- LOGIN

- MemberShip

- 2026-03-10 00:45:09

- Policy

- 'Key is in compensating innovation that exceeds price cuts'

- by Lee, Jeong-Hwan Jan 22, 2026 08:22am

- Director Yeon-sook Kim explains the drug pricing system reform plan.“While the media has largely focused on how the upcoming drug pricing system reform plan involves adjustments and reductions in drug prices, the true core of the policy is a fundamental strengthening of innovation-based compensation for pharmaceutical R&D beyond mere adjustments Whether it's a new drug or a generic, if it demonstrates innovation, we will increase drug price compensation and extend the preferential period from the current one year to three years plus alpha, creating a virtuous cycle of innovation in the pharmaceutical industry.”The Ministry of Health and Welfare reiterated its stance that the core keywords of the drug pricing system reform plan announced for implementation this year are ‘innovative new drugs’ and ‘resolving supply instability,’ and that it will enhance the tangibility of preferential drug pricing incentives for pharmaceutical companies that achieve these goals.This involves establishing a drug pricing compensation structure proportional to the level of investment in new drug R&D and extending the preferential period from the current one year to ‘three years or more.’Regarding resolving supply instability, the government announced plans to guarantee preferential treatment for up to 10 years for drugs using self-manufactured APIs and for essential medicines made with domestic APIs.The Ministry's policy is to overhaul the post-listing drug price control system to enhance predictability for pharmaceutical companies while reducing the administrative burden on the government.Kim outlined the reform and its operational roadmap on the 21st at the 55th Dailypharm Future Forum held at the Catholic University of Korea’s Songeui Campus Institute of Biomedical Industry.“The current pricing system has limitations in supporting innovation and essential drug stability”The Ministry of Health and Welfare maintains that the current drug pricing system has clear limitations in reliably ensuring the creation of innovative new drugs and stable patient access to essential medicines.It was further diagnosed that, compared to other countries, South Korea's generic drug prices are relatively high, leading to stagnation in innovation through new drug R&D.The ministry believes that many pharmaceutical companies remain entrenched in business models centered on high generic drug prices, neglecting new drug R&D.At the same time, population aging and rising pharmaceutical expenditures have significantly increased drug spending, making it increasingly difficult to strike a balance between fostering an innovation-based pharmaceutical industry ecosystem and ensuring the sustainability of the National Health Insurance system.“Drug price reform to foster a new drug ecosystem and ensure a stable supply of essential medicines”To strengthen the new drug development ecosystem, the ministry plans to shorten the reimbursement listing period for rare disease treatments to within 100 days and to advance cost-effectiveness evaluations for treatments targeting severe and intractable diseases.To facilitate the early domestic introduction of innovative medicines, the scope of the flexible drug pricing contract system should be expanded, and compensation should be provided proportional to the level of innovation creation efforts, such as new drug R&D.This includes strengthening R&D-linked pricing incentives and ensuring stable preferential periods.For essential medicines, the ministry will overhaul the exit-prevention drug system across the entire lifecycle, strengthen the effectiveness of preferential treatment for essential drugs, and reinforce coordination between relevant policies.Through a public–private consultative body, supply stability medicines will be monitored throughout their lifecycle and addressed proactively.The government will also strengthen monitoring of pharmaceutical supply and distribution and implement tailored measures based on the causes of shortages.In particular, for medicines with unstable supply, the government plans to support substitution prescribing and dispensing at the national level.“Generic pricing rate to be adjusted to the 40% range… stepwise cuts to apply from the 11th product”The most controversial part of the reform among domestic pharmaceutical companies is the rationalization of price management.The ministry plans to revise the pricing structure based on international benchmarks, with the key change being a reduction of the generic pricing rate from the current 54.55% to the 40% range.The stepwise price reduction system will also be strengthened. Currently, stepwise cuts apply from the 21st product of the same ingredient, with the price set at 85% of the lowest price.Under the reform, price cuts will apply from the 11th product, and the reduction rate will be set at an additional 5 percentage points below the first generic price.The Ministry of Health and Welfare anticipates that this reform will significantly increase the perceived benefits for pharmaceutical companies by applying price premiums primarily to those contributing to new drug innovation and supply stability.For price reductions of already-listed generics, items maintaining a price level of 53.55% since the 2012 blanket price reduction adjustment will be sequentially reduced over three years.The post-listing management system will standardize the timing for adjusting price reductions linked to expanded usage and price-volume linkage agreements. Actual transaction price surveys will be restructured to a market competition-linked model. The reimbursement adequacy reassessments will be restructured around clinical evidence.Kim emphasized, “Korea is at a critical moment, both a crisis and an opportunity, to build an innovative new drug ecosystem. We will raise pricing rewards for innovation and significantly extend preferential periods to send a clear signal toward innovation.”She added, “Even if a product is not a new drug, it will receive preferential pricing if it contributes to a stable supply of essential medicines. For exit-prevention drugs, we will collaborate with organizations like the Korea Pharmaceutical and Bio-Pharma Manufacturers Association and the Health Insurance Review and Assessment Service to identify tasks for improving drug pricing levels or systems after conducting research studies. We will ensure that the number of generic items remains at an appropriate level, avoiding excessive proliferation.”“When too many products of the same ingredient are listed at once, prices will be adjusted according to stepwise criteria after an appropriate period. For already-listed products, prices that have remained high since 2012 will be reduced gradually and sequentially over three years.”

