- LOGIN

- MemberShip

- 2026-03-09 20:47:41

- Policy

- Adstiladrin receives expedited review in Korea

- by Lee, Tak-Sun Mar 09, 2026 08:53am

- The gene therapy for bladder cancer ‘Adstiladrin,’ developed by Swiss company Ferring Pharmaceuticals, has been selected for Korea’s GIFT program, enabling expedited regulatory review by the Ministry of Food and Drug Safety (MFDS).The drug is the world’s first gene therapy for bladder cancer and received U.S. FDA approval in 2022.The MFDS announced on the 6th that Adstiladrin (nadofaragene firadenovec) has been designated as a drug eligible for fast-track review. The designation date was February 4th.The therapy has been submitted for approval in Korea for the treatment of high-risk non–muscle-invasive bladder cancer (NMIBC) that is Bacillus Calmette-Guerin (BCG)-unresponsive with carcinoma in situ (CIS), with or without papillary tumors.The MFDS designated the drug for fast-track review, citing improved efficacy compared with existing treatments. It had previously also been designated as an orphan drug.Adstiladrin also underwent fast-track review during the U.S. FDA approval process, leading to its accelerated approval. The therapy exerts its antitumor effect through the expression of the interferon alpha-2b (IFNα2b) gene delivered via a non-replicating adenovirus vector, administered intravesically.The GIFT program is a Global Innovative products Fast-Track Review Program designed to support the development of innovative medical products in Korea and has been in operation since September 2022.Eligible products include innovative medicines targeting life-threatening diseases, rare diseases with no existing treatment alternatives, and new drugs developed by certified Korea Innovative Pharmaceutical Companies.The MFDS conducts a comprehensive evaluation of the candidates’ innovative therapeutic benefits, contributions to addressing public health crises, and the developer’s efforts, among other factors.Adstiladrin has been designated as GIFT No. 65. Among the 50 products approved under the GIFT program so far, 42 are orphan drugs.

- Policy

- Health and Welfare Committee to conduct inquiries on pending issues next week

- by Lee, Jeong-Hwan Mar 09, 2026 08:53am

- The ruling and opposition party leaders of the National Assembly's Health and Welfare Committee have agreed to hold a plenary session on the 10th of next week to receive this year's (2026) business reports and conduct inquiries on pending issues.The committee plans to hold the First and Second Subcommittees for Legislations on the 11th and 12th, respectively, to process pending legislation. Following this, the bills are expected to be approved during a plenary session on the 13th and forwarded to the Legislation and Judiciary Committee.Key issues to be highlighted during next week's plenary session include the findings regarding contaminated COVID-19 vaccines and the proposed restructuring of the drug pricing system, which includes price cuts for generics and preferential pricing for innovative pharmaceuticals.Other pressing topics include policies to strengthen regional, essential, and public healthcare, such as increasing medical school quotas, establishing new regional·public medical schools, and implementing a regional physician system.The opposition, led by the People Power Party, is expected to take issue with Minister of Health and Welfare Jung Eun Kyeong's failure to publicly announce cases of COVID-19 vaccines containing mold or foreign substances during her previous leadership as Commissioner of the Korea Disease Control and Prevention Agency (KDCA). They are likely to demand a parliamentary investigation.Rep. Kim Mi-ae, the executive secretary of the committee, along with Rep. Na Kyung-won and Rep. Shin Dong-wook, are strongly calling for Minister Jung’s immediate resignation. They are also demanding that the government drop its appeals against vaccine-related lawsuits and initiate a parliamentary investigation into the contaminated vaccines.Lawmakers from the Democratic Party also plan to question the announcement regarding the contaminated vaccine issue during next week's session. As the majority party, they are expected to counter the opposition's criticisms by emphasizing the necessity of vaccinations during the peak of the COVID-19 pandemic.Regarding the drug pricing restructuring, which the Ministry of Health and Welfare (MOHW) plans to implement in July following approval by the Health Insurance Policy Deliberation Committee this month, inquiries are expected to focus on whether the system adequately encourages and fosters innovation within the domestic pharmaceutical and biotech industry.In fact, Rep. Kim Yoon of the Democratic Party previously criticized the MOHW's plan as "too mechanical" and insufficient for rewarding the innovativeness of domestic pharmaceutical companies, and subsequently demanded the submission of a revised proposal.Despite persistent protests from the Korean pharmaceutical industry against the restructuring plan, the MOHW is maintaining its position in its policy to secure Health Insurance Policy Deliberation Committee approval in March.The MOHW plans to hold a one-point subcommittee meeting on the drug pricing restructure next week, followed by a final vote at the plenary session at the end of the month. Detailed calculation rates for generic drugs and preferential pricing measures for innovative pharmaceutical companies are expected to be finalized within this month.The MOHW has proposed reducing the generic pricing rate from the current 53.55% to the 40%, while the pharmaceutical industry views 48% as their bottom line or maximum acceptable cut.Furthermore, the industry argues that the criteria and mechanisms for preferential pricing must be significantly revised to reflect contributions to the development of the domestic industry and to the manufacturing, production, and distribution of high-quality medicines, in order to achieve the Ministry's policy goals.An official from a Health and Welfare Committee member’s office commented, "Since the New Year's business reports have been delayed and the bill subcommittees have not met properly for months, holding the standing committee in March is essential," adding , "The People Power Party has agreed to participate, and I understand that pending issues like the COVID-19 vaccine contamination played a role in that decision."

