposed areas like the head, neck, and hands. These areas are known to be challenging to treat, and it is precisely in these areas that we believe Adtralza provides tangible and meaningful benefits to Korean patients.”LEO Pharma has also secured Korean approval for ‘Anzupgo Cream (delgocitinib),’ a topical pan-JAK inhibitor targeting chronic hand eczema, and added it to its dermatology portfolio. Anzupgo is a topical formulation that inhibits JAK1, JAK2, JAK3, and TYK2 and was developed for patients who do not respond sufficiently to existing therapies.EVP Kier explained, “Chronic hand eczema is an inflammatory disease that persists for more than 3 months or recurs frequently, with a significant patient population not responding adequately to existing topical treatments. It represents a clear area of unmet medical need. Anzupgo Cream demonstrated strong clinical efficacy and was shown to improve multiple eczema symptoms. We are currently in the final stages of preparation for its official launch in Korea.”LEO Pharma is also preparing reimbursement procedures for Spevigo (spesolimab), a treatment for acute exacerbations of generalized pustular psoriasis (GPP). The company recently acquired commercialization rights through a licensing agreement with Boehringer Ingelheim.EVP Kier described the developments as part of building an end-to-end portfolio spanning mild localized diseases to severe and rare dermatologic conditions.EVP Keir specifically highlighted the Korean market as a strategic operational base in Asia. In his view, Korea is not merely a sales market, but an operational hub for data generation through clinical trials involving Koreans and a joint promotional base for raising awareness on the necessity of long-term treatment among healthcare professionals.EVP Keir stated, “Chronic skin diseases are not conditions resolved with short-term prescriptions. Both clinicians and patients must share a common understanding of the need for long-term management.”He added, “LEO Pharma views providing therapies for diseases with significant unmet medical needs as its most important contribution. To further establish leadership in dermatology, we will continue developing new candidates and treatment options within these disease areas.”“Healthcare as both industry and diplomacy”… the need for government–private collaborationThe significance of the discussion extended beyond introducing LEO Pharma’s corporate strategy. Its weight lay in the shared recognition, based on the common ground that both Korea and Denmark are welfare states operating public healthcare systems, of how to design and implement healthcare as a pillar of national strategy.Ambassador Winther said, “Denmark holds Korea's healthcare system in high regard. To address common challenges like aging populations and fiscal burdens, cooperation between the government and private sectors will become increasingly vital going forward. Healthcare is not merely an industry but a policy domain that the state must shoulder responsibility for. We need a structure where intergovernmental policy dialogue and corporate activities are discussed together.”EVP Kier echoed this perspective. “Korea possesses an advanced healthcare system, and its medical professionals demonstrate high understanding and implementation capabilities regarding innovative therapies. LEO Pharma seeks to act not merely as a supplier but as a long-term partner aligned with Korean healthcare professionals.”Both Ambassador Winther and EVP Kier expressed confidence in the expansion of Korea–Denmark cooperation.Another key theme emerging from this discussion was LEO Pharma's expansion of its domestic communication scope.EVP Kier stated, “While engagement previously centered on patient groups in the past, it has recently expanded to include academic exchanges and clinical discussions with Korean medical professionals, broadening the scope of collaboration. This expansion of domestic communication contributes to enhancing understanding within the healthcare field and strengthening the practical implementation capabilities for innovative therapies.”EVP Kier also added that certain skin conditions significantly impact patients' social lives and work performance. He remarked, “These conditions require greater attention from the medical community and society at large. LEO Pharma will continue being committed to introducing innovative new drugs to Korea.”Ambassador Winther said, “Korea and Denmark face significant demographic and economic challenges. Through close cooperation among health authorities, governments, and the private sector, both nations can share experience and deliver greater benefits to patients,” he stated.He concluded, ”The values shared by companies rooted in Denmark are reflected not only in LEO Pharma's treatments but also in the overall operations of Danish companies in Korea. We hope LEO Pharma's activities will contribute positively to Korean society.”

