- LOGIN

- MemberShip

- 2026-03-10 07:05:54

- Policy

- 10th DREC members to be appointed next year

- by Jung, Heung-Jun Dec 05, 2025 08:33am

- The appointment of members for the 10th term of the Drug Reimbursement Evaluation Committee (DREC), which assesses the appropriateness of drug reimbursements, is expected to be delayed until next year.The 12th committee meeting held today (4th) will see the existing 9th-term members participate as usual. The Health Insurance Review and Assessment Service (HIRA) is currently conducting personnel verification procedures, including checking administrative disciplinary records, prior to appointing the 10th-term members, with appointments expected soon.Although the 9th-term members' official two-year term ended last September, their tenure has been extended due to delays in recommending and appointing the 10th-term members.DREC members are appointed after receiving around 70 recommendations from professional medical societies and organizations. The Korean Pharmaceutical Association may also recommend one member.The committee consists of approximately 105 members. Once the HIRA appointments are finalized, various subcommittees, such as the Pharmacoeconomic Evaluation Subcommittee and the Risk-Sharing Agreement Subcommittee, will also be newly reorganized.Seventy-six members were appointed for the 9th term. For the monthly DREC meetings, 20 members are randomly selected to participate.Among the recommended DRED members, the following are excluded: ▲Those currently performing pharmacoeconomic evaluation-related services for pharmaceutical companies ▲Officers, employees, or practicing physicians/pharmacists of the recommending medical/pharmaceutical organization ▲Those deemed unable to perform duties impartially during the pre-appointment ethics screening ▲ Individuals with administrative sanctions or legal penalties within the last 5 years under the Medical Service Act, Pharmaceutical Affairs Act, National Health Insurance Act, or Medical Benefit Act ▲ those who have served as a DREC member for two or more consecutive terms.Since HIRA is currently reviewing candidates’ administrative sanction histories, the committee may be fully reorganized with new members as early as January next year. The term of office is 2 years.Additionally, HIRA revised the Drug Evaluation Committee regulations last July, changing the chairperson election method from an election by committee members to appointment by the HIRA Director. The authority to form subcommittees and elect subcommittee chairs was also transferred from the committee chair to the HIRA Director, an issue criticized during the National Assembly audit.The number of individuals each organization (KMA, KPA, KSHP, etc.) can recommend for the candidate pool was also reduced from two to one..

- Policy

- MFDS announces revision to the ODD regulations

- by Lee, Tak-Sun Dec 05, 2025 08:32am

- From now on, Orphan Drug Designation (ODD) can be expedited without the need to submit documentation of significant improvement in safety and effectiveness compared to substitute drugs.The Ministry of Food and Drug Science (MFDS) (Minister Yu-Kyoung Oh) announced on December 4 that it has issued an administrative notice for the amendment to the 'Regulations on the Orphan Drug Designation' (MFDS Notice), expanding the criteria to provide diverse treatment opportunities for patients with rare diseases.The amendment is part of the 'The Top 50 Food and Drug Safety Tasks' and it will allow drugs used to treat or diagnose rare diseases to receive expedited designation as orphan drugs without having to submit data proving 'significantly improved safety and efficacy compared to alternative medicines.'A rare disease is one with a prevalence of fewer than 20,000 people, or one whose prevalence is unknown due to diagnostic difficulty, as designated and publicly announced by the Korea Disease Control and Prevention Agency (KDCA).The amendment enhances predictability by clearly specifying the documentation requirements that companies must submit when applying for Orphan Drug Designation, aligning them with the specific designation criteria.Since July of this year, the MFDS has been operating a 'Consultative Body for Improving the ODD System' to discuss various improvement measures, including the ease of designation criteria.The MFDS anticipates that this revision will help foster an environment in which patients with rare diseases can receive stable treatment and will contribute to the government's national agenda to fulfill a 'A Strong Welfare Nation Built on Solid Foundations'.Detailed information on the administrative notice for the regulation amendment can be found on the MFDS official website (www.mfds.go.kr) → Legislation/Data → Legislation Information → Legislation/Administrative Notice.