- Policy

- GSK’s Nucala-Omjjara enters pricing negotiations for reimb in Korea

- by Jung, Heung-Jun Mar 09, 2026 08:53am

- [GSK Korea’s new myelofibrosis drug Omjjara (momelotinib) and the eosinophilic disease treatment Nucala Autoinjector (mepolizumab) have entered drug price negotiations with the National Health Insurance Service (NHIS).In addition, Janssen Korea’s new multiple myeloma treatment, Darzalex SC injection (daratumumab), is also proceeding with price negotiations, the final stage of reimbursement listing.According to industry sources on the 6th, new drugs that passed the Drug Reimbursement Evaluation Committee (DREC) in January have entered the negotiation process with the NHIS.Both Omjjara and Nucala passed the DREC with the condition that reimbursement would be accepted only if the price is set below the committee’s evaluation amount. AI-generated imageOmjjara Tab (100, 150, and 200 mg) was deemed adequate for reimbursement as a treatment for intermediate- or high-risk myelofibrosis in adults with anemia. Nucala Inj was deemed adequate for reimbursement as an add-on maintenance therapy for the treatment of severe eosinophilic asthma in adults and adolescents that is inadequately controlled with existing treatments.With GSK receiving reimbursement approval for two new drugs simultaneously, expectations are rising on the possibility of their concurrent listing.Omjjara passed the Cancer Disease Deliberation Committee review last March but faced delays in reaching the DREC due to issues such as the selection of comparator drugs, requiring a resubmission. It cleared the DREC hurdle approximately 10 months after resubmission.Meanwhile, the Nucala Autoinjector, a new formulation of the drug, is a self-injectable device that allows patients to administer the treatment at home. If reimbursement coverage is expanded to include the self-injection formulation, Nucala’s prescription market presence is expected to grow.At the previous DREC meeting, both Omjjara and Nucala were approved with the condition that reimbursement is appropriate only if the company accepts a price below the evaluated amount. Since the pharmaceutical company has accepted this condition, negotiations with the NHIS are expected to focus on details such as the projected claims amount.Meanwhile, Janssen Korea’s Darzalex SC Inj was recognized as appropriate for reimbursement for ‘combination therapy with bortezomib, cyclophosphamide, and dexamethasone in newly diagnosed light-chain amyloidosis patients.’Unlike Omjjara and Nucala, Darzalex did not receive the “below evaluation price” condition from DREC, allowing it to proceed directly to price negotiations.Following its approval by the CDDC in the latter half of last year, the subcutaneous injection formulation of Darzalex is steadily gaining access to tertiary hospitals in Korea.

- Policy

- Pharmaceutical Act prohibiting non-face-to-face wholesaling

- by Lee, Jeong-Hwan Mar 09, 2026 08:53am

- The amendment to the Pharmaceutical Affairs Act, prohibiting non-face-to-face care platforms from concurrently operating as pharmaceutical wholesalers, is expected to be passed in its original form without revisions.Analysis suggests that related personnel, including Representative Choo Mi-ae, Chairperson of the Legislation and Judiciary Committee, and Representative Han Jeoung-ae, Chair of the Democratic Party's Policy Committee, have maintained a firm commitment to the original bill, which had been stalled at the plenary session for several months after being initially scheduled for processing late last year.The legislation had previously passed the Health and Welfare Committee and the Legislation and Judiciary Committee with agreement between both parties. However, it was repeatedly excluded from the plenary agenda due to opposition from certain lawmakers and the Ministry of Small Businesses and Startups.According to officials from the National Assembly and the pharmaceutical industry, the Pharmaceutical Act prohibiting non-face-to-face care platforms from concurrently operating as pharmaceutical wholesalers is likely to pass the National Assembly plenary session this month.The amendment is aimed at preventing conflicts of interest that arise when a non-face-to-face platform also acting as a wholesaler. If a platform acts as an intermediary for non-face-to-face treatment while also functioning as a wholesaler, a conflict of interest can arise. This is because the platform would be directly involved in prescribing, preparing, and distributing the medications it manages. Additionally, this setup raises concerns that the system could be misused as a method for providing rebates on illegal medications.Some Representatives characterized the bill as the "Doctor Now Prevention Act" and argued it would stifle innovation in the telemedicine sector. Accordingly, this bill was delayed for the National Assembly consideration.In this process, a sharp difference in positions between the relevant government agencies, the Ministry of Health and Welfare (MOHW) and the Ministry of SMEs and Startups, emerged, leading to suggestions that mediation by the Prime Minister's Office and the Office of the President was necessary.However, Ministry of Health and Welfare Minister Jung Eun Kyeong maintained firmly on passing the original version to ensure institutional safety and block market distortions. Within the Democratic Party, voices grew to maintain the original bill, with leadership emphasizing that revised proposals should not compromise the legislative process.In fact, ruling party lawmakers, including Democratic Party Chairman Jung Cheong-rae and Rep. Choo Mi-ae, visited the General Assembly of the Korean Pharmaceutical Association and promised to pass pharmacy-related legislation, including a bill to prevent intermediary platforms from concurrently operating wholesale businesses. Consequently, it is likely that the bill will be considered and processed during this month's plenary session.An official from a Democratic Party lawmaker’s office commented, "From the start, the bill that passed the Legislation and Judiciary Committee was not a matter where amendments should have been discussed, or its tabling in the plenary session was repeatedly excluded without a specific reason." The official added, "While there were some differing opinions within the party, the floor leadership stayed committed to passing the original version."

- Company

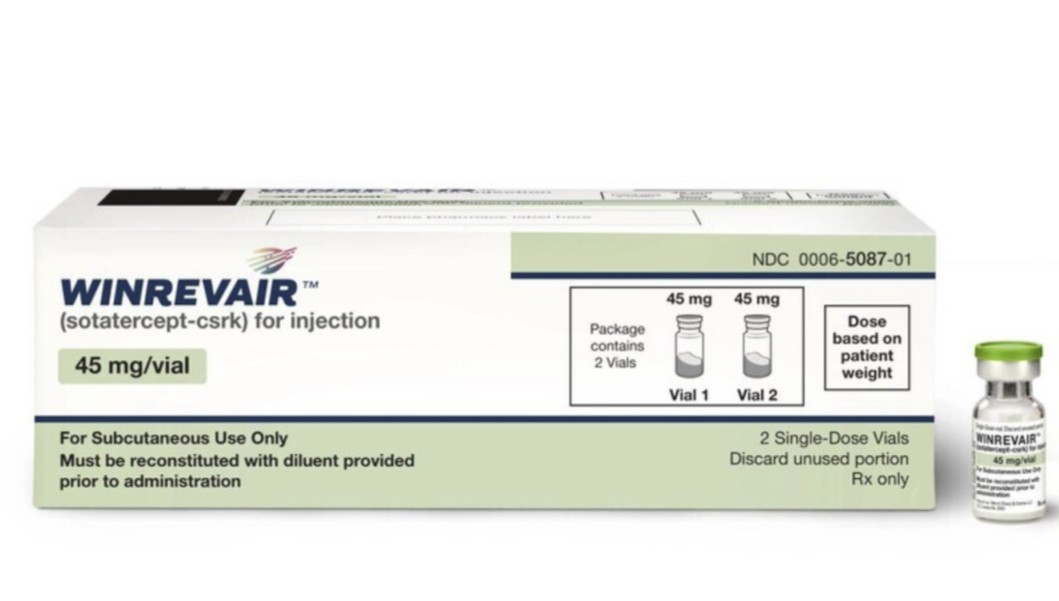

- PAH drug Winrevair may be prescribed at general hospitals in Korea

- by Eo, Yun-Ho Mar 09, 2026 08:53am

- The new pulmonary arterial hypertension (PAH) drug Winrevair is beginning to gain prescribing access at major hospitals in Korea.According to industry sources, MSD Korea’s activin signaling inhibitor (ASI) Winrevair (sotatercept has passed the drug committee (DC) reviews at leading tertiary hospitals, including Samsung Medical Center and Seoul National University Hospital.At the same time, MSD is currently conducting landing procedures at about 20 major medical institutions nationwide.Winrevair is a first-in-class innovative drug with a new mechanism of action, emerging 20 years after sildenafil, which targets the NO–sGC–cGMP pathway, was introduced in 2005. The drug is currently selected for the second phase of Korea’s ‘Approval-Evaluation-Negotiation Concurrent Pilot Program’ and is undergoing reimbursement procedures, but no significant progress has been made so far.Pulmonary arterial hypertension is a particularly challenging area for new drug development. Unlike existing treatments focused on dilating blood vessels, Winrevair improves vascular remodeling, the fundamental cause of the disease.Consequently, no comparable therapeutic alternative is available. If Winrevair is evaluated within the existing economic assessment framework, it would be compared to treatments developed two decades ago. This situation naturally delays the listing process. This challenge is not unique to Winrevair but is one commonly faced by drugs included in the parallel pilot program. Nearly 200 days have already passed since Winrevair received approval from Korea’s Ministry of Food and Drug Safety.Therefore, attention is now focused on whether Winrevair will successfully complete the reimbursement listing process and ultimately establish itself as a treatment option for patients.Winrevair received regulatory approval based on the STELLAR clinical trial. This study evaluated the efficacy and safety of Winrevair in 323 adult patients with pulmonary arterial hypertension (PAH) classified as WHO functional class (WHO-FC) II or III. During the 24-week study period, patients received Winrevair or a placebo in combination with their existing therapy once every three weeks.Results showed that Winrevair increased the 6-minute walk distance by 40.8 meters (Hodges–Lehmann estimate) compared with placebo at Week 24. It also reduced the risk of clinical worsening or death by 84%.In addition, significant improvements were observed across 8 secondary endpoints, including WHO-FC, pulmonary vascular resistance (PVR), and the heart failure biomarker NT-proBNP, compared with placebo.Wook Jin Jeong, President of the Korean Society of Pulmonary Hypertension (Professor of Cardiology at Gachon University Gil Medical Center), said, “Winrevair is a treatment with a new mechanism of action that restores abnormal pulmonary vascular structure toward normal. Based on the latest evidence, updated global clinical guidelines now present it as an option for combination therapy in the early phases of treatment. This approval broadens the treatment options available to pulmonary arterial hypertension patients in Korea.”

- Company

- Pharma labor groups voice "job security concerns" ahead of drug pricing reform

- by Kim, Jin-Gu Mar 06, 2026 08:44am

- Gemini 생성 이미지.As the government's drug pricing reform plan is soon to be finalized, labor groups in the pharmaceutical industry visited the Blue House (Presidential Office) to voice concerns regarding the policy's potential impact on employment.According to pharmaceutical industry sources on the 5th, the Pharmaceutical and Cosmetics Division of the Federation of Korean Chemical Workers' Unions (FKCU), under the Federation of Korean Trade Unions (FKTU), recently hosted a meeting with the Secretary to the President for Health and Welfare and the Secretary for Labor at the Presidential Office. The meeting was attended by Jang-hoon Lee, Chairman of the Pharmaceutical and Cosmetics Division, along with members of the FKTU's External Cooperation Headquarters.During a phone call with DailyPharm, Chairman Lee stated, "Organized by the FKTU, we met with the Secretary to the President for Health and Welfare and for Labor. We delivered our opinions on the drug price reductions from the perspective of workers." "We expressed concerns that if the government forces through the drug price reductions, it will undermine job security and hurt job creation," he said, "Regarding this, the Presidential Office responded that they could not provide a definitive answer at this time."The drug pricing reform plan was originally scheduled to be finalized through a resolution of the Health Insurance Policy Deliberation Committee last month; however, the schedule was postponed once due to continued backlash from the pharmaceutical and labor sectors. The government plans to hold a meeting in March to finalize the proposal, which includes the calculation rate for reductions in generic drug prices. Within the industry, a schedule is being discussed to pass the plan through the subcommittee on the 11th and reach a resolution at the plenary session in mid-March.Labor groups maintain that the government must consider the impact on industry and employment as it finalizes the reform plan. However, as specific details of the reform have not been disclosed, they plan to determine the intensity of their response after monitoring the HIPDC's discussion process.Regarding this, pharmaceutical labor unions under the FKCU will hold a two-day resolution rally starting on the 10th to fight for victory in the 2026 wage and collective bargaining agreements. Their response to the drug pricing reform is also expected to be discussed at this meeting.Chairman Lee stated, "Although this meeting is intended for the 2026 wage negotiations, discussing the direction of the union's response will be a major topic because concerns regarding the drug price reductions are great. Chairmen of the FKTU and the FKCU are also scheduled to attend, and we will review countermeasures together."The possibility of a joint response with the pharmaceutical and biotech industry has also been raised. Chairman Lee added, "I understand that the Korea Pharmaceutical and Bio-Pharma Manufacturers Association (KPBMA) is also discussing countermeasures," adding, "It is reported that various methods, such as a national signature campaign or a public petition, are being considered. We are exploring ways to respond jointly with the Association."On January 29, the FKTU issued a statement opposing the government's drug pricing reform, stating, "A hasty reform that excludes workers can protect neither the health insurance finances nor the pharmaceutical industry."At the time, the FKTU criticized, "We express deep concern that the drug pricing reform currently pursued by the government is being unilaterally pushed forward without sufficient social discussion and agreement," adding, "Indiscriminate drug price reductions are highly likely to eventually lead to a deterioration of labor conditions and layoffs. Policies that threaten the survival rights of workers will, in the long term, undermine the public's access to medicines and right to health.""As an organization representing National Health Insurance subscribers, we cannot tolerate policy decisions made through closed-door and desk-bound administration while excluding workers, patients, and the public," adding, "The government must transparently disclose the basis and financial effects of the drug pricing reform and immediately establish a social discussion structure where the opinions of stakeholders are substantially reflected."The FKTU concluded, "We will fulfill our responsible role to ensure that the interests of health insurance subscribers and the survival rights of workers are harmoniously reflected in the future drug pricing reform discussion process," adding, "We clearly state that we will never slip any attempts to cause a retreat in labor conditions or job insecurity under the disguise of this policy."

- Company

- US-Iran tension hits business trips for medical device Middle East projects

- by Hwang, byoung woo Mar 06, 2026 08:44am

- AI이미지 제작Although military tensions between the United States and Iran are escalating and destabilizing the Middle East, it appears that no direct setbacks have yet emerged in the operations of South Korean medical device companies established in thes regions.However, the industry is closely watching the situation, as factors such as overseas business trips and flight operations could have a short-term impact.According to the Korean medical device industry, medical AI companies and aesthetic·medical device firms currently active in the Middle East are monitoring the situation with local partners and medical institutions. So far, no direct disruptions to business operations have been identified.An official from Medical AI Company A, which operates in the Middle East, stated, "Upon checking with local partners and medical staff, there have been no particular changes in hospital operations or collaborative projects. We currently judge that there are no major setbacks to our business progress."An official from Company B also stated, "Our Middle East operations are primarily focused on Saudi Arabia, and we believe the likelihood of these military tensions directly affecting our business is low. As Saudi Arabia's medical digital transformation policy is being pursued as a long-term national strategy, it is unlikely to be suspended due to short-term variables."The situation suggests it is difficult to predict the outcome at this stage as local companies and hospitals continue to operate normally. An official from KOTRA's Dubai Trade Center stated in a call with DailyPharm, "As the conflict has only recently begun, there is currently no major impact on local companies or businesses. The UAE government also appears to be maintaining a normal daily routine as much as possible." They added, "While impact may appear if the situation is prolonged, no specific business disruptions or corporate inquiries have been received so far."Business trips and flight variables are variables…identified as short-term risksHowever, what companies are concerned about is not the local business itself, but the travels.As the Korean Ministry of Foreign Affairs has placed a Level 4 travel ban on Iran (effective March 5, 2026) and issued a Special Travel Advisory (Level 2.5) for seven other countries, including the UAE and Saudi Arabia, the burden on overseas business trips has increased significantly. This is particularly relevant for medical device companies, which often require Korean personnel to visit in person for local sales, medical staff training, and equipment installation.The industry also considers the psychological burden on employees with families, who may be hesitant to travel to the Middle East during a conflict, regardless of whether flights are operational. One industry official noted, "While local hospitals and partners are operating as usual, there is psychological pressure regarding movement, separate from the resumption of flights."The industry is particularly focused on the schedule following Ramadan. Ramadan is a religious period where Muslims fast from sunrise to sunset, and this year it is expected to continue until March 19, 2026. Generally, the Middle Eastern medical device market sees its most active sales activities begin after this religious period.In fact, visits from overseas companies typically increase around April for Abu Dhabi Global Health Week 2026, scheduled for April 7–9.The official from Company B stated, "Many domestic companies set the April to June period after Ramadan as a 'sprint month' and actively conduct overseas sales," adding, "We are currently keeping a close eye on the situation while considering various variables."The KOTRA official added, "Because medical exhibitions and events in the Middle East are organized after Ramadan, company visits are naturally high during this time," and concluding, "If the conflict stabilizes quickly, scheduled plans may proceed normally."

- Policy

- Rezurock, Fetroja reimbursed through Refund-type RSA

- by Jung, Heung-Jun Mar 06, 2026 08:44am

- The number of domestic pharmaceutical companies entering refund-type risk-sharing agreements (RSA) is gradually increasing. Following GC Biopharma’s Livmali solution in January, Jeil Pharmaceutical's Fetroja Inj has now signed a reimbursement contract.This brings the total number of domestic pharmaceutical companies that have signed Refund-type RSA contracts with the National Health Insurance Service (NHIS) to five, including Yuhan Corp, JW Pharmaceutical, and Handok.As of January and February this year, the number of domestic companies participating in Refund-type RSA has reached five. AI-generated imageAccording to the list of drugs eligible for refund-type RSA released by the NHIS this year, three new active ingredients signed contracts in January and February.In January, GC Pharma’s Livmarli solution (maralixibat chloride) for pruritus associated with Alagille syndrome signed a refund-type RSA contract. In February, Jeil Pharmaceutical’s gram-negative antibiotic Fetroja Inj (cefiderocol tosylate sulfate hydrate) and Sanofi Aventis’s third-line treatment for chronic graft-versus-host disease, Rezurock Tab (belumosudil mesylate), also entered refund-type RSA agreements.The listed prices were KRW 29,002,835 for Livmarli solution, KRW 210,097 for Fetroja Inj, and KRW 424,742 for Rezurock Tab.With additional refund contracts signed this year, the number of RSA refund-target drugs has reached 64 ingredients, or 115 products when dosage strengths are counted separately.Domestic companies that had previously signed refund-type agreements include Yuhan Corp for Leclaza (lazertinib), JW Pharmaceutical for Hemlibra (emicizumab), and Handok for Defitelio Inj (defibrotide), Vyxeos liposomal Inj, and Pemazyre Tab (pemigatinib).Among domestic companies, all except Yuhan Corp’s Leclaza are imported new drugs. The remaining 59 ingredients under refund agreements belong to drugs from 26 multinational pharmaceutical companies.With the addition of Rezurock, Sanofi now holds 5 RSA refund-type drugs, including four dosage forms of Dupixent and Rezurock.Among multinational pharmaceutical companies, AstraZeneca holds the largest number of RSA refund-type drugs, including Tagrisso, Lynparza, Imfinzi, Koselugo, Strensiq, and Fasenra. When dosage strengths are counted separately, AstraZeneca has 14 products under RSA refund contracts.

- Policy

- Padcev–Keytruda combo receives orphan drug designation for bladder cancer

- by Lee, Tak-Sun Mar 06, 2026 08:44am

- The Padcev–Keytruda combination therapy for bladder cancer has been designated as an orphan drug in Korea. Since orphan drug designation enables expedited review by the Ministry of Food and Drug Safety (MFDS), the timeline to commercial approval is expected to be shortened.On the 4th, the MFDS announced that it has designated three drugs, including the enfortumab vedotin–pembrolizumab combination therapy for bladder cancer, as orphan drugs.Enfortumab vedotin is the generic name of Padcev, an antibody-drug conjugate (ADC) developed by Astellas. Pembrolizumab is the generic name of Keytruda, the immuno-oncology drug developed by MSD.The newly designated orphan indication is muscle-invasive bladder cancer in the perioperative setting for patients ineligible for cisplatin-containing chemotherapy (limited to cases where both components are administered in combination).This indication was approved by the U.S. FDA in November last year. Results from the KEYNOTE-905 clinical trial, which evaluated the combination therapy of the two drugs for bladder cancer, showed that the combination of Padcev and Keytruda improved event-free survival (EFS) by 60% compared to the control group (NR. vs 15.7 months; HR 0.40; 95% CI 0.28–0.57; P<.001), and overall survival (OS) improved by 50%. The pathological complete response rate (pCR) was also significantly higher in the Padcev-Keytruda combination group.It appears that the company applied for domestic approval following FDA approval. If the combination therapy receives commercial approval, patient access to treatment is expected to improve substantially.The orphan drug designation also includes nirogacestat (tablet) and tovorafenib (oral formulation).Nirogacestat is a drug indicated for the treatment of desmoid tumors, marketed under the brand name Ogsiveo by Merck.SpringWorks Therapeutics, a healthcare affiliate of Merck, received approval for the oral gamma-secretase inhibitor Ogsiveo from the European Commission (EC) in August last year as monotherapy for adults with progressing desmoid tumors requiring systemic treatment.Ogsiveo is the first and only therapy approved in the European Union for the treatment of desmoid tumors.Tovorafenib is a treatment for pediatric low-grade glioma (pLGG). It is a type II BRAF inhibitor developed for pediatric low-grade glioma patients with BRAF gene mutations. Marketed as Ipsen's ‘Ojemda,’ the drug received U.S. FDA approval in 2024. It is expected to provide a new treatment option for pediatric brain tumor patients who have failed existing therapies.Designation as an orphan drug shortens the approval period through expedited review. Beyond conditional approval and fee reductions, submission requirements are simplified, including exemptions from bridging studies, and a fast-track approval process is conducted through priority review.

- Company

- Amgen immediately reapplies for Imdelltra’s reimbursement in Korea

- by Eo, Yun-Ho Mar 06, 2026 08:44am

- The bispecific antibody anticancer drug ‘Imdelltra’, which faced an initial setback in its reimbursement journey in Korea, is immediately making another attempt.According to industry sources, Amgen Korea recently resubmitted its application for reimbursement listing of Imdleltra (tarlatamab), a treatment for relapsed or refractory extensive-stage small cell lung cancer (SCLC).This comes less than 2 months after the drug failed to establish reimbursement criteria at the Health Insurance Review and Assessment Service’s Cancer Drug Deliberation Committee in January, highlighting the company’s strong commitment to securing coverage.With rapid reorganization and swift action, attention is now on whether Imdelltra can succeed in obtaining reimbursement status and emerge as a treatment option in the underserved small-cell lung cancer field.Approved domestically last May, Imdelltra is a bispecific antibody therapy targeting ‘Delta-like ligand 3 (DLL3)’, which is expressed in 85-96% of small cell lung cancer patients. The DLL3 antigen is typically distributed within normal cells but abnormally expressed on the surface of cancer cells in neuroendocrine tumors, including small cell lung cancer.Imdelltra binds to both the DLL3 antigen on cancer cells and the CD3 antigen on T cells, inducing T cells to kill cancer cells. Crucially, it acts directly on the antigens of T cells and cancer cells, independent of Major Histocompatibility Complex Class I (MHC-1) expression, a key mechanism tumors use to evade immune detection, making it effective even against cancer cells that escape immune surveillance.The drug demonstrated efficacy in the DeLLphi-301 clinical trial, a Phase II study involving adult patients with extensive-stage small-cell lung cancer whose disease had progressed after at least two prior treatments, including platinum-based chemotherapy.Study results showed Imdelltra demonstrated a significant objective response rate. The objective response rate in 100 patients treated with Imdelltra 10mg was 40%, and 58% of responders (23/40) maintained responses for more than 6 months.Furthermore, the median overall survival (OS) in the Imdelltra 10mg group was 14.3 months, and the median progression-free survival (PFS) was 4.9 months. Treatment-related adverse events in the Imdelltra 10mg group were mostly low grade, with grade 3 or higher adverse events occurring in 29% of patients in Parts 1-2 and 15% of patients in Part 3 of the trial.Based on these results, the National Comprehensive Cancer Network (NCCN) recommends Imdelltra monotherapy as a preferred regimen for platinum-resistant patients and an alternative recommended regimen for platinum-sensitive patients. Additionally, the American Society of Clinical Oncology (ASCO) also strongly recommends Imdelltra monotherapy for patients whose disease has relapsed after chemotherapy.Meanwhile, small cell lung cancer (SCLC) accounts for approximately 10-15% of all lung cancer patients and is characterized by rapid cancer cell proliferation, leading to widespread metastasis within a short period. It is known that 6 to 7 out of 10 patients are diagnosed at the extensive stage, where cancer cells have metastasized to the opposite lung or other organs.Currently, the main treatment options for extensive-stage small cell lung cancer are limited to chemotherapy and immunotherapy, and the choices become even more limited when treatment progresses beyond the third line. Although the initial response rate to chemotherapy in small-cell lung cancer patients is relatively high, it often does not last long, and the disease tends to progress rapidly. Particularly in refractory or resistant patients whose disease progressed within 6 months after the last chemotherapy treatment, the response rate to traditional chemotherapy drops below 10%, creating a high demand for new treatment options.