- Policy

- Gov't addresses unstable supply of essential drug·API

- by Lee, Jeong-Hwan Jan 22, 2026 08:22am

- To strengthen response to drug supply instability this year, the government is expanding support for pharmaceutical companies producing items in short supply, improving self-sufficiency in active pharmaceutical ingredients (APIs), and enhancing the manufacturing capabilities for biopharmaceutical raw materials and components.On the 20th, Yim Kang-seop, Head of the Division of Health Industry at the Ministry of Health and Welfare (MOHW), met with the Korea Special Press Association to explain measures to address the supply chain crisis facing the pharmaceutical and biotech industries.To address structural limitations in the drug supply system, the MOHW has secured a total budget of KRW 15.6 billion for this year and is pursuing five projects.The projects include support for production facilities and equipment for companies supplying drugs with unstable supply, support for stockpiling core medicines, support for diversifying API procurement, user testing support for bio-based raw materials and components, and manufacturing support for domestic raw materials and components.First, the MOHW will increase the number of pharmaceutical companies receiving budget support for producing drugs with unstable supply from 1 last year to 4 this year.This project, launched for the first time last year, currently supports 'Boryung Questran Powder For Suspension (Cholestyramine resin),' a bile acid sequestrant-based hyperlipidemia treatment, and the only drug safe for use by pregnant women and children.Yim plans to reorganize the program to allow subsidy support for up to two years, taking into account the actual time required for pharmaceutical companies' demand and equipment setup, while also increasing the number of target items.To produce API domestically, new projects starting this year include support for diversifying raw material procurement, which helps consortia between raw material suppliers and finished product manufacturers, and a project to cover stockpiling costs to ensure a stable supply of medicines even during crises.In collaboration with the Korea Health Industry Development Institute (KHIDI), the MOHW will also launch initiatives for user testing and manufacturing support to promote the use of domestically produced biopharmaceutical raw materials and components.Yim explained, "Korea's self-sufficiency rate for API is currently low, in the low 20% range. He noted that dependence on specific countries, such as China and India, is high, and that supply chain risks are growing as countries shift toward protectionist trade policies," adding, "To resolve these structural issues, the ministry is launching new projects this year to directly support supply chain stability, including the localization of raw materials and components, stockpiling core medicines, and user testing for bio-based materials.Yim added, "The ministry is ensuring that preferential drug pricing for the use of domestic raw materials and essential medicines is reflected in the drug price system reform plan. The goal is to create a structure that links budget support not only to simple raw material procurement but also to the improvement of facilities and equipment. Enhancing overall supply chain stability remains the core of this year's projects."Yim emphasized, "The issue of localizing and increasing the self-sufficiency rate of raw materials and bio-based components has been repeatedly pointed out during parliamentary audits," and added, "The MOHW will establish a research commission to develop a roadmap for API self-sufficiency and identify additional tasks through a two-track strategy that links the budget to pharmaceutical policies."