- Policy

- KPA counters oppositions on need for INN prescribing

- by Kim JiEun Dec 04, 2025 09:15am

- Sujin Noh, General Affairs/Public Relations Director, KPA The Korean Pharmaceutical Association has fully refuted concerns raised by some quarters on how the introduction of international nonproprietary name prescribing will not generate the expected healthcare cost savings and infringe on physicians' prescribing rights.At a media briefing on the 1st, Director of General Affairs and Public Relations Soo-jin Noh discussed the association’s advocacy efforts regarding international nonproprietary name prescribing and introduced portions of the final report from the Korea Institute for Pharmaceutical Policy Affairs ‘INN Prescribing Model Development’ that was completed last October. The KPA also announced that it recently issued an advocacy booklet titled ‘A Citizen-Centered INN Prescribing System: Why It Is Absolutely Necessary,’ to strengthen outreach to government bodies around its INN Prescription Task Force and to support lobbying activities by regional branches and sub-branches.This booklet, focusing on why the system is beneficial for the public, highlights: ▲ Definition of INN prescribing ▲Benefits for improving public health ▲ Reducing the burden of drug costs ▲ Addressing drug supply instability ▲ Strengthening patients' right to know and choice of medications ▲ Safety considerations ▲ Phased and stable implementation plans.The booklet particularly drew attention by including the KPA's position on issues and questions raised by some sectors regarding the INN prescribing system.This is interpreted as a counter-rebuttal to the Korean Medical Association's strong opposition to the legislative amendment currently proposed in the National Assembly regarding the introduction of generic name prescribing for out-of-stock drugs, which counters some of the KPA's arguments.The KPA first countered the claim that INN prescribing infringes on doctors' prescribing rights and undermines the principle of separation of medical and pharmaceutical practices, stating, “It is, in fact, a system that aligns with the intent of separating prescribing and dispensing practices.The KPA emphasized, “Physicians hold the core authority in patient treatment to determine the active ingredient, dosage, administration method, frequency, and duration. Pharmacists guide and dispense medications, enabling rational selection based on drug supply conditions and the patient's economic situation. INN prescribing aligns with the principle of rational drug use inherent in the separation of medical and pharmaceutical practices.”The KPA also countered the KMA’s recent objections to its claim, based on research by the Korea Institute for Pharmaceutical Policy Affairs, that introducing INN prescribing could save KRW 7.9 trillion in medical costs.The KPA stated, “Even under the current system, dispensing based on the lowest price criterion could save KRW 7.9 trillion annually, and including socioeconomic costs, we can expect savings exceeding KRW 9 trillion. If drug price system improvements and INN prescribing are implemented together, the savings will be even greater.” Regarding the criticism that INN prescribing cannot resolve the root cause of drug supply instability, the KPA emphasized, “This is an issue that remains unresolved despite attempts at various measures, including drug price increases, distribution improvements, and cooperation from pharmaceutical companies to increase production.” It stressed, “The most effective solution on the ground is for pharmacists to assist patients in exercising their right to choose the correct medication, ensuring patients can take government-guaranteed therapeutically equivalent drugs on time.”The KPA announced plans to produce additional materials for public outreach beyond this advocacy booklet.Director Noh stated, “We initially printed about 1,000 copies of this document, which will be distributed to provincial branches nationwide, the Korean Pharmaceutical Association's board members, and lawmakers. We also plan to produce additional public awareness leaflets and distribute them to local pharmacies and hospital pharmacists to explain the necessity of INN prescribing to the public." Director Noh also disclosed part of the results from a citizen survey included in the final research report on ‘‘INN Prescribing Model Development’ completed last month by the Korea Institute for Pharmaceutical Policy Affairs.Noh stated, “In a survey of 3,000 adults regarding awareness of INN prescribing, 83.8% of respondents agreed with the practice. Notably, citizens with prior experience of generic substitution showed higher positive perceptions of INN prescriptions. Reasons cited included improved access to dispensing and enhanced understanding of medication information.”Noh added, “It appears the public is choosing their preference based on individual convenience rather than professional disputes like conflicts between doctors and pharmacists. As drug shortages persist, overall public awareness and positive sentiment toward generic substitution and prescribing drugs with the same active ingredient seem to have increased.”