- Opinion

- [Reporter's View] New drugs for intractable cancers

- by Son, Hyung Min Feb 20, 2026 10:04am

- Although there are diverse types of intractable cancer, different diseases and varying prognoses coexist. The common feature of platinum-resistant ovarian cancer, small cell lung cancer (SCLC), and bile duct cancer is clear. They are characterized by limited treatment options, a short average survival period, and quickly diminishing next-line options.Drug discovery is fundamentally challenging in this field. The number of patients is limited, biological heterogeneity is significant, and designing a clinical trial scheme is difficult because many patients have worsened systemic conditions at diagnosis. Furthermore, it is difficult to set up a control group and clearly demonstrate a difference in overall survival (OS) due to crossover or follow-up treatments.As a result, clinical outcomes are mostly reported as improvements in Progression-Free Survival (PFS) or Hazard Zatios (HRs). There have been studies in which the difference in PFC between the control and treatment groups is only 1 month. The outcomes, such as HR 0.73, a 27% reduction in disease progression or risk of death, and an HR below 1, indicate effective treatment and statistical significance.However, what patients experience is not the relative risk reduction or the time they have saved. Studies with PFS extended from 3.8 months to 5.2 months translate to HR 0.73 and a 1.4-month extension. It shows progress in terms of statistics; however, the clinical significance is much more complicated.Nevertheless, a tiny improvement in PFS cannot be taken lightly. For patients with few treatment options remaining, disease control of 6 to 8 weeks can represent an opportunity to bridge to the next treatment and time to preserve quality of life. If Objective Response Rate (ORR) or PFS2 appear meaningful, and a patient group with a long Duration of Response (DoR) exists, the 'long tail' behind the median is by no means small. In the HR 0.72 value, the varying times of different patients are contained.The problem arises when these figures assume identical expectations for all patients. Outcomes such as a 1 to 2-month improvement in PFS must be interpreted alongside toxicity burden, treatment discontinuation rates, and Patient-Reported Outcomes (PRO). Particularly in situations where OS data is not sufficiently mature, the criteria for 'meaningful time' become more complex as PFS-centered evaluations are repeated.This concern extends beyond the clinical field into institutional judgment. Within limited budgets, which drugs should be permitted for which patient groups and at what point? The fact that the risk of death was reduced by 20% does not necessarily translate into the same reduction for all patients. It is more important to determine how precisely patients with a high likelihood of response can be selected, and how to verify and enhance efficacy in clinical practice.The approach must be more careful in the field of intractable cancers. Rather than opening the door uniformly to all patients, a structure is needed that applies treatments stepwise, starting with patient groups where evidence is confirmed. A system must be operated in parallel, with access initially permitted on a limited basis while accumulating Real-World Data (RWD), followed by a re-evaluation of OS, PFS2, treatment durability, and quality-of-life improvements after a certain period.The issue is not the size of the number, but how it is interpreted. Between the desperation of intractable cancer and statistical significance, judgment must be more delicate and transparent.However, if OS improvement is used as the sole absolute criterion without sufficient consideration of the characteristics of intractable diseases and the difficulties of drug development, patient access to new drugs will inevitably remain low. It is difficult to justify a structure where treatment opportunities are narrowed simply because a patient has a specific type of cancer.

- Policy

- Empagliflozin, linagliptin see sharp price drops amid generic entry

- by Jung, Heung-Jun Feb 20, 2026 10:04am

- The weighted average prices of diabetes drugs empagliflozin and linagliptin plummeted by as much as 34% after patent expiry due to generic penetration.For empagliflozin 10mg, the weighted average price stood at KRW 618 two years ago but fell to KRW 408 last year, reflecting significant downward pressure from generic competition.According to a comparison of the 2025 annual weighted average prices by active ingredient, released by the Health Insurance Review & Assessment Service (HIRA), with 2024 figures, empagliflozin and linagliptin recorded notable price reductions.Statin+ezetimibe combination therapies also posted weighted average price declines of 1–3% across strengths. AI-generated image.Additionally, the weighted average prices of other dyslipidemia combinations, such as atorvastatin + ezetimibe and rosuvastatin + ezetimibe, also decreased slightly. While the reduction rate is lower than that of diabetes drugs, at around 3%, the financial impact remains substantial given the large prescription volumes.The patent expiry of Jardiance triggered a surge of generic launches, significantly reducing empagliflozin’s weighted average price. In 2024, empagliflozin 10mg and 25mg were priced at KRW 618 and KRW 798, respectively, but fell to KRW 408 and KRW 532 last year.Linagliptin followed a similar trajectory after patent expiry of Trajenta, with expanding generic competition driving weighted average price erosion. The weighted average price for linagliptin 5mg fell 23.7%, from KRW 523 to KRW 399.Salt-modified products, including linagliptin besylate, also recorded parallel reductions. The weighted average price, which was KRW 525 in 2024, decreased by 23% to KRW 402 last year.Dyslipidemia combination drugs showed relatively smaller declines. The weighted average prices of statin+ezetimibe combinations decreased slightly.For example, the weighted average price of atorvastatin 80mg + ezetimibe 10mg decreased from KRW 1,387 to KRW 1,340, a 3.4% drop. Rosuvastatin 2.5mg + ezetimibe 10mg decreased from KRW 696 to KRW 670, a 3.7% drop.The statin + ezetimibe market is worth approximately KRW 1.4 trillion, and due to the large volume of prescriptions, even a single-digit percentage decrease results in a significant reduction.Despite the slight decline in the weighted average price, the statin + ezetimibe market continues to grow. This indicates that prescription volumes are increasing sufficiently to offset the price declines.