- Company

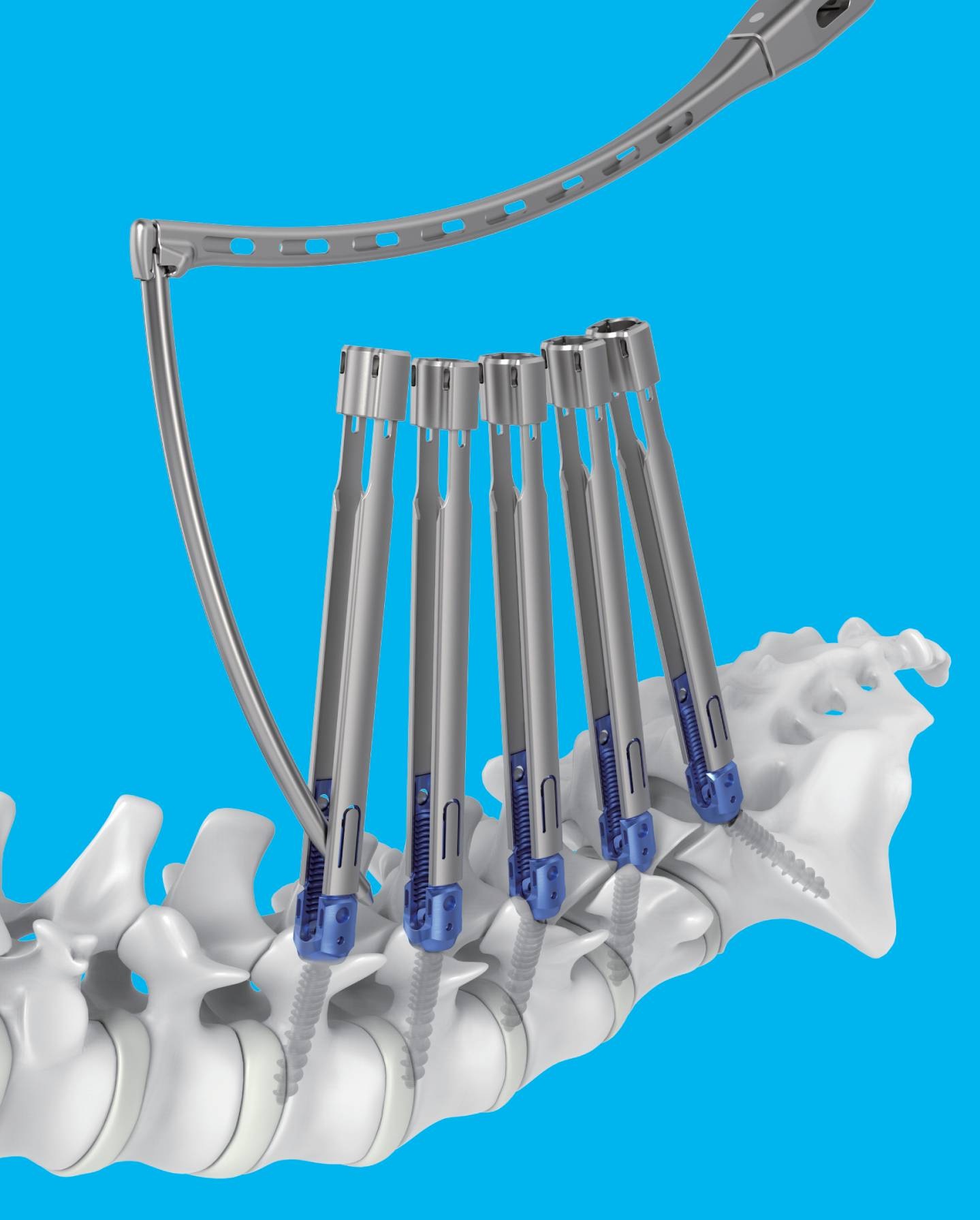

- Medtronic Korea launches new spine portfolio, Kanghui

- by Hwang, byoung woo Jan 22, 2026 08:22am

- 메드트로닉 신규 척추 포트폴리오 강휘Medtronic Korea (CEO Seung-rok Yoo) announced on the 21st that it has launched a new spine portfolio, “Kanghui,” aimed at expanding access to spine solutions.Kanghui is a new brand designed to deliver Medtronic’s accumulated technological expertise and quality management capabilities built across a broad range from the cervical spine to the lumbar spine at more affordable price points.With the introduction of Kanghui, Medtronic has established a comprehensive spine portfolio in Korea, ranging from standard models to premium models.The first product introduced within the Kanghui portfolio is the ‘ECO MIS’ system, an interbody fixation device.It consists of screws and rods in various shapes and lengths, along with fixation set screws, to provide patients with the appropriate size, shape, and design.It is used for minimally invasive surgery to stabilize and fixate the posterior thoracic, lumbar, or sacral spine in patients with unstable spinal fractures, spinal deformities (such as scoliosis), degenerative spinal disorders, spinal stenosis, degenerative disc disease (such as disc herniation), and segmental instability.Seung-rok Yoo, CEO of Medtronic Korea, said, “The introduction of Kanghui is part of a customized portfolio strategy reflecting the growing number of spinal disease patients in Korea and the expansion of specialized spine hospitals. Medtronic will continue to optimize and expand its portfolio to strengthen its competitiveness in the domestic spine market, while also contributing to the advancement of surgical techniques and the creation of a better treatment environment through partnerships with Korean medical professionals.”Meanwhile, the number of spinal disease patients in Korea increased by 9.1% over five years, from 8,912,158 in 2020 to 9,723,544 in 2024. The number of spinal surgery patients increased by 16.7% during the same period.Medtronic is a market leader with a total spine solution portfolio covering spinal disorders across the entire spine, from the cervical to the lumbar region.Through its extensive portfolio, which includes spinal fixation devices (Solera, Infinity, Zevo), minimally invasive spinal fixation systems (Sextant II, Longitude II), interbody fusion devices (Capstone, Clydesdale), and artificial discs (Prestige LP), it provides diverse minimally invasive treatment options.In addition, Medtronic integrates advanced technologies such as surgical navigation systems, contributing to improved surgical precision and enhanced patient safety.

- Company

- Drug price cuts without support disturb pharma independence

- by Hwang, byoung woo Jan 22, 2026 08:22am

- The Korean pharmaceutical industry has voiced strong concerns regarding the government's proposed drug price reform plan.Dailypharm 55th New Year Special Future ForumIt is a warning that repeated drug price cuts are depleting the foundational R&D strength of the domestic pharmaceutical industry and could ultimately lead to a health security crisis, such as the discontinuation of essential medicine supplies.On the 21st, DailyPharm hosted its 55th New Year Special Future Forum at the main auditorium of the The Catholic University of Korea Institute of Biomedical Industry under the title, "Our Attitude in Facing the Era of Great Transformation in Drug Pricing," to collect frontline opinions.The forum was attended by key figures including Yeon-sook Kim, Head of the Division of Pharmaceutical Benefits at the Ministry of Health and Welfare (MOHW); Jun-seop Park, Board of Director at Jeil Pharmaceutical; Jaeho Jung, Head of Department at Novartis Korea; and members of the Healthcare Team from the law firm Lee & Ko. They shared various views on the contents, analysis, and response strategies related to the drug price reform plan."KRW 63T in Cumulative Price Cuts… Unpredictability is the Greatest Risk"Jun-seop Park, Board of Director at Jeil Pharmaceutical, who delivered a presentation representing the domestic pharmaceutical industry, emphasized that repeated drug price reduction policies are forcing the industry to face a crisis of an unpredictable investment environment.According to Park, starting with the introduction of the actual transaction price reimbursement system in 1999, followed by the 2012 blanket price cuts and the 2020 differential requirement system, continuous reductions through 2023 are estimated to have resulted in a cumulative decrease of approximately KRW 63 trillion.The industry's greatest concern regarding these continuous cuts is 'uncertainty.'Park said, "This unpredictable policy environment makes it virtually impossible for pharmaceutical companies to establish long-term survival strategies."However, it was also emphasized that despite the repeated price-cutting environment, the domestic pharmaceutical industry has continued to build achievements in new and incrementally modified drugs (IMDs).Jun-seop Park, Board of Director at Jeil PharmaceuticalAccording to growth indicators for 2024 compared to 2000 presented by Director Park: ▲ Industry scale: KRW 7.9 trillion → KRW 29.8 trillion (277% growth); ▲ Number of employees: 55,000 → 120,000 (118% growth).In particular, R&D investment surged 18-fold (1727%) from KRW 0.197 trillion to KRW 3.6 trillion. Since the launch of the first domestically developed new drug in 1999, the industry has produced 41 new drugs and 142 IMDs, establishing advanced clinical and quality systems.However, Park warned that this virtuous cycle of growth is coming to a halt.As the basis, he cited the "essential medicine supply discontinuation" crisis. According to data from the Ministry of Food and Drug Safety (MFDS), the number of reported cases of drug supply discontinuation and shortages has nearly tripled over the five years since 2020."While prices have risen by 20%, the standards for low-priced medicines have been frozen for over 10 years, threatening the sustainability of manufacturing basic medicines," Park said. "In Europe, unsustainable pricing policies are also acting as one of the primary causes of drug shortages."The issue of equity in government support was also brought to the fore. While the government's R&D investment ratio for all industries stands at 21–24%, the ratio for the pharmaceutical industry was a mere 5.5% as of 2023."While companies cover 94.2% of pharmaceutical R&D with their own profits, slashing the profitability of generics and IMDs, which form that financial base, is like cutting off a runner's supply line during a marathon for new drug development," Park compared."Instead of short-term indicators like the R&D investment ratio of the past three years, we must comprehensively evaluate cumulative investment amounts, continuity, and substantial outcomes," Park suggested. "It is time to consider drug price preferences through the designation of 'Research-Oriented Pharmaceutical Companies' for those who continue substantial investment, in addition to the existing 'Innovative Pharmaceutical Companies' certification."Park urged, "What the pharmaceutical industry needs right now is not drug price cuts, but the breathing room and support to prepare for the next 10 years. Instead of securing finances by cutting drug prices, we need policies that strengthen self-sustainability, allowing the industry to create jobs and reinvest in global competitiveness through appropriate drug pricing.""Cutting Generic Prices to Approximately 40%, Legal Rationality in Question"Following this, Attorney Jin-hwan Jeong from the law firm Lee & Ko presented a legal and industrial analysis of the drug price reform plan announced by the MOHW last November.Member of the Healthcare Team from the law firm Lee & KoHe also questioned the government's plan for drug price cuts related to the generic drug price estimation criteria."The government cites cases from Japan and France, but it is worth considering whether a horizontal comparison is possible given the industrial structures and the proportion of global new drugs in those countries," Jeong said. "We need to examine whether there is rationality in how a cut to the 40% range contributes to stimulating new drug development by domestic pharmaceutical firms."Furthermore, he raised questions regarding the 'differentiation of the price addition system,' a core part of the reform. The government's plan grants high price additions only to the top 30% of Innovative Pharmaceutical Companies in terms of R&D ratios."It is difficult to see a substantial difference in R&D capabilities between a company at the 30th percentile and one at the 31st, and a structure where rankings change every year based on sales fluctuations hinders corporate predictability," Jeong said. "Evaluating companies primarily by ratios without considering comprehensive indicators, such as cumulative R&D investment or technology transfer achievements, may be irrational."Jeong added, "There may be grounds for claims regarding the deviation or abuse of discretionary power under the Administrative Litigation Act. The collapse of an industry happens in an instant, but its revival takes a long time. We need a detailed institutional design where welfare and industry can coexist."Predictability over Speed… Issues of Scope and Timing for Listed DrugsIn the subsequent Q&A session, questions focused on the 'speed' and 'predictability' of the policy.Attendees expressed concern that, as the reform is being pushed forward rapidly, a 'big picture timeline' for when and to what extent the system will be applied must be presented first so companies can prepare.There were also questions reflecting anxiety about the uncertainty of policy implementation, specifically about which of the currently listed medicines will be subject to price cuts and when.(from left) Yeon-sook Kim, Head of the Division of Pharmaceutical Benefits at the Ministry of Health and Welfare (MOHW), ; Jaeho Jung, Head of Department at Novartis Korea, Jun-seop Park, Board of Director at Jeil PharmaceuticalThe standard view among the domestic pharmaceutical industry was that, since each company had already established mid- to long-term business plans, an accelerated implementation date could destabilize management, employment, and decisions on development and investment.In response, Yeon-sook Kim, Head of the Division of Pharmaceutical Benefits at the MOHW, expressed a commitment to setting specific targets as soon as possible to increase industry predictability."The government also fully recognizes that policy predictability is important," Director Kim explained. "We will quickly finalize and announce the targets for listed drug adjustments, and we are reviewing measures for a soft landing, considering the impact on the industry."Kim emphasized that rather than a unilateral speed race, the government would ensure detailed adjustments through communication with the industry, stating, "We will not focus simply on cutting prices, but will sufficiently examine areas for supplementation by taking the voices of the industrial field into account."In conclusion, Kim added, "We are considering a phased implementation, starting with a primary review of medicines listed before 2012. We plan to finalize the specific targets and scope through technical verification and close communication with associations to avoid confusion."