- Company

- Industry groups voice unified concern over price cuts

- by Chon, Seung-Hyun Dec 04, 2025 09:14am

- (From left) Dong-hee Lee, Vice Chairman of the Korea Pharmaceutical Traders Association; Young-joo Kim, President of Chong Kun Dang; Jung-jin Kim, Chairman of the Korea Drug Research Association; Yeon-hong Noh, Chairman of the Korea Pharmaceutical and Bio-Pharma Manufacturers Association; Hyung-seon Ryu, Chairman of the Korea Pharmaceutical Traders Association; Yong-joon Cho, Chairman of the Korea Pharmaceutical Industry Cooperative; Jae-kook Lee, Vice President of the Korea Pharmaceutical and Bio-Pharma Manufacturers Association.Leaders of pharmaceutical organizations have reached a consensus that the government's additional drug price cuts will inflict significant damage on the Korean pharmaceutical industry.The Emergency Countermeasure Committee for Drug Pricing System Reform for Industry Development, formed by major pharmaceutical groups, including the Korea Pharmaceutical and Bio-Pharma Manufacturers Association, held a meeting at the association on the 27th.This meeting comes just three days after the KPBMA, the Korea Biomedicine Industry Association, the Korea Pharmaceutical Traders Association, the Korea Drug Research Association, and the Korea Pharmaceutical Industry Cooperative resolved to join the emergency committee on the 24th.The committee discussed the potential impact of the drug pricing reform based on the details known so far, as the government has not formally announced the plan, and exchanged views on future countermeasures. The government is reportedly preparing to announce a major overhaul of the drug pricing system that will significantly lower the pricing standards for generics compared to current rules.Participants agreed that implementing additional drug price cuts during the industry’s “golden time” for advancing into a global pharmaceutical powerhouse—driven by increased R&D investment—would weaken the nation’s R&D and manufacturing base. They also raised concerns that the reform could increase reliance on expensive imported medicines, thereby undermining national health security.Attendees included the co-chair of the emergency committee, Yeon-hong Noh (Chairman of the Korea Pharmaceutical and Bio-Pharma Manufacturers Association), as well as co-vice-chairs Hyung-seon Ryu (Chairman of the Korea Pharmaceutical Traders Association), Jung-jin Kim, (Chairman of the Korea Drug Research Association), Yong-joon Cho (Chairman of the Korea Pharmaceutical Industry Cooperative), as well as committee leaders including Young-joo Kim, Head of the Planning & Policy Committee, and Jae-kook Lee, head of the Public Relations Committee, and executives from the associations and member companies.The committee stated it will continue to deliver rational industry feedback to the government on the proposed pricing reforms and will proactively present practical alternatives to minimize negative impacts on the industry.

- Company

- Keytruda shows benefit in head and neck cancer

- by Son, Hyung Min Dec 04, 2025 09:14am

- The immunotherapy Keytruda has opened the era of early treatment for head and neck cancer by gaining approval as a perioperative therapy.On December 2, MSD Korea held a media session to outline the clinical value of ‘Keytruda (pembrolizumab)’.Last month, Keytruda received expanded approval for use as a perioperative therapy—both neoadjuvant and adjuvant—for patients with resectable, locally advanced head and neck squamous cell carcinoma (HNSCC). Keytruda was previously approved in 2020 as a first-line treatment for metastatic or recurrent HNSCC.Professors Hye Ryun Kim, Hyun Jun Hong, Yonsei Cancer CenterThis expanded approval is significant as it broadens the treatment paradigm, previously centered on traditional palliative approaches (first- and second-line treatment for recurrent/metastatic head and neck cancer), to include the preoperative stage. With its confirmed efficacy as adjuvant therapy in the highly recurrent and high-mortality locally advanced patient group, Keytruda’s expanded approval is expected to reshape treatment strategies.The approval is based on results from the Phase III KEYNOTE-689 study in patients with Stage III or IVA HNSCC.In the study, patients received Keytruda monotherapy (2 cycles) before surgery, followed by Keytruda plus radiotherapy (with cisplatin for high-risk patients) for 3 cycles after surgery, and then Keytruda monotherapy for up to 12 cycles.Median follow-up of 38.3 months showed a 30% reduction in the risk of disease progression, recurrence, or death in the PD-L1-positive (CPS ≥1) patient group. The median event-free survival (EFS) was 59.7 months, more than double the control group's 29.6 months. The 3-year EFS also showed a gap of over 10 percentage points, with 58.2% in the Keytruda group versus 44.9% in the control group.Although the median overall survival (OS) has not yet been reached, the risk of death was reduced by 28%, confirming the potential for extending survival.Professors Hye Ryun Kim of the Department of Medical Oncology at Yonsei Cancer Hospital emphasized, “Head and neck cancer has a high recurrence rate, no matter how well surgery and radiation therapy are performed. Major immune checkpoint inhibitors, including Keytruda, can now be used preoperatively, leading to an increase in patients achieving long-term survival. Their greatest strength is their ability to prevent distant metastasis and recurrence.”"The need for perioperative therapy options is emerging... “Use of Keytruda will increase.”Head and neck cancer refers to cancers occurring in the oral cavity, pharynx (nasopharynx, oropharynx, hypopharynx), larynx, nasal cavity (sinuses), neck, salivary glands, and thyroid, excluding the brain and eyes. It can develop in over 30 sites in the head and neck region, with tumors originating in the squamous epithelial cells lining mucous membranes—such as the pharynx and salivary glands—accounting for 90% of all cases.Roughly half of HNSCC patients present with resectable disease, but the complex anatomical structures and vital functions around the face limit the extent of surgery, and achieving adequate resection margins is challenging when major organs are nearby.The standard treatment regimen, postoperative radiotherapy, has limited efficacy in improving survival, and even after surgery, it is difficult to completely remove microscopic residual disease.Even in resectable stages, the standard postoperative radiotherapy alone offers limited survival improvement, with 15-50% of patients relapsing within 5 years. Over half of these patients ultimately die, highlighting a substantial unmet need.This has led to continuous demand for neoadjuvant and adjuvant immunotherapy to reduce the risk of head and neck cancer recurrence. Preoperative adjuvant therapy can reduce tumor size and eliminate micrometastases, facilitating resection. Postoperative adjuvant therapy can remove micrometastases and contribute to preventing recurrence.Professor Hyun Jun Hong, Department of Otolaryngology at Yonsei Cancer Center, emphasized, “Head and neck cancer surgery can lead to major functional and cosmetic burdens. From an otolaryngology perspective, minimizing recurrence is a priority. When Keytruda was used perioperatively, we saw real benefit. It holds high potential to improve long-term prognosis of patients through synergistic effects with existing treatments.”