- InterView

- "Leclaza comb included in the U.S. guideline"

- by Cha, Ji-Hyun Feb 20, 2026 10:04am

- Professor Se Hoon Lee of the Division of Hematology-Oncology at Samsung Medical CenterThe global status of Korea-made novel anticancer drug 'Leclaza' (ingredient: lazertinib) is shifting. The shift was brought by the 2026 National Comprehensive Cancer Network (NCCN) Clinical Practice Guidelines for Non-Small Cell Lung Cancer (NSCLC), which included the combination therapy of Leclaza + 'Rybrevant' (ingredient: amivantamab) as a 'Preferred Regimen' for first-line treatment, while Leclaza monotherapy was included as an option that is 'Useful in Certain Circumstances.'Analysis suggests that this is highly significant as the first Korea-made novel drug has been included in the NCCN Category 1 first-line treatment bracket. DailyPharm met with Professor Se Hoon Lee of the Division of Hematology-Oncology at Samsung Medical Center, who led the follow-up studies of the Phase 3 MARIPOSA trial, to discuss the significance of this guideline revision and the evolving treatment strategies in clinical practice.OS data changed the standard... "Combination therapy enters the stage of discussion"Yuhan's Leclaza and Janssen's RybrevantLeclaza is a third-generation NSCLC treatment targeting Epidermal Growth Factor Receptor (EGFR) mutations, which received domestic approval in January 2021 as South Korea's 31st novel drug. The Leclaza-Rybrevant combination therapy was approved by the U.S. Food and Drug Administration (FDA) in August 2024 as a first-line treatment for adult patients with locally advanced or metastatic NSCLC with EGFR exon 19 deletions or exon 21 L858R substitution mutations.Professor Lee identified the foundation of this revision in the Overall Survival (OS) data.Professor Lee stated, "The Phase 3 MARIPOSA trial, which served as the basis for this revision, was a study comparing the Leclaza-Rybrevant combination therapy against the existing standard of care, 'Tagrisso' (ingredient: osimertinib) monotherapy. Given that monotherapy has already established itself as the standard treatment, demonstrating whether clinical benefits actually translate into OS improvement was paramount, especially considering the inevitable toxicity burden of combination therapy."Professor Lee added, "If it were a comparison between monotherapies with similar efficacy and toxicity profiles, a shift in the standard could be discussed based on Progression-Free Survival (PFS) results alone. However, for combination therapies, the criteria for decision differ," and added, "It is meaningful that by confirming statistical significance for OS through this study, the grounds for discussing combination therapy as a standard treatment option have been established."According to the Phase 3 MARIPOSA OS results presented at the European Lung Cancer Congress (ELCC) last March, the Leclaza-Rybrevant combination therapy demonstrated statistical significance, reducing the risk of death by approximately 25% (HR 0.75, 95% CI 0.61–0.92) compared with Tagrisso monotherapy.The median Overall Survival (mOS) has not yet been reached (not reached). This means that more than half of the patients in the combination therapy group survived during the follow-up period, and a sufficient number of death events did not occur to calculate a median value. Considering that the mOS of Tagrisso monotherapy was confirmed at 36.7 months, there are projections that once the mOS for the Leclaza-Rybrevant combination therapy is finalized in the future, the gap between the two groups could widen to more than a year.Professor Lee also expected that this revision could serve as a starting point for restructuring international treatment guidelines. He noted, "The NCCN guidelines are be revised relatively quickly among global guidelines, so this change is highly likely to become the starting point for revisions of other international guidelines in the future. While European guidelines may take a more cautious approach as they consider economic evaluations simultaneously, I expect the general direction itself to unfold similarly."Changes in the guidelines are also influencing the domestic clinical field.Professor Lee stated, "Following the changes in global guidelines, a shift in perception regarding first-line treatment strategies is emerging in the domestic medical field. Since OS has improved by more than a year, many medical professionals believe that combination therapy should be considered a priority."He added, "Compared to when the MARIPOSA study's PFS data was first released, I can feel that the perception of medical staff is changing over time. While individual opinions vary, it is a clear trend that as more experts gather to discuss, the proportion of those considering combination therapy is gradually expanding."Comparison of monotherapies…attention on safety differencesThe double-blind, Head-to-Head direct-comparison data between Leclaza and Tagrisso monotherapy are gaining attention.Generally, it has been perceived that studies directly comparing two drugs with proven efficacy are difficult to establish. Regarding a standard treatment that has already preempted the market, a result showing inferiority could pose significant commercial risks, and the practice of randomly assigning patients when a standard treatment is established can provoke ethical controversies.Professor Lee explained, "As the FDA required the individual contribution of each component drug in the combination therapy study to be proven, a design involving a direct comparison of monotherapies within the same study could be included," added, "This data is unique globally and is precious data that will be difficult to replicate in the future."As this was an exploratory analysis, it has limitations regarding the number of patients. However, the professor explained that the reliability of the interpretation is enhanced by the fact that the two drugs were directly compared under the same conditions within the same clinical trial, rather than through indirect methods that compare results from different studies. Such data can serve as evidence for fine-tuning treatment strategies in clinical practice.The direct comparison showed that the two drugs had similar efficacy, as evidenced by their survival curves, but differences in their safety profiles were observed. Among these, the point of clinical interest is cardiac toxicity.Professor Lee stated, "Tagrisso showed a tendency toward more reports of cardiac-related adverse events such as heart failure or QT prolongation compared to Leclaza," added, "It has been suggested that this may be due to Tagrisso's characteristic of more broadly inhibiting HER2 (ERBB2), which is associated with cardioprotection."Professor Lee further explained, "While the incidence of cardiac toxicity itself is low at less than 2%, it is a clinically important consideration as it is a life-threatening adverse event," added, "Peripheral neuropathy is observed more frequently in Leclaza monotherapy, but this is not a life-threatening adverse event, and its clinical impact tends to be limited."Consistent survival benefit confirmed in Asian patients... "Combination will become the basic option"Leclaza is also securing consistent clinical data in the Asian patient population. This contrasts with the FLAURA2 study, which evaluated the Tagrisso-chemotherapy combination, where the efficacy in the Asian subgroup excluding China appeared limited.In the FLAURA2 study, the OS Hazard Ratio (HR) for the Asian subgroup excluding China was 1.00 (95% CI 0.71–1.40), showing no additional survival benefit compared to monotherapy. In contrast, the MARIPOSA study reported an OS HR of approximately 0.77 for the total population, including Asian patients, confirming a death risk reduction effect.Professor Lee stated, "The mechanism explaining the HR difference observed in the Asian patient population is not yet clear, making it difficult to draw conclusions based on subgroup analysis alone. However, since consistent OS improvement was confirmed in the total population, including Asian patients, in the MARIPOSA study, these differences need to be scrutinized through further research in the future."Professor Lee believes the focus on first-line treatment strategies is gradually shifting toward combination therapy.Professor Lee said, "In the past, monotherapy was the default, with combination therapy considered for some patients; however, recently, there is a spreading view that combination therapy should be the baseline strategy, with monotherapy applied selectively," added, "This is similar to the trend where the combination of immunotherapy and chemotherapy has become the standard of care in NSCLC."Furthermore, Professor Lee stated, "In my opinion, a strategy of first checking the response with monotherapy for about three to six weeks and then switching to combination therapy for patients who need it is desirable," added, "However, in a reimbursement system, it is important to secure the option of combination therapy, so an approach starting with combination therapy whenever possible can be rational."Ultimately, Professor Lee predicted that future first-line treatment strategies will be restructured as a matter of choice between combination therapies. He concluded, "If both Leclaza + Rybrevant and Tagrisso + chemotherapy combination therapies are included in the reimbursement system, the focus of discussion will move beyond simply whether to use combination therapy to which of the two combination strategies to choose,'' and concluded, "At that stage, further discussions will be necessary, considering not only survival indicators but also the mechanistic differences, immunological changes, and molecular biological characteristics of each treatment strategy."

- Policy

- Will the generic drug price cut be put on hold?

- by Lee, Jeong-Hwan Feb 20, 2026 10:03am

- The Ministry of Health and Welfare (MOHW) has decided to exclude the proposed drug pricing reform plan, which includes price reductions for already listed generics, from the agenda of the Health Insurance Policy Deliberation Subcommittee meeting scheduled for today (20th), drawing attention to the rationale behind the move.With the reform proposal removed from the subcommittee agenda, it is also expected to be excluded from the February HIPDC meeting set for the 25th.Observers suggest the ministry deferred subcommittee review to gather additional industry opinions, following strong opposition from the pharmaceutical industry against the Ministry's plan to significantly lower the generic drug price calculation rate from 53.55% to the 40% range.Originally, the Ministry planned to approve the broad framework of the drug pricing system reform plan at this month's HIPDC meeting, targeting implementation in July this year.However, the Ministry appears to have excluded the drug pricing system reform plan from the February subcommittee agenda to gather additional opinions, following strong opposition to the price reduction policy from an emergency counterresponse committee comprising 5 major organizations - Korea Pharmaceutical and Bio-Pharma Manufacturers Association (KPBMA), Korea Biomedicine Industry Association (KoBIA), Korea Pharmaceutical Traders Association (KPTA) , Korea Drug Research Association (KDRA), and Korea Pharmaceutical Industry Cooperative (KPICO).As a result, the timeline for subcommittee review of the reform plan is effectively delayed by approximately one month. During this period, the domestic pharmaceutical industry is expected to actively engage in negotiations with the Ministry of Health and Welfare for potential revisions.The industry argues that the Ministry's excessive generic drug price reduction rate undermines investment momentum for new drug R&D, encourages the production of low-quality generics, exacerbates employment instability, and ultimately collapses the pharmaceutical industry.The scale of future conflict surrounding the drug price reduction administration will likely depend on how much and how the Ministry of Health and Welfare accommodates the industry's opinions.A representative from domestic pharmaceutical company A commented, “We understand the Ministry excluded the item from February's deliberation agenda to gather sufficient opinions. Since the implementation date is set for July, the key question is whether the public and private sectors can agree on concrete revisions beyond simply excluding the item.”A representative from domestic pharmaceutical company B said, “Given the pharmaceutical industry's growing resistance, it would have been difficult for the Ministry to unilaterally push through the drug price reduction plan as scheduled. But delaying the deliberation once has little effect in quelling substantial industry backlash. What is needed now is policy action that genuinely reflects on-the-ground realities.”

- Policy

- GOV to boost open innovation in the pharma industry

- by Lee, Jeong-Hwan Feb 13, 2026 08:29am

- The government will support industry growth by linking matching between global biopharma companies and domestic pharmaceutical companies in Korea.The Ministry of Health and Welfare (MOHW) and the Korea Health Industry Development Institute (KHIDI) announced that they are recruiting participating companies for the "2026 Global Leading Company Collaboration Program" to vitalize global open innovation in the pharmaceutical and biotechnology sectors.The MOHW and KHIDI have been promoting this global open-innovation support project to solve significant uncertainties for domestic firms. While Korean companies often lack capital and experience in global drug development and face complex regulatory landscapes across different nations.Previously, various programs that facilitated global companies' selection of outstanding domestic firms have yielded success, such as in technology transfer and transactions. As global leading companies show increasing interest, the project will be integrated into a single unified brand starting this year: "K-BioPharma Next Bridge."Specifically, the global companies will select domestic partners as follows: Roche: 4 companies for the "Korea-Switzerland Bio Pass," AbbVie: 2 companies for the "Biotech Innovator Award," Amgen: 2 companies for the "Golden Ticket," Novo Nordisk: 3 companies for "Partnering Day," MSD: 5 companies for "Partnering Day," AstraZeneca: Selection for "Project Nova" (no limit).The Summary of the "K-BioPharma Next Bridge". Roche: 4 companies for the "Korea-Switzerland Bio Pass," AbbVie: 2 companies for the "Biotech Innovator Award," Amgen: 2 companies for the "Golden Ticket," Novo Nordisk: 3 companies for "Partnering Day," MSD: 5 companies for "Partnering Day," AstraZeneca: Selection for "Project Nova" (no limit).Companies selected for the "K-BioPharma Next Bridge" project will receive various growth opportunities, including R&D support, business consulting, prize money, support for residency at international accelerating centers (such as Basel SIP), and investment matching.Eun-young Jung, Head of the Bureau of Health Industry at the MOHW, stated, "As the achievements of open innovation accumulate, the interest of global companies in Korean firms is rising," and added, "We will continue to expand open innovation with global leading companies to ensure domestic companies with promising technologies can enter the global market and succeed in business."Soon-do Cha, President of KHIDI, added, "We will lay the bridge for domestic companies to reach the global market through various open innovation collaborations, such as joint research, mentoring, and residency support," and added, "We will actively support the global expansion and performance of the Korean pharmaceutical and bio industry."