- Policy

- MFDS reviews mutagenicity of clarithromycin impurity

- by Lee, Tak-Sun Jan 21, 2026 09:07am

- While investigations into nitrosamine impurities in the antibiotic clarithromycin are underway, the Ministry of Food and Drug Safety (MFDS) is reportedly also reviewing their mutagenicity.The European Medicines Agency (EMA) has already concluded that the clarithromycin-related nitrosamine impurity is non-mutagenic.If the MFDS also concludes that there is no mutagenicity, the threshold for excessive nitrosamine detection in clarithromycin would be removed, making quality control significantly easier for the pharmaceutical industry.According to the MFDS on the 20th, nitrosamine impurities (N-nitroso-N-desmethyl clarithromycin) were detected in excess in finished drug products using clarithromycin ingredients from India. Consequently, the MFDS has ordered an investigation into 77 companies holding related items.The MFDS orders an investigation within one month for known impurities and a three-month investigation for relatively unknown impurities.The threshold for nitrosamine impurities in clarithromycin has already been established. In December 2023, the acceptable intake was set at 1,500 ng per day.An official from the MFDS stated, "Impurities were first detected in raw materials from India, and excessive amounts were also confirmed in one domestic finished drug product using those materials. We have therefore issued investigation orders to all companies with relevant items."Upon receiving reports of the investigation results from these companies, the MFDS will review usage patterns and supply status before ordering product recalls.However, it has been noted that the MFDS is also reviewing the mutagenicity (a chemical reaction to cause genetic mutations) of the clarithromycin nitrosamine impurity.While the European EMA has already concluded it is non-mutagenic, the U.S. FDA is currently conducting review.If the impurity is determined to be non-mutagenic, it would no longer pose a regulatory issue, even if detected in excess, since the acceptable limit would be deleted.The MFDS official explained. "We are conducting the mutagenicity review and the impurity investigation concurrently," adding, "If the conclusion that clarithromycin nitrosamine is non-mutagenic had reached first, this investigation would not have taken place."Meanwhile, clarithromycin is a widely used antibiotic for infections of the upper and lower respiratory tracts.