- InterView

- [Reporter’s View] Is the pricing reform realistic?

- by Hwang, byoung woo Dec 04, 2025 09:13am

- As the government unveils its drug-pricing reform plan, the pharmaceutical industry immediately began preparing its response. Yet many industry voices point out a widening gap between the policy’s stated direction and the realities companies face on the ground.Despite the government’s rationale of “industry restructuring,” concerns are growing over potential repercussions, including reduced R&D investment, weakened manufacturing capacity, and diminished momentum for new drug development. It remains unclear how carefully these impacts were factored into the new framework.This reform plan is reportedly designed based on the principles of streamlining the supply structure, establishing rational drug pricing, and strengthening the government’s fiscal soundness.Specifically, alleviating the burden on insurance finances and eliminating market duplication and inefficiencies are presented as core priorities, with the government emphasizing its intent to increase proactive efforts and support new drug development.But the response from the field tells a different story.A large portion of domestic pharmaceutical companies are already struggling with rising baseline costs—raw materials, labor, and clinical trial expenses. In this context, implementing drug price adjustments simultaneously constrains not only immediate profitability but also future investment capacity.This raises questions about the appropriateness of the policy's pace and intensity.Of course, there is a certain level of consensus on the broader direction of ensuring the sustainability of insurance finances and refining drug price management.However, given that domestic firms lack the robust R&D foundations owned by multinational companies, the reform is widely seen as a disproportionate burden on the local industry.Over the past several years, the Korean government has repeatedly positioned pharmaceuticals and biotech as a key future growth engine and implemented various support policies.Yet the latest pricing overhaul may likely conflict with companies’ mid- to long-term investment plans. Critics argue that prioritizing short-term fiscal stability may ultimately weaken Korea’s long-term industrial competitiveness.The pharmaceutical and biotech industries operate based on uncertainties, such as long-term R&D, potential failures, and technological advancements, rather than short-term profits.Therefore, drug pricing policy inherently carries significance beyond simple price adjustments —it can reshape the industry’s underlying dynamism.The intent behind the reform is understandable in some respects. But if the pace and magnitude of implementation are not calibrated properly, companies may be forced to reduce future R&D investment as their first line of survival.Consequently, a cautious approach is needed, as this could erode the industry's growth capacity and disrupt efforts to secure technological competitiveness. How to strike a delicate balance between government systems and the national strategy of fostering the industry as a future growth engine will be the key challenge moving forward.

