- LOGIN

- MemberShip

- 2026-03-09 20:47:42

- Policy

- Will pharma be able to request 'records of administrative sanctions' during acquisition?

- by Lee, Jeong-Hwan Mar 03, 2026 09:21am

- A bill is being developed to grant pharmaceutical manufacturers that intend to acquire an existing pharmaceutical company the authority to request and receive records of administrative sanctions imposed on the previous owner (the former operator) by administrative authorities.This legislation aims to address the issue that the current law lacks a legal basis for an assignee to verify the assignor's history of administrative sanctions.Once the bill is passed, cases in which an assignee suffers unfair losses, such as managerial damage, by acquiring a pharmaceutical company without knowledge of existing administrative sanctions are expected to disappear.On February 27, 2026, Representative Park Hyeong-soo of the People Power Party proposed a partial amendment to the Pharmaceutical Affairs Act containing these details.Under the current law, when a new operator succeeds to the status of a former operator through business transfer, inheritance, or merger between corporations, the effects of administrative sanctions on the former operator are transferred to the assignee, except for cases of good faith acquisition.In other words, if a pharmaceutical company with finalized administrative sanctions is purchased, the responsibility and effects of those sanctions are transferred to the assignee rather than the assignor.Rep. Park raised concerns that if a pharmaceutical company is acquired without knowledge of any administrative sanction history, the assignee is forced to fulfill the existing sanctions, which can sometimes lead to a situation worse than not having acquired the company at all.Accordingly, Rep. Park introduced a bill that allows a person seeking to succeed to a pharmaceutical manufacturing business (a person intending to acquire a pharmaceutical company) to request the history of past administrative sanctions and details of administrative sanctions currently in progress from the Minister of Health and Welfare (MOHW), the Minister of Food and Drug Safety (MFDS), provincial governors, or heads of local governments (mayors, governors, or district heads).Rep. Park explained, "This bill allows assignees to check the records of administrative sanctions against the previous operator in advance, enabling them to make more rational decisions regarding the acquisition," adding, "The Anti-Corruption and Civil Rights Commission has also recommended establishing procedures to verify administrative sanctions, as cases of attempting to transfer businesses to evade administrative sanctions have become frequent."

- Policy

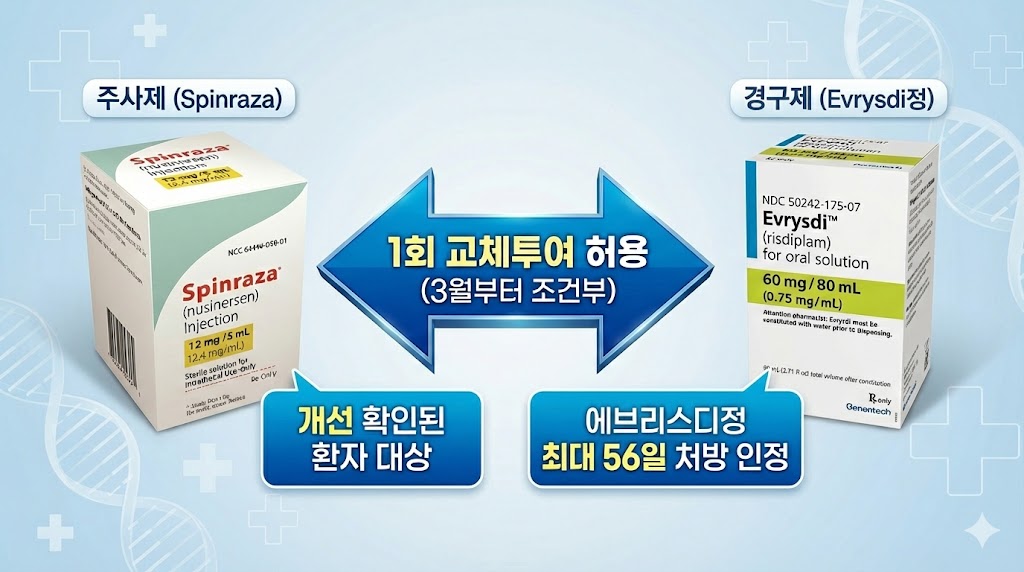

- Reimb for switching between Evrysdi and Spinraza allowed in Korea

- by Jung, Heung-Jun Mar 03, 2026 09:21am

- Beginning in March, the scope for switching between spinal muscular atrophy (SMA) treatments Evrysdi and Spinraza will be expanded with reimbursement.With bidirectional switching now permitted between injectable and oral therapies, prescriptions can be adjusted based on changes in patient condition. Previously, only a single switch from Spinraza to Evrysdi had been allowed.AI-generated ImageOn the 27th, the Health Insurance Review and Assessment Service (HIRA) announced updated reimbursement criteria for SMA therapies, effective March 1, following revisions to the Ministry of Health and Welfare’s reimbursement standards.Until now, switching or combination therapy between SMA treatments had not been covered. Under the revised policy, a one-time conditional switch will be permitted between the injectable Spinraza and the oral formulations Evrysdi Dry Syrup and Evrysdi Tab.Switching is allowed if clinical improvement has been confirmed during treatment, the discontinuation criteria are not met, and there is a valid clinical reason. This applies not only to switching from an injectable to an oral medication but also from an oral medication to an injectable. Patients can even switch from an injectable to an oral medication and then return to an injectable.The change enhances treatment accessibility by allowing reimbursement coverage when medication adjustments are necessary based on a patient’s condition.However, patient motor function assessment criteria have become more detailed. Previously, assessment tools were applied uniformly based on whether the patient was under or over 24 months of age.Starting in March, assessment tools will instead be differentiated based on whether the patient can sit, among other refinements. This will apply to assessments conducted after implementation.With the new reimbursement listing of Evrysdi Tab in March, long-term prescription limits have also been established. The maximum prescription duration for Evrysdi Tab is 56 days.Roche Korea’s Evrysdi Tab 5mg is scheduled for reimbursement listing next month at KRW 793,333, adding a tablet formulation alongside the existing dry syrup.With the addition of a new formulation, the wording has been revised to refer to ‘Evrysdi Dry Syrup, etc.’ in prior review procedures and reimbursement criteria to reflect the expanded formulations.

- Product

- Wegopro, Mounjung? Warning over supplements resembling medicines

- by Kim JiEun Mar 03, 2026 09:21am

- The Korean Pharmaceutical Association (President Young-hee Kwon) has urged consumers to exercise caution regarding health functional foods and general food products that may be confused with prescription medicines.The KPA emphasized, “As the distribution of general foods that are classified as other processed goods with names and appearances similar to pharmaceuticals increases in the market, there is a growing risk of treatment delays, misuse, and other health harms. This is not merely a matter of product choice but an issue directly linked to public health and safety, requiring special caution.”The association noted that cases have recently been identified in which health functional foods and general foods are being sold with names and appearances similar to prescription drugs.In particular, products using names reminiscent of diabetes or obesity treatments are being distributed, raising concerns that consumers may mistake them for medicines.Some products reportedly mimic pharmaceutical packaging colors and design layouts, further increasing the risk of confusion.The KPA mentioned that it had previously raised the issue during a National Assembly Health and Welfare Committee audit last year.Rep. Bo-yoon Choi pointed out that distinctions among pharmaceuticals, quasi-drugs, and health functional foods are not clearly conveyed to consumers. She cited examples such as Ursa–Ursaji, Jeil Cool Pap–Jeil Pap Cool, and Madecassol–Madecassol Care, where similar names and packaging may blur distinctions.At the time, Rep. Choi stated, “Even if the legal distinction is clear, if identical display and similar packaging persist, consumers inevitably perceive them as the same drug,” pointing out the resulting risks of delayed treatment and side effects.Eun-gyo Kim, Director of Health Functional Foods at the Korean Pharmaceutical Association, said, “Pharmaceuticals are therapeutic products whose safety and efficacy are verified through clinical trials and regulatory approval by the Ministry of Food and Drug Safety, whereas health functional foods and general foods are supplementary products that cannot replace medicines. Selling products with similar names or that exploit the recognition and social interest in treatments for specific diseases poses a high risk of misleading consumers.Meanwhile, the KPA urged consumers to always verify the distinction between pharmaceuticals, health functional foods, and general foods, along with their labeling information, when purchasing products. It also stated that it will continue monitoring similar cases and actively pursue policy improvements to protect public health.Furthermore, it stressed the need for: ▲ Establishing prior review and restriction criteria for products using names closely resembling medicines ▲ Creating new regulatory standards for packaging and designs that evoke pharmaceuticals ▲ Strengthening mandatory distinction labels and warning statements to prevent confusion ▲ Enhancing inspection and management of advertising and online promotional practices that imply disease treatment effects.

- Policy

- MOHW to newly establish 'Bureau of Regional·Essential·Public Healthcare'

- by Lee, Jeong-Hwan Mar 03, 2026 09:21am

- 고형우 국장The Ministry of Health and Welfare (MOHW) plans to complete the establishment of the 'Bureau of Regional·Essential·Public Healthcare' within the first half of this year. The Office of the President agrees with the necessity of strengthening 'Bureau of Regional·Essential·Public Healthcare,' and the Ministry plans to create a new bureau following consultations with the Ministry of the Interior and Safety.On the 2nd, Ko Hyung-woo, Director of the Division of Essential Healthcare at the MOHW, shared these plans during a briefing with the Korea Special Press Association.Director Ko explained that the new division is still in its early stages and requires further coordination with the Ministry of the Interior and Safety.However, he added that discussions are in full swing following the passage of the Regional Essential Healthcare Act in the National Assembly, and that the Office of the President is responding positively.Consequently, the Ministry intends to establish the new Division-level organization during the first half of the year to take full charge of the new healthcare policies.Ko stated, "While the 'Bureau of Regional·Essential·Public Healthcare' will include three distinct bureaus (Regional Healthcare, Essential Healthcare, and Public Healthcare), we will not be creating all new divisions," adding, "Some will be reorganized and recombined from existing structures."Ko added, "Bureaus that require new establishment, such as those related to national medical schools, will be created. I hope that the workforce will increase under this new Bureau-level structure. The healthcare sector is short-staffed. If sufficient personnel are deployed, the quality of our policies will be significantly higher than it is now."Regarding the allocation of KRW 1.13 trillion annually for the Regional and Essential Healthcare Special Account, Director Ko said, "If we design our projects well, we can pull budget from other general finances if necessary. Therefore, the KRW 1.13 trillion is not set but it could increase or decrease."Ko emphasized, "The important part is our decision to proceed with KRW 800 billion for new projects. Typically, projects exceeding KRW 50 billion over five years must undergo a preliminary feasibility study, which takes considerable time and would prevent immediate implementation next year," adding, "Since KRW 800 billion over five years totals KRW 4 trillion, we must apply for an exemption from the preliminary feasibility study for this KRW 4 trillion plan. We are putting efforts into developing the content for this."Ko further explained, "According to our surveys of local governments, the majority believe that support is essential for childbirth, pediatrics, emergency, and cardiovascular care," adding, "While medical personnel represent the most critical portion of the KRW 800 billion budget, regional doctors will not emerge for another 10 years. Therefore, we are currently considering how to address non-physician medical personnel."

- Company

- Will Vyloy secure reimb this year?...Passes CDDC review

- by Eo, Yun-Ho Feb 27, 2026 08:36am

- Attention is turning to whether the gastric cancer targeted therapy Vyloy will succeed in its renewed bid and secure reimbursement after clearing the Cancer Disease Deliberation Committee review.Vyloy (zolbetuximab), developed by Astellas Korea for Claudin 18.2–positive gastric cancer, passed the Health Insurance Review and Assessment Service (HIRA) Cancer Disease Deliberation Committee in October last year and is currently undergoing procedures for submission to the Drug Reimbursement Evaluation Committee.Approved in Korea in September 2024, Vyloy failed to clear the CDDC review with its initial application in February last year but promptly submitted a reapplication, ultimately securing approval.Vyloy is the world’s first approved Claudin 18.2–targeted therapy. It is an immunoglobulin monoclonal antibody that binds to Claudin 18.2, a protein expressed and exposed in gastric cells.According to the Phase III SPOTLIGHT study, which formed the basis for Vyloy's approval, the median progression-free survival (mPFS) for Vyloy combined with mFOLFOX6 (oxaliplatin, leucovorin, fluorouracil) was 10.61 months, exceeding the placebo group’s 8.67 months. Median overall survival (mOS) was also longer at 18.23 months versus 15.54 months.In the GLOW study, the Vyloy plus CAPOX (capecitabine and oxaliplatin) combination group achieved a median progression-free survival of 8.21 months, reducing the risk of disease progression or death by approximately 31%.Professor Sun Young Rha of Yonsei Cancer Center stated, “About 90% of patients with metastatic gastric cancer are HER2-negative, underscoring the urgent need for therapies targeting new biomarkers. Given that about 40% of HER2-negative patients are reported to be Claudin 18.2-positive, the emergence of Vyloy, which selectively binds to Claudin 18.2, presents a new therapeutic option for these patients.”Meanwhile, the Korean Gastric Cancer Association revised its treatment guidelines on January 6, 2025, in the Journal of Gastric Cancer (JGC), granting Vyloy the ‘highest-level’ recommendation as first-line therapy for patients who are HER2-negative and Claudin 18.2-positive.Vyloy has also been listed as a standard treatment option in Japan’s gastric cancer guidelines and the European Society for Medical Oncology (ESMO) clinical practice guidelines. It is included as a preferred regimen in the U.S. NCCN guidelines, rapidly establishing itself as a global standard of care for gastric cancer.

- Policy

- Erleada Tab's expanded reimbursement bid falls through

- by Jung, Heung-Jun Feb 27, 2026 08:36am

- Expanded reimbursement for Janssen Korea's Erleada (apalutamide), a treatment fors prostate cancer, fell through due to failed negotiations between the company and the National Health Insurance Service (NHIS).Erleada Tab has encountered a hurdle requiring a refund rate adjustment due to expanded reimbursement, as it is designated a Risk-Sharing Agreement (RSA) medicine. Janssen Korea plans to prepare for reapplication to expand the drug's reimbursement.According to industry sources on the 24th, Erleada Tab recently failed to clear the final hurdle in price negotiations with the National Health Insurance Service (NHIS), the last step before receiving expanded reimbursement.Erleada Tab was approved for reimbursement for treating 'metastatic hormone-sensitive prostate cancer' (mHSPC) in April 2023. It was listed at KRW 20,045 under a refund-type Risk-Sharing Agreement. Additionally, it became the first in the Androgen Receptor Targeted Agent (ARTA) to receive essential reimbursement, with a 5% patient co-payment.Then, the company applied to expand reimbursement to 'treatment of patients with high-risk non-metastatic castration-resistant prostate cancer (nm CRPC)', which was approved by the Cancer Disease Review Committee (CDRC) in March last year. In October of the same year, the Drug Benefit Evaluation Committee recognized the adequacy of this drug's expanded reimbursement.However, the issue appears to be the contract regarding the RSA refund rate associated with the expanded prescription target, and they ultimately failed to narrow the gap in their positions during negotiations.Janssen Korea stated, "Although these negotiations fell through, we plan to apply for expanded reimbursement again as soon as possible by following the procedures for re-initiating expanded reimbursement. We will continue to strive to improve treatment accessibility for patients."According to the pharmaceutical market research firm UBIST, Erleada Tab's prescription volume last year reached KRW 53.3 billion, a 71% increase from KRW 31.2 billion the previous year. Since receiving reimbursement for mHSPC in 2023, the drug has shown steep annual revenue growth.Competing products for Erleada Tab include Astellas' Xtandi (enzalutamide), indicated for high-risk nmCRPC, followed closely by Bayer's Nubeqa (darolutamide).In December last year, Nubeqa passed the first hurdle of the CDRC for establishing reimbursement criteria for ▲treatment of high-risk nmCRPC ▲combination with androgen deprivation therapy (ADT) for mHSPC patients ▲combination therapy with docetaxel and ADT for mHSPC patients.

- Policy

- Flexible pricing extended to listed drugs…boosts new drug exports

- by Jung, Heung-Jun Feb 27, 2026 08:36am

- The government’s decision to expand the dual-pricing “flexible pricing agreement scheme” to already-listed drugs is expected to support the global expansion of Korean new drugs.With the broader application of the scheme, cases like HK Inno.N’s K-CAB are likely to increase. Domestic pharmaceutical companies preparing for exports are already gearing up for the expansion.On the 25th, the MOHW decided at the Health Insurance Policy Deliberation Committee (HIPDC) to push to expand the flexible drug pricing scheme in the first half of this year to enhance the global competitiveness of new drugs.The Medical Care Benefit Rules will be revised to expand the flexible drug pricing contract system, currently applied to ‘new drugs developed by innovative pharmaceutical companies, etc.’, to cover ‘new drugs and biosimilars, etc.’.AI-generated imageAlthough the eligible products were not specified in detail, already-listed medicines are included among the targets.This means that Korean new drugs with established reimbursement ceiling prices will also qualify. Contracting a higher official listed price can work favorably when setting prices for exports.K-CAB, for example, had been subject to a price reduction under the price-volume agreement system, but maintained its listed price through negotiations with the NHIS. While not a treatment for severe diseases, the product’s expanding overseas exports meant that a price cut would have had significant repercussions.As the only Korean new drug granted dual pricing (flexible pricing), K-CAB was able to preserve competitiveness in overseas price negotiations.An industry official at the domestic pharmaceutical company A commented, “For listed medicines, the ceiling price is already visible, but if a product is being prepared for export, raising the listed price is highly beneficial. The domestic listed price serves as a reference when determining prices abroad. Companies are already expecting the inclusion of already-listed medicines and already preparing for this.”Because biosimilars are also included in the expanded scope, Korean companies such as Celltrion and Samsung Bioepis are likewise expected to benefit from expanding their global sales channels.Above all, the greatest beneficiaries are multinational pharmaceutical companies' new drugs and patients with rare and severe diseases. Maintaining a higher listed price in Korea helps avoid disrupting global drug pricing policies, thereby reducing the risk of “Korea passing” in launch strategies.The HIPDC materials also include plans to “continuously improve cost-effectiveness evaluations to better reflect the innovation and value of new drugs,” suggesting that access to new drugs from multinational pharmaceutical companies will likely improve further this year.

- Policy

- COVID-19 pill now limited to 'Paxlovid'… Lagevrio stock depleted

- by Lee, Jeong-Hwan Feb 27, 2026 08:36am

- From now on, oral COVID-19 treatments will be limited to 'Paxlovid.' This is due to the stock exhaustion of Lagevrio, another oral antiviral, which will lead to its discontinuation starting on the 17th of next month.On the 26th, the Korea Disease Control and Prevention Agency (KDCA, Commissioner Seung-Kwan Lim) announced that, since the government-supplied stock of Lagevrio has been depleted, the available oral treatments for COVID-19 will be restricted to Paxlovid only.Originally, among the three COVID-19 treatments supplied by the government (Paxlovid, Lagevrio, and Veklury), Paxlovid and Veklury received marketing authorization and have been covered by Nationa Health Insurance since October 25, 2024.Lagevrio's marketing authorization process has not been completed and has maintained only Emergency Use Authorization (EUA) to date. While it continues to be supplied on a limited basis using government inventory, its shelf life has expired, and its use will be discontinued starting from the 17th of next month.Paxlovid is used for mild-to-moderate patients among the elderly (aged 60 and over), those with underlying medical conditions, and immunocompromised individuals. Patients for whom Paxlovid administration is restricted typically use Lagevrio or Veklury.Once Lagevrio use is discontinued, patients previously eligible for Lagevrio can use Veklury. Clinics will need to refer patients restricted from Paxlovid to hospitals where Veklury can be administered.Meanwhile, the approval scope of Paxlovid was recently expanded by the Ministry of Food and Drug Safety (MFDS) to include patients with severe renal impairment, including those on dialysis (as of January 14).Patients with severe renal impairment, who were previously used to taking Lagevrio because Paxlovid was not recommended, can now be administered Paxlovid through dose adjustment. Consequently, it is expected that a significant number of patients who previously received Lagevrio due to difficulties in prescribing Paxlovid will now be able to transition to Paxlovid.The government is preparing measures to improve prescribing convenience at medical institutions to facilitate the use of Paxlovid, which will become the sole oral treatment available.Paxlovid involves some inconvenience in clinical settings because of the need to verify the patient's use of contraindicated drugs (40 types).To expand the use of Paxlovid among those taking contraindicated drugs, the KDCA plans to distribute pamphlets providing detailed guidance based on the marketing authorization (such as suspending the drug in question or prescribing alternative medications).

- Company

- Twice-yearly HIV treatment 'Sunlenca' nearing KOR mkt entry

- by Eo, Yun-Ho Feb 27, 2026 08:35am

- The domestic market entry of twice-yearly injectable 'lenacapavir', a new drug for HIV prevention, is imminent.The Ministry of Food and Drug Safety (MFDS) is currently conducting a final review for the approval of Gilead Sciences' Sunlenca (lenacapavir), an HIV treatment. It is expected to be approved as early as the first half of this year.The drug's detailed indication is 'to be used in combination with other antiretrovirals to treat patients with multidrug-resistant HIV-1 infection for whom antiretrovirals cannot be used.'This drug is the first-in-class long-acting HIV-1 capsid inhibitor that is subcutaneously administered every six months. It was approved in the United States and Europe in 2022 and is available for prescription.The current HIV treatment regimen requires daily oral administration of antiretrovirals. As long-acting agents are being developed, the treatment frequency has been extended to every 2 or 6 months.Although this indication has not been submitted for approval in Korea, lenacapavir is gaining interest because it can be used for prophylaxis, beyond HIV treatment.This drug obtained approval in the United States in June last year and in Europe in August of the same year as a 'pre-exposure prophylaxis (PrEP) to reduce the risk of sexually acquired HIV-1 infection in adults and adolescents weighing at least 35 kg who are at increased risk of HIV-1 infection.' The product name for lenacapavir used for prophylaxis is 'Yeytuo.'The efficacy of lenacapavir for PrEP was demonstrated through the Phase 3 PURPOSE 1 and PURPOSE 2 trials.The PURPOSE 2 study result has shown that lenacapavir reduced HIV infection by 96% compared to baseline HIV prevalence (HIV).In a group of 2,180 participants, only two cases occurred, showing that 99.9% of the participants in the lenacapavir treatment group did not become infected with HIV.In 2024, Gilead Sciences concluded the double-blind trial conducted in Sub-Saharan Africa early after meeting the key endpoints. This PURPOSE1 clinical trial evaluated lenacapavir as a PrEP among cisgender women.Meanwhile, lenacapavir was selected as 'Breakthrough of the Year' in Science, the academic journal and outlet for scientific news, based on these study results.

- Policy

- Novo Nordisk’s next-gen obesity drug enters Korean trials

- by Lee, Tak-Sun Feb 27, 2026 08:35am

- AI-generated imageNovo Nordisk, the developer of the obesity treatment Wegovy (semaglutide), will conduct multinational Phase III clinical trials for its next-generation obesity therapy in Korea.The candidate is amycretin, the company’s next-generation obesity treatment candidate , with the company aiming for global commercialization through multinational trials.On the 24th, the Ministry of Food and Drug Safety (MFDS) approved two Investigational New Drug (IND) applications for Novo Nordisk’s NNC0487-0111.One is a Phase IIIa trial (AMAZE 2) evaluating the efficacy and safety of once-weekly NNC0487-0111 s.c. in subjects with overweight or obesity and type 2 diabetes. The other is a Phase IIIb clinical trial (HF-POLARIS) evaluating the efficacy and safety of NNC0487-0111 versus placebo on morbidity and mortality in patients with obesity and heart failure with preserved or mildly reduced ejection fraction.NNC0487-0111 is the development code for amycretin, which is being developed by Novo Nordisk.Amycretin is a next-generation obesity treatment with a dual mechanism of action: it stimulates the GLP-1 receptor like Wegovy, while also acting on the pancreatic hormone amylin, which is involved in appetite regulation.Novo Nordisk is developing amycretin in both a once-weekly injectable formulation and a once-daily oral formulation. In earlier clinical trials, amycretin demonstrated up to 24.3% weight reduction over 36 weeks of subcutaneous administration.Based on these results, Novo Nordisk plans to conduct a multinational Phase III trial starting this year. Commercialization is expected after 2028. South Korea is included in the global, multi-national Phase III trial network.In Korea, the planned enrollment is 155 patients for HF-POLARIS (global total: 5,610) and 60 patients for AMAZE 2 (global total: 630).HF-POLARIS will be conducted at Wonju Severance Christian Hospital, Seoul National University Hospital, Chungnam National University Hospital, Gachon University Gil Medical Center, Pusan National University Yangsan Hospital, Inha University Hospital, Ajou University Hospital, Samsung Medical Center, Severance Hospital (Sinchon), Seoul National University Bundang Hospital, Keimyung University Dongsan Medical Center, Seoul St. Mary’s Hospital, Korea University Ansan Hospital, Seoul Asan Medical Center, and Hallym University Sacred Heart Hospital.AMAZE 2 will take place at Kyung Hee University Medical Center, Chonnam National University Hospital, Seoul Asan Medical Center, Seoul National University Hospital, Seoul National University Bundang Hospital, Yeouido St. Mary’s Hospital, and Severance Hospital (Sinchon).Novo Nordisk’s development of amycretin is viewed as a strategic move to maintain competitiveness in the GLP-1 obesity treatment market.In Korea, Wegovy and Eli Lilly’s Mounjaro have formed a two-horse race. Wegovy, approved by the MFDS in 2023, recorded domestic sales of KRW 467 billion last year, according to IQVIA.Mounjaro, which targets both GIP and GLP-1 receptors, was launched in Korea in the second half of last year and generated KRW 215.5 billion in sales. The two companies continue to compete globally, including through the development of oral obesity treatments.