- Company

- Major hurdles still remain for Entresto generics

- by Kim, Jin-Gu Jan 21, 2026 09:07am

- Patent risks surrounding Novartis’ heart failure drug Entresto (sacubitril/valsartan) have effectively been resolved with the recent Supreme Court ruling. Although patent disputes concluded in favor of generic companies and the patent barriers have now been lifted, the launch of generic versions remains far from straightforward.Now firmly established as a blockbuster with annual prescriptions of nearly KRW 80 billion, Entresto presents a structural challenge in which generic manufacturers have successfully defeated the patents but are still unable to enter the market due to approval delays.Entresto’s repeated surge in prescription sales drives the generic companies’ patent challengesAccording to the pharmaceutical market research firm UBIST on the 20th, Entresto recorded KRW 79.4 billion in outpatient prescriptions last year.Entresto rapidly expanded its prescription sales since its launch in 2018. After recording KRW 6.3 billion in prescription sales in its first year (2018), it surged to KRW 15 billion in 2019 and KRW 22.4 billion in 2020.This rapid expansion of its presence in the heart failure treatment market led to patent challenges from generic companies. Starting with Elyson Pharm in January 2021, over 20 companies filed comprehensive patent invalidation lawsuits against Entresto's five patents.Novartis ‘Entresto’ annual prescription sales (Unit: KRW billion, Source: UBIST)The generics companies' judgment ultimately proved correct. Over the past five years of patent disputes (2021-2025), Entresto's prescription sales surged 2.5-fold in just four years, from KRW 32.4 billion in 2021 to KRW 79.4 billion last year.Not a simple combination drug but a ‘co-crystal complex’... Generic approvals remain at ‘0’Despite the favorable court ruling, generic launches are unlikely anytime soon. The regulatory approval for generic products is holding things back.To date, there have been zero approvals for Entresto generics. More than 10 patent challengers filed marketing authorization applications between April 2022 and July 2023, based on their first-instance patent victories.However, nearly three years later, there is still no news of Entresto's generic product approvals. Considering that generic product approvals typically take about a year and a half after application, this is considered unusual.According to industry sources, the Ministry of Food and Drug Safety (MFDS) has requested multiple rounds of supplementary data. The root cause lies in Entresto’s unique solid-state structure. The pharmaceutical industry points to Entresto's unique crystalline structure as the reason behind these supplementary requests. Entresto works by having its two components, sacubitril and valsartan, act on cardiac neurohormones via separate pathways. What is unique is that these two components form a single crystalline structure in a ‘co-crystal’ form.Most fixed-dose combinations consist of two separate crystalline APIs physically blended together. In contrast, a cocrystal involves two or more components bonded at the molecular level like a single compound, exhibiting properties similar to a single compound, right up until absorption in the body. For this reason, the industry describes Entresto not as a simple ‘combination drug’ but as a molecular ‘complex’ with its own distinct characteristics.The problem is that there are almost no precedents for approving drugs in this co-crystal form. Entresto is known to be the only drug approved as an API-API co-crystal complex, not only in Korea but also in the US and Europe. There are also no known cases worldwide of generic approval for co-crystal complex drugs. This is where the MFDS's dilemma begins. It is reported that they are struggling to find an appropriate analytical method for generic approval. The differing physicochemical properties of co-crystal structures compared to conventional compounds are cited as a burden in the approval review process, making it difficult to apply existing analytical methods directly.Approval Variables remain despite supreme court bictory... early launch may be delayedEntresto has five patents listed in Korea’s patent registry. Following the Supreme Court’s rulings, all five patent barriers have effectively been removed. From a patent perspective, generic manufacturers are now free to launch their products once marketing authorization is granted.However, regulatory approval has emerged as a new bottleneck. Despite the elimination of patent risk, prolonged MFDS review has made it difficult for generic firms to predict their market entry timelines.The pharmaceutical industry interprets this as Entresto's structural uniqueness, creating a new barrier at the approval stage. This means that even with a blockbuster market worth KRW 80 billion annually within reach, a regulatory hurdle separate from the patent dispute remains. Ultimately, the timing of generic approval and actual launch will depend on the regulatory authority's judgment and review direction.

- Company

- "Pharma consignment business faces difficult times"

- by Chon, Seung-Hyun Jan 21, 2026 09:07am

- The survival of consignment production businesses for pharmaceutical companies is threatened. As joint development regulations and the tiered drug pricing system block the entry of late-comer generics, contract manufacturers are struggling to maintain their operations. Concerns are growing that the market will freeze further as the new drug price reform lowers the criteria for generic price calculation and strengthens the tiered pricing system. An increasing sense of poor treatment is being expressed as the government expands support for the biopharmaceutical Contract Development and Manufacturing Organization (CDMO) sector while neglecting synthetic drug consignment.ChatGPT-generated imageAccording to industry sources on the 19th, Korea's domestic pharmaceutical companies are facing concern that the upcoming drug price reform could determine the survival of their consignment businesses. In the reformed system scheduled for implementation this July, the price calculation criteria for generics will drop from 53.55% of the original drug's price before patent expiration to about 40%. The final figure is expected to fall between 40% and 45%. If the maximum generic price drops to 40%, a 25% decrease in profit is expected.A decrease in the generic price criteria inevitably leads to a downturn in the consignment business. Contract manufacturers typically set their supply prices at a certain percentage of the product's insured drug price.For example, if a product is priced at KRW 1,000, the supply price is set around KRW 300–500. Consequently, lower generic insurance prices result in lower supply prices for contract manufacturers. The more unfavorable the cost structure, the higher the supply price becomes.If the insurance price of a generic supplied by a contract manufacturer drops, the consigning company is forced to demand a lower supply price due to its own falling profitability. However, pharmaceutical companies argue they have limited capacity for such cuts due to continuous prior price reductions.Recently, as regulations on authorization and pricing have tightened, more companies are reportedly considering scaling back or abolishing their consignment operations.The tiered drug pricing system, implemented during the 2020 reform, has blocked latecomer generics.Under the tiered drug pricing system, the upper price limit decreases each month as a generic enters the market later. Reintroduced in 2020 after being abolished in 2012, it mandates a 15% price reduction for any generic entering a market with over 20 identical listed products. This makes it difficult for latecomers to enter the market at such low prices. Contract manufacturers, in turn, struggle to expand as they cannot recruit additional consigning companies for their current products.Before the tiered drug pricing system was implemented, the first 20 companies to enter a market would quickly reach their full quota, leaving latecomers without any incentive to join.Additionally, joint development regulations acted as a catalyst for the scale down. Since the revised Pharmaceutical Affairs Act took effect in July 2021, the so-called '1+3' regulation has limited the number of incrementally modified drugs (IMDs) and generics that can be authorized using a single clinical trial.If a product is manufactured at the same site using the same formula and process as the drug used in the bioequivalence study, the bioequivalence data may be used only 3 times. This means only four generics (one original and three others) can be authorized per study. The same '1+3' rule applies to clinical trial data.These regulations also apply to generics already authorized and on sale. After the regulation took effect, only up to three additional consigning products can be added. For instance, a contract manufacturer that previously produced 10 generics can add only 3 more, for a total of 13. Since contract manufacturers can only recruit new clients if an existing one leaves, expanding business regardless of production capacity has become nearly impossible.A consignment manager at a pharmaceutical company commented, "In the past, the government actively encouraged consignment, expecting that specialized mass production would improve quality control," adding, "If they treat the consignment business as the cause of the proliferation of generics and pursue only restrictive policies, we will have no choice but to consider job cuts due to business scaling down or withdrawal."Tiered drug pricing system (different pricing based on the order of listing)The strengthening of the tiered drug pricing system in the upcoming reform is also cited as a factor that will aggravate these difficulties.The Ministry of Health and Welfare (MOHW) has proposed a plan to reduce the price by 5 percent (p) for each subsequent item listed, starting with the 11th product of the same formulation. Because the stepped system will trigger at the 11th product instead of the 21st, the system for additional price cuts will activate much faster across the generic market. Analysis suggests that changing the reduction standard from a flat 15% to a 5%p decrease will disadvantage latecomers in terms of drug pricing cuts.For example, under the current system, if the maximum generic price is KRW 53.55, the 21st generic cannot exceed KRW 45.52 (a 15% drop). The 22nd and 23rd generics fall to KRW 38.69 and KRW 32.89, respectively. The 24th is KRW 27.95, and the 25th is KRW 23.76. The reduction amount decreases as more products enter.Under the reformed system, if the maximum price is 40 KRW, the 11th and 12th generics would drop to KRW 35 and KRW 30 due to the 5%p reduction (representing cuts of 12.5% and 14.3%, respectively). The 13th generic would drop another 5%p to KRW 25, a 16.7% cut. Even at the third step, the rate of reduction is already higher than under the current system.As the 14th and 15th generics drop to KRW 20 and KRW 15, the reduction rates accelerate exponentially to 20% and 25%. Even after only five steps, the price cap falls to about 15% of the original drug's pre-patent price, effectively abolishing the incentive for any further entries and blocking the expansion of consignment businesses.The government's recent active support for the biopharmaceutical CDMO industry further increases the sense of poor treatment among those in the synthetic drug consignment.On December 30 last year, the "Special Act on Regulatory Support for Biopharmaceutical Contract Development and Manufacturing Organizations" was announced. The core of this law includes establishing a registration system for biopharmaceutical export manufacturing, which was not defined in the Pharmaceutical Affairs Act, setting facility standards for export-specialized sites, and institutionalizing GMP certification and raw material certification for CDMO sites.The Ministry of Food and Drug Safety (MFDS) plans to prepare detailed criteria for customized regulatory support, including simplifying import procedures for raw materials used by CDMOs, providing prior GMP consultations, and offering technical advice on manufacturing facilities.An industry official stated, "Previously, there was a strong perception that the consignment business contributed to improving production capacity and creating new revenue streams, but business scaling down has become inevitable due to continuous regulations and price cuts," adding, "It is currently impossible to predict future profit changes, making even this year's business plans unclear."

- Company

- Paxlovid’s prescription market uniquely volatile

- by Chon, Seung-Hyun Jan 21, 2026 09:07am

- The COVID-19 treatment ‘Paxlovid’ recorded approximately KRW 80 billion in outpatient prescriptions last year. With the 2024 National Health Insurance reimbursement decided, it caused a storm in the prescription market. Despite its high price, nearing KRW 1 million per course, it achieved massive prescription volumes. Driven by fluctuations in COVID-19 patient numbers, Paxlovid showed an unusual prescription pattern, with monthly sales differing by as much as 50-fold.According to the pharmaceutical market research firm UBIST on the 20th, Paxlovid generated KRW 79.4 billion in outpatient prescription sales last year.Paxlovid is an oral antiviral that suppresses replication of the COVID-19 virus and is primarily prescribed to high-risk patients at risk of progression to severe disease. In the early phase of its introduction in Korea, the government directly procured and distributed the drug free of charge. However, in June last year, the government halted new supply purchases, transitioning Paxlovid to routine prescribing in medical institutions. Starting October 2024, Paxlovid formally entered the prescription market after its National Health Insurance coverage was finalized. The reimbursement ceiling price was set at KRW 941,940 per course, with a patient co-insurance of 5%.Monthly Paxlovid Outpatient Prescription Amount (Unit: million won, Source: UBIST)Paxlovid made its full-scale market debut in Q4 of last year with KRW 4.1 billion in prescriptions. In Q2 this year, prescriptions exceeded KRW 10 billion, reaching KRW 11.4 billion. In Q3, sales surged more than fourfold quarter-on-quarter, reaching KRW 47.7 billion. At that time, total influenza drug prescriptions accounted for only 0.4% of Paxlovid’s volume.Paxlovid showed fluctuating quarterly prescription sales last year. Sales rose 40% from KRW 8.2 billion in Q1 to KRW 11.4 billion in Q2, then soared to KRW 47.7 billion in Q3. However, Q4 sales plummeted to KRW 12.1 billion, just 25% of the previous quarter's level.The high cost of Paxlovid, coupled with the rapidly fluctuating number of COVID-19 patients, led to significant fluctuations in prescription performance.In the first half of last year, weekly COVID-19 hospitalizations remained relatively stable at around 100 patients per week. The peak was recorded in Week 13 (March 24–30) with 178 admissions, compared with a low of 56 patients in Week 5 (January 27–February 2).Weekly COVID-19 Hospitalization in 2025 (Unit: Persons, Source: Korea Disease Control and Prevention Agency)COVID-19 hospitalization counts are tallied based on patient numbers reported by 221 hospitals and higher-level medical institutions participating in the Acute Respiratory Infection Surveillance Program.Hospitalizations began rising sharply in Week 31 (July 28–August 3) with 220 patients, and peaked in Week 37 (September 8–14) at 459 patients, triggering concerns of another major outbreak. However, from October onward, case numbers declined steadily, returning to first-half levels by November and December.Monthly prescription data clearly reflects this trend. Paxlovid prescriptions rose from KRW 5.5 billion in July to KRW 17.4 billion in August, surpassing KRW 10 billion for the first time. In September, when COVID-19 hospitalizations peaked, monthly prescriptions reached KRW 24.9 billion, the highest among all pharmaceutical products. As hospitalizations declined, prescriptions dropped sharply to KRW 8.1 billion in October, followed by KRW 2.9 billion in November and just KRW 1.2 billion in December.

- Company

- Alteogen licenses out new drug tech to GSK subsidiary

- by Cha, Ji-Hyun Jan 21, 2026 09:07am

- Alteogen has signed a technology out-licensing agreement with a subsidiary of global big pharma, GlaxoSmithKline (GSK), based on its Hybrozyme platform.According to the Financial Supervisory Service on the 20th, Alteogen signed an exclusive license agreement with GSK subsidiary Tesaro for the development and commercialization of a subcutaneous (SC) formulation of the PD-1 immuno-oncology drug ‘Dostalimab’ utilizing the liver hyaluronidase-based SC formulation modification platform ‘ALT-B4’.Under the agreement, Tesaro obtains exclusive rights to develop and commercialize a subcutaneous formulation of dostarlimab using Alteogen’s Hybrozyme technology. Alteogen will be responsible for supplying ALT-B4 for both clinical and commercial products.The total contract value is up to USD 285 million (approximately KRW 421 billion). The deal includes a non-refundable upfront payment of USD 20 million (approximately KRW 29.5 billion) and development, regulatory, and sales-based milestone payments of up to USD 265 million (approximately KRW 391.4 billion). Alteogen will also receive additional royalties linked to product sales upon commercialization.Alteogen's ALT-B4 hydrolyzes hyaluronic acid in the subcutaneous tissue, enabling the conversion of intravenous (IV) formulations into SC formulations. Unlike IV formulations, which require patients to receive injections at the hospital for 4-5 hours, the SC formulation allows patients to self-administer the injection at home in less than 5 minutes.Alteogen's Hybrozyme platform has proven its competitiveness through multiple licensing agreements with global pharmaceutical companies, including MSD, GSK, AstraZeneca, Daiichi Sankyo, Sandoz, and Intas. Notably, MSD developed a subcutaneous formulation of Keytruda using ALT-B4, which received approval in the US and Europe last year and has since been launched commercially.

- InterView

- "Leclaza+Rybrevant shifts the EGFR lung cancer trt paradigm"

- by Son, Hyung Min Jan 21, 2026 09:04am

- "The Leclaza + Rybrevant combination therapy confirmed improvement to survival in high-risk patient group with EGFR-mutant lung cancer. The result shifted the existing treatment strategy centered around monotherapy to combination therapy."During a recent meeting with DailyPharm, Professor Ji-Youn Han from the Division of Hematology-Oncology at the National Cancer Center explained the clinical significance of the Leclaza + Rybrevant combination therapy and the changes in EGFR-mutant non-small-cell lung cancer (NSCLC).Professor Ji-Youn Han from the Division of Hematology-Oncology at the National Cancer Center 'Leclaza (lazertinib)' is an EGFR-mutant NSCLC treatment developed by Yuhan Corp. It is a third-generation tyrosine kinase inhibitor (TKI) that targets exon 19 deletions and the exon 21 (L858R) mutation. Johnson & Johnson secured the global rights to Leclaza and has been conducting clinical research on its combination therapy with 'Rybrevant (amivantamab).'Rybrevant is a fully human bispecific antibody that fundamentally blocks tumor growth pathways by simultaneously inhibiting active EGFR mutations and MET mutations·amplification. This drug inhibits various resistance pathways observed in EGFR-mutated lung cancer by blocking ligand binding and promoting receptor degradation.The Leclaza + Rybrevant combination therapy demonstrated improvement in overall survival (OS) in the global Phase 3 MARIPOSA study. In an Asian sub-analysis presented at the European Society for Medical Oncology Asia Congress (ESMO Asia 2025) this year, the combination therapy reaffirmed an OS effect consistent with the global clinical data.A total of 858 participants were enrolled in the MARIPOSA study, including 501 Asian patients. In an analysis at a median follow-up of 38.7 months, the combination therapy reduced the risk of death in Asian patients by 26%. While the median OS for the combination group was not reached, it was 38.4 months for the control group receiving 'Tagrisso (osimertinib)' monotherapy, suggesting the survival benefit of the combination could exceed one year. The 36-month survival rate also remained higher for the combination group at 61% compared to the Tagrisso group.Since Asian patients have a higher prevalence of EGFR mutations and different disease characteristics compared to Western populations, shifts in treatment strategies have a more significant impact on clinical practice. This analysis, which confirmed survival-improvement effects identical to those in the global data, once again demonstrated that Leclaza + Rybrevant has sufficient efficacy in Asian patients.Currently, Leclaza + Rybrevant is approved as a first-line treatment in major countries, including South Korea, the United States, Europe, Japan, and China. Given the high prevalence of EGFR mutations among Korean patients, this Asian analysis is expected to significantly influence clinical guidelines and first-line treatment strategies. Furthermore, the fact that major adverse events (paronychia and rash) of the combination therapy can be managed preventively through the COCOON study is emerging as a competitive advantage.Professor Han assessed, "Leclaza + Rybrevant combination therapy clearly demonstrated consistency in therapeutic effect by showing results in the Asian patient group identical to those of the global clinical trial," adding, "I believe the paradigm shift toward combination therapy-centered treatment has begun."Q. Sub-analysis data from MARIPOSA were recently released. What is your evaluation of the results?Research on combination therapy for the treatment of EGFR-mutated NSCLC has shown a complete shift in the first-line treatment paradigm. Clinically significant improvements in progression-free survival (PFS), the primary endpoint, and OS, the secondary endpoint, were confirmed. These results clearly suggest that combination therapy rather than monotherapy should be adopted as a treatment strategy.However, it is difficult to see combination therapy in its current form as the definitive answer. While there is an OS benefit, it does not manifest identically in all patients. Depending on the mechanism of action, some patients may find the Rybrevant combination therapy more advantageous, while others may prefer 'Alimta (pemetrexed)'-based treatment. Additionally, the possibility remains open for new drugs with different mechanisms to be added as combination partners in the future.What is clear is that a distinct unmet need for monotherapy has existed. Specifically, the limitations of existing treatments were evident in high-risk patients, underscoring the need for a breakthrough therapeutic. Leclaza + Rybrevant presented a meaningful alternative for high-risk patient groups and further clearly demonstrated OS improvement. Based on this evidence, I assess that the treatment paradigm has now completely shifted.Q. How do you interpret the reason why the survival improvement effect of Leclaza + Rybrevant appeared consistently in Asian patients?If the global and Asian data are consistent across all subgroups and show no significant differences, this is the ideal clinical result.As a bispecific antibody, Rybrevant has the advantage of simultaneously inhibiting both the EGFR and MET pathways. Clinically, approximately 10–15% of patients exhibit MET-dependent resistance pathways. This patient group has a relatively poor prognosis, and Rybrevant has the potential to show long-term survival benefits in these patients.Q. Is it the ideal direction to proceed with combination therapy as the standard of care?While it is an ideal direction, I do not believe that combination therapy must be applied to every single patient.Recently, researchers have redefined high-risk patient groups for whom combination therapy should be applied, thereby refining the first-line treatment approach strategy, which I view as an essential step. In my opinion, the patient groups to whom I recommend combination therapy are those with a high tumor burden. For example, high-risk groups with confirmed bone, liver, or central nervous system (CNS) metastases.This also includes patients who show biologically aggressive characteristics, such as mutations being detected in circulating tumor DNA (ctDNA) tests. Additionally, because patients with the EGFR L858R mutation often do not achieve long-term response with monotherapy, combination therapy is considered.Looking at the distribution of EGFR mutations that constitute the high-risk patient group, exon 19 deletions and L858R substitution mutations are roughly split half-and-half. Specifically, I estimate exon 19 deletions at about 60% and L858R at about 40%. Among these, patient groups with high tumor burdens include those accompanied by bone or brain metastases. Among these patients, about 30–40% are high-risk EGFR-mutated NSCLC patients.Q. Overall, how do you evaluate the safety data regarding the adverse events of the Rybrevant combination therapy?Looking at the entire development process, from CHRYSALIS to MARIPOSA and MARIPOSA-2, the journey to find the proper indications was long. Because the drug's adverse events were clear, Johnson & Johnson conducted extensive research on them and simultaneously developed educational programs to help medical staff using the drug in clinical settings do so safely. The COCOON study was also conducted in this context.The COCOON study is significant in that it presented a standardized protocol for systematic management. Whereas management methods previously varied by medical staff or institution, a standardized management strategy that anyone can apply has now been introduced with the COCOON regimen.Rybrevant tends to have more adverse events than Alimta-based treatment. Since it is a drug targeting EGFR, there are areas where EGFR-related adverse events partially overlap when combined with Leclaza. In fact, combining Rybrevant and Leclaza for patients with exon 19 deletions or exon 21 (L858R) mutations may be more challenging than combining Rybrevant and chemotherapy for patients with exon 20 insertion mutations. This is particularly true for adverse events directly associated with EGFR mutation inhibition.A standardized adverse event management strategy was established through the COCOON study, which was designed to preventively manage skin-related adverse events associated with the Rybrevant combination therapy. For example, detailing the active use of chlorhexidine preparations or topical treatments when paronychia occurs is a novel part organized by the COCOON study.Overall, it was a very consistent and determined development strategy. The study did not avoid the drug's adverse events but addressed them directly, ultimately building a clinically applicable management system.Q. The subcutaneous (SC) formulation of Rybrevant was approved in the United States. What impact do you think it will have on clinical practice if introduced in Korea in the future?The characteristic of an SC formulation for anticancer drugs differs from that of methods such as insulin injections, which are administered in small volumes. Anticancer drugs require a specific dose to be administered, and a process is needed to wait for the drug to be absorbed by the body after administration. In cases like exon 20 insertion mutations, where it is combined with intravenous (IV) chemotherapy, a method of simultaneously administering IV and SC drugs during treatment may not be feasible.While there might be a possibility of administering the SC formulation alone with an oral targeted therapy, even in this case, the volume of drug to be injected is not small, and the local volume after administration is significant. Considering that one must wait for the drug to be absorbed into the local area after administration, we need to wait and see how applicable it will be in actual clinical practice. For these reasons, the application of the SC formulation in combination therapy is likely to be more limited compared to monotherapy.Q. With treatment options diversifying and long-term survival being expected, how do you view the issue of reimbursement for combination therapy?Currently, there are quite a few patients who maintain long-term treatment for over five years while taking an EGFR-TKI. In fact, there is a patient who has continued taking the same EGFR-TKI since the early days of our hospital's founding. Because these patients have a great fear of recurrence if they stop the drug, they continue treatment, having become accustomed to it.As the emergence of targeted therapies has led to an increase in stage 4 lung cancer patients surviving long-term at levels similar to patients who have undergone surgery, the 'Special Case Medical Expense Coverage System' is not being fully applied. There are cases where the exception ends after taking an EGFR-TKI for more than 5 years, and a realistic consideration is becoming necessary about how long the subsequent treatment can be recognized by insurance.Q.How do you expect the first-line treatment paradigm for EGFR-mutated lung cancer to change in the future?The MARIPOSA study shifted the paradigm for first-line treatment of EGFR-mutated NSCLC. In particular, it demonstrated the consistency of the therapeutic effect, as results identical to the global data were confirmed in the Asian patient group.Rybrevant’s mechanism of action clearly shows an overall survival benefit by comprehensively blocking not only the major signaling pathways centered on EGFR mutations but also MET-dependent bypass pathways, which occur in about 10–15% of cases. Considering these mechanistic characteristics, one can also expect a "long-tail effect," showing long-term survival after administration, in the latter half of the survival curve for the Rybrevant combination therapy.Of course, the possibility of accompanying adverse events is higher in combination therapy since two agents are used together. However, through studies like COCOON, an excellent protocol for adverse event management has been developed, establishing a foundation for easier application in the real world.