- Company

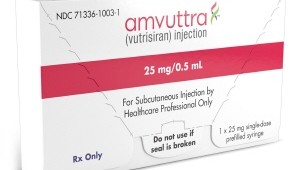

- RNAi therapeutic 'Amvuttra' enters reimb review

- by Eo, Yun-Ho Dec 04, 2025 09:12am

- 'Amvuttra,' an RNA interference (RNAi) therapeutic, has been put on a test stand for insurance reimbursement entry. According to sources, Amvuttra (vutrisiran), a new drug for the treatment of hereditary transthyretin amyloidosis (hATTR) with polyneuropathy (hATTR-PN), will be considered for the Health Insurance Review and Assessment Service (HIRA)'s Drug Reimbursement Evaluation Committee (DREC) today (December 4). Amvuttra was developed by Alnylam Pharmaceuticals and introduced to South Korea by Medison Pharma Korea.Amvuttra obtained an orphan drug designation from the Ministry of Food and Drug Safety (MFDS) in November 2023 and received final approval last year.Amvuttra is administered once every 3 months and is designed to target and silence messenger RNA, thereby blocking the production of wild-type and mutant transthyretin (TTR).The efficacy of Amvuttra was demonstrated through the Phase 3 HELIOS-A study. In the Phase 3 trial, 164 patients with hATTR-PN and accompanying polyneuropathy from 22 countries participated. Participants were randomly assigned to either a subcutaneous injection group receiving Amvuttra 25 mg once every 3 months (Amvuttra group, 122 patients) or an intravenous injection group receiving 'Onpattro (patisiran)' 0.3mg/kg once every 3 weeks (Onpattro group, 42 patients).Furthermore, the effectiveness of Amvuttra was evaluated by comparison with the placebo group in the APOLLO study, which evaluated the efficacy and safety of Onpattro in a patient group similar to that in the HELIOS-A trial.As a result, during the 9-month treatment period, the Amvuttra group experienced less severe neurological damage than the placebo group, and had improved quality of life. Additionally, the 10 Meter Walk Test, which evaluates patients' walking speed and exercise capacity, showed that patients treated with vutrisiran had no change in time. NT-proBNP, a biomarker of heart function, improved.Meanwhile, hATTR-PN, which affects approximately 1 in 100,000 people, is caused by a genetic mutation in the TTR gene. It is characterized by systemic multiple autonomic neuropathy, including symptoms related to the heart, digestive system, and ocular manifestations. Vyndaqel stabilizes the TTR protein.Symptoms typically begin in the lower extremity nerves, where the abnormal protein readily accumulates, presenting as pain, paresthesia, and paralysis before progressing to involve the upper limbs. Complications spread to other organs, including the heart, kidneys, and eyes. The average life expectancy after symptom onset is approximately 7 to 12 years.

- Policy

- Bill banning pharma wholesale platforms

- by Lee, Jeong-Hwan Dec 03, 2025 08:47am

- Minister of Health and Welfare Jeong Eun Kyeong, Rep. Kim Yoon of the Democratic Party of Korea, and Rep. Seo Young-kyo of the Democratic Party of Korea (from left)"This bill is not a second 'Tada Ban Law,' as mentioned by Rep. Shin Dong-uk in the press. It is not intended to prohibit the non-face-to-face healthcare platform itself, but rather to impose restrictions to solve problems arising when a platform operates a pharmaceutical wholesale business. Currently, the establishment of medical institutions and pharmacies is also currently prohibited from engaging in wholesaling."With the formal legislation bill for non-face-to-face healthcare and the bill banning intermediary platforms from establishing pharmaceutical wholesale (the so-called 'Doctor Now Bejin Pharm Prevention Act') passing the National Assembly's Legislation and Judiciary Committee, the evaluation is that "the government has achieved results in legislation that guarantees the safety of public pharmaceuticals."Minister of Health and Welfare Jeong Eun Kyeong addressed questions from both ruling and opposition party members in the Legislation and Judiciary Committee on the afternoon of November 26. It is reported that the Minister said, "The platform wholesale prohibition act is not a second 'Tada Ban Law,' with a firm stance, remaining calm, and giving logical and clear explanation of the potential side effects if the bill failed to pass led to its passage by the Committee.The ruling Democratic Party of Korea also played a major role, directly proposing the regulatory bill (Rep. Kim Yoon) and endorsing the Minister's philosophy and concerns through supportive questioning (Rep. Seo Young-kyo). This combined effort pushed through the necessary legislative act to establish a comprehensive non-face-to-face healthcare environment.The government and the ruling party effectively collaborated to proactively block the potential criticism of having a 'impractical non-face-to-face care bill,' which they would have faced if the platform wholesale prohibition act had not passed.The amendment to the Medical Service Act (institutionalizing non-face-to-face healthcare) and the amendment to the Pharmaceutical Affairs Act (prohibiting intermediary platforms from establishing wholesalers) are expected to be put to a vote and processed in the National Assembly plenary session on November 27.If approved by the plenary session without issue, all necessary parliamentary procedures for the legislation will be complete. Following government transfer and Cabinet Meeting approval, the laws will be announced next month (December). The implementation dates for both the Non-face-to-face Care Act and the Doctor Now Bejin Pharm Prevention Act are set to "one year from the date of government promulgation," meaning they will officially take effect in December 2026.Minister Jeong's firm stance... "Medicine is a public good, platform must not be abused"Throughout the Legislative and Judiciary Committee meeting, Minister Jeong logically persuaded the National Assembly, explaining why non-face-to-face healthcare intermediary platforms must be prohibited from engaging in wholesaling and detailing the anticipated side effects if it were allowed.Minister Jeong's core argument was that the bill prohibiting the concurrent operation of a platform and a wholesale business is not intended to regulate the non-face-to-face care intermediary industry, which is a new and innovative sector. Instead, it is a preventive law designed to prevent platforms from abusing their immense authority to control the distribution, prescribing, and dispensing of pharmaceuticals, which are considered a public good, for unfair profit.In explaining this, Minister Jeong pointed to the precedent of the domestic market-leading platform, Doctor Now, which had already caused controversy by establishing the pharmaceutical wholesaler Bejin Pharm as a subsidiary and by entering the drug distribution market.Doctor Now's operation of Bejin Pharmacy was strongly opposed by the pharmacists' community and caused public controversy over fair pharmaceutical distribution. It ultimately served as a critical justification for the Legislation and Judiciary Committee's amendment to the Pharmaceutical Affairs Act."Platform operators possess far greater influence than doctors or pharmacies," Minister Jeong explained. "They can use their affiliated pharmacies or medical institutions to influence the prescribing or dispensing of specific drugs. A case has already occurred where a platform operator, by concurrently operating a pharmaceutical wholesaler, induced affiliated pharmacies to source drugs through that wholesaler."Minister Jeong added, "This could become a form of unfair trade (illegal pharmaceutical rebates) and serve as an incentive to use specific drugs. The concern is that the platform, with its enormous power and influence, could impact physician prescribing and pharmacy dispensing. This power could be misused, for example, if the platform receives investment from pharmaceutical companies."Minister Jeong stressed, "We sought to address these issues preventively during the introduction of the new system because the misuse of the platform business could affect drug transactions, prescribing, and dispensing, all of which are considered a public good. It would ultimately have a negative impact on patients. This is consistent with the prohibition on medical institution or pharmacy founders from concurrently engaging in wholesaling."Following this explanation, Rep. Shin Dong-uk, who had raised the initial question, concluded his query by saying, "Yes, I understand," which led to the bill's passage by the Committee.Rep. Kim Yoon proposes the Bejin Pharm Prevention Bill...Rep. Seo Young-kyo questions the opening of a wholesale websiteRep. Kim and Rep. Seo of the Democratic Party also played crucial roles in the bill's passage.First, Rep. Kim proposed the amendment to the Pharmaceutical Affairs Act, representing the concern that Doctor Now's direct involvement in drug distribution and sales through the establishment and operation of Bejin Pharm could sharply increase the potential for new types of illegal activities (rebates) and significantly raise the probability of violating the Medical Service Act and Pharmaceutical Affairs Act by guiding patients to specific medical institutions and pharmacies. The legislative intent was to establish a fair pharmaceutical sales order.Immediately following the bill's proposal, Doctor Now publicly criticized the ban on platform-owned wholesalers as unfair legislation, expressing "regret that the bill was proposed despite policy authorities judging it difficult to be viewed as unfair trade."Prior to proposing the bill, Rep. Kim had summoned Doctor Now CEO Jeong Jin-woong to the Parliamentary Inspection last year to directly question him about the side effects of establishing and operating a wholesaler.Later, when the bill faced challenges during the National Assembly Health and Welfare Committee's plenary session, Rep. Kim, Rep. Park Hee-seung, and others strongly advocated for the legislative validity, arguing to their colleagues that the "Doctor Now Bejin Pharma Prevention Act is not a ban on non-face-to-face healthcare, but a regulation on illegal platform rebates."Rep. Seo emphasized the need for the legislation at the Legislation and Judiciary Committee hearing by publicly disclosing a text message that illustrated the potential problems if platforms were allowed to operate wholesale businesses alongside.Based on a text message Doctor Now sent to local pharmacies, Rep. Seo requested that the bill be passed. The Doctor Now text message announced the opening of a pharmaceutical wholesale website as a new function within its Doctornow-Web.The Doctor Now text included details that inventory would be linked based on the pharmacy's purchase history of specialized drugs distributed by Doctor Now, and upon linking, a 'Guaranteed Dispensing' badge would be displayed on the user application.Rep. Seo stated, "There are good startups and others that are not. This bill allows startups and the neighborhood pharmacies across the country to achieve a favorable coexistence."Thus, with Rep. Kim proposing the platform-wide prevention bill, Minister Jeong strongly asserting the legislative necessity, and Rep. Seo providing the final compelling evidence, the bill successfully passed the Health and Welfare Committee and the Legislation and Judiciary Committee, moving closer to final processing in the National Assembly plenary session.Regarding the legislation, Rep. Kim said, "Medical treatment for convenience should not be corrupted into dangerous distribution. The law is designed to prevent illegal rebates, as non-face-to-face platforms can influence the use and prescribing of pharmaceuticals through connections with pharmacies. If we allow non-face-to-face care without preventing this, there is a high risk of another new form of pharmaceutical rebates becoming a major issue, and we must stop it."

- Policy

- Xofluza, Ongentys generics apply for approval

- by Lee, Tak-Sun Dec 03, 2025 08:43am

- Roche’s flu treatment XofluzaAttention is focused on whether market competition will intensify with approval applications being filed for items where no generic drugs have emerged until now.However, given that the original drugs' patents are registered, overcoming patent barriers is expected to be key for entering the market.According to the Ministry of Food and Drug Safety (MFDS) on the 2nd, applications for generic versions of the influenza treatment Xofluza Tab (baloxavir marboxil, Roche) and the Parkinson's disease treatment Ongentys Cap (opicapone, SK Chemicals) have recently been submitted for approval.MFDS has notified the originator companies of the applications in accordance with Korea’s patent–approval linkage system, since the patents for these originators are registered on the Green List.This gives the originators the right to seek sales injunctions on grounds of patent infringement.Xofluza is Roche's next-generation influenza antiviral, an upgrade from Tamiflu. While Tamiflu requires a 5-day course, Xofluza offers the advantage of treatment and prevention with just a single dose, providing much improvement in terms of dosing convenience.However, since receiving domestic marketing approval in November 2019, Xofluza has not yet been listed for reimbursement and therefore is not being sold properly in the market.Meanwhile, follow-on manufacturers are eyeing the market with generics containing the same active ingredient. Last month, Kwangdong Pharmaceutical filed a passive scope confirmation trial to circumvent Xofluza’s formulation patent (a solid formulation having excellent stability).This marks the first detected application filing following the patent challenge. Should Kwangdong Pharmaceutical succeed in circumventing the formulation patent, an early launch of generics will become possible.Ongentys, which was approved the same month as Xofluza, has also been targeted by generic companies. The drug is used as adjunct therapy for Parkinson’s disease patients experiencing motor fluctuations who do not adequately respond to standard levodopa/dopa-decarboxylase inhibitor (DDCI) regimens.Ongentys was added to the reimbursement list in October last year at KRW 2,515 per capsule. Development of a generic version began less than a year after its reimbursement listing.Myung In Pharm filed a passive scope confirmation trial in May to challenge Ongentys’ composition patent (pharmaceutical composition containing a nitrocatechol derivative and its manufacturing processes).Applications filed for generic versions were detected soon after, accelerating the opening of the follow-on generic market.The market entry of generics for Xofluza and Ongentys hinges on their patents. For Xofluza, 2 substance patents are scheduled to expire in 2031 and 2036, respectively.Even if companies succeed in avoiding the formulation patent expiring in 2039 through patent challenges, the substance patents are expected to delay generic market entry by another 10 years. Therefore, analysis suggests that overcoming the substance patent barrier is necessary for generics to enter the market sooner and start sales in earnest.For Ongentys Cap, the substance patent expires in July 2026 and the use patent in October 2027. Therefore, if the composition patent expiring in 2030 is successfully avoided, a generic launch could occur within 2 years.However, it remains uncertain whether the Patent Trial and Appeal Board will rule in favor of the generic challengers.Meanwhile, another application has been filed for the generic version of Hanmi Pharmaceutical’s AmosartanQ, for which Huons earlier became the first to receive generic approval in September.Huons obtained approval for BesylsartanQ Tab, which contains an “alternative salt form” product containing the same active ingredients (amlodipine camsylate+ losartan + rosuvastatin). However, the formulation patent for AmosartanQ is expected to remain in force until November 2033, making its market launch uncertain. Huons has filed a passive claim scope confirmation trial against this patent, aiming to circumvent it.Amid this situation, another pharmaceutical company has now applied for approval of a generic version.

- Company

- ‘BMS seeks to redesign growth through open innovation’

- by Son, Hyung Min Dec 03, 2025 08:43am

- Bristol Myers Squibb (BMS) defines itself as an ‘open innovation company’ for a reason.Over 60% of the company’s global pipeline now consists of assets sourced through external collaborations, including next-generation platforms such as targeted protein degradation, cell therapy, and radiopharmaceuticals.Steve Sugino, Senior Vice President and General Manager, BMS Asia-PacificSteve Sugino, Senior Vice President and General Manager at BMS Asia-Pacific, recently stated to reporters, “Science knows no borders. BMS goes where the science is.”BMS is one of the global pharmaceutical companies most actively pursuing open innovation and mergers and acquisitions (M&A).The company had faced declining sales due to patent cliffs with the expiry of several major drug patents, including the anticoagulant Eliquis (apixaban) and the blood cancer treatment Revlimid (lenalidomide), and the entry of their generic versions. Furthermore, its global blockbuster immunotherapy drug Opdivo (nivolumab) is also nearing patent expiration.To address this, BMS has expanded its pipeline over the past five years through investments in companies like Karuna Therapeutics (USD 14 billion), RayzeBio (USD 4.1 billion), Mirati Therapeutics (USD 4.8 billion), and SystImmune (USD 8.4 billion).Through its acquisition of Karuna, BMS developed the schizophrenia drug ‘Cobenfy (xanomeline /trospium chloride). It also entered the radiopharmaceutical market by acquiring RayzeBio and plans to develop new anticancer drugs through Mirati and SystImmune.This principle is also evident in APAC. One prime example is the agreement with Orum Therapeutics in Korea.In 2023, BMS paid Orum Therapeutics USD 180 million (approximately KRW 260 billion) and successfully secured its degrader antibody conjugate (DAC) technology.Sugino stated, “Protein degradation is an area where BMS holds a strategic advantage, and Orum's technology had clear global scalability. This is a landmark case of Korean technology becoming a global standard.”Sugino also emphasized that manufacturing and supply chain (M&SC) collaboration with domestic companies is a core pillar of BMS's strategy.He explained, “Amid complex global circumstances, a stable supply chain is an essential competitive capability for global pharmaceutical companies. BMS is strengthening its global supply chain not only through its own production but also through collaborations with Samsung Biologics and Lotte Biologics. Based on the collaborations, BMS is reliably supplying innovative therapies to patients worldwide.”BMS is working to systematically implement its collaborative framework with companies in Korea. One flagship program is the ‘Seoul–BMS Innovation Square Challenge,’ which BMS has operated since 2022. Through this program, companies like Prazer Therapeutics (proteasome inhibitors), Illimis Therapeutics (Alzheimer's disease drug), and Galux (AI-driven protein design) have been selected and are growing, leveraging BMS's global network and commercialization expertise. This serves as an incubator, placing Korean biotech companies on a global growth trajectory.BMS's criteria for evaluating external collaborations are straightforward: scientific excellence, commercial potential, strong intellectual property (IP), and ideally, both first-in-class and best-in-class potential.Sugino advised, “While excellent science is adequate, companies also must further develop global commercialization capabilities. Articulating how science translates into patient value is key to partnering.Organization dedicated to APAC established… BMS's growth axis shifts to AsiaBMS's open innovation strategy and manufacturing/supply chain collaborations ultimately align with the strategic question of ‘where to create innovation and where to execute it.’Sugino stressed, “APAC, which includes Korea, is one of the most dynamic regions, with strengths across science, clinical infrastructure, manufacturing, and commercial potential. Asia’s role will only continue to grow.”This assessment is directly reflected in BMS's global reorganization. In January this year, BMS created a dedicated APAC division through a structural reorganization. Sugino explained, “This strategic realignment was made to support key markets like Korea, Japan, China, and Australia from a closer location.”He explained that this organizational change is not merely a restructuring but the result of a company-wide decision recognizing APAC as the next-generation growth engine. BMS determined that the core APAC countries—Korea, China, Japan, and India—would be the central axis after questioning ‘Where should we invest and where should we expect growth?’BMS is seeking to expand partnerships with domestic companies. Vice President Steve Sugino and BMS Korea Country Manager Hye Young Lee at the Global Open Innovation Week held last month in Seocho-gu, Seoul.APAC has already established itself as a major clinical base for BMS. BMS has set a long-term goal of securing 40% of patients enrolled in Phase III clinical trials from APAC. In fact, Korea is included as a ‘priority country’ across all phases of development, from Phase 1 to Phase 3.Sugino noted, “Korea's medical infrastructure, clinical execution capabilities, and patient accessibility are among the best globally. There is a reason Korea has become an essential region for pivotal trials.”Since 2022, BMS has acquired 8 approvals and 6 insurance reimbursement listings in Korea alone, across key therapeutic areas including solid tumors, hematologic malignancies, and rare cardiovascular diseases.Sugino assessed, “The Korean government and regulatory authorities are making significant contributions to expanding access to innovative therapies. This is an important signal that goes beyond short-term results, earning Korea the trust of global pharmaceutical companies.”However, he clearly pointed out structural challenges. The one-year introduction rate for new drugs is only 5% in Korea compared to 78% in the US, and the health insurance coverage rate is also significantly lower at 22% in Korea versus 85% in the US and 48% in Japan. The average 46-month timeframe from approval to coverage was also highlighted as a problem.Sugino emphasized, "My father also battled cancer. If he had to wait 46 months for treatment, he would have lost his chance. Innovation only matters when it reaches patients in time."Ultimately, BMS’s goal is clear: Deliver innovative therapies to patients with serious diseases faster and more widely. AI-driven R&D, open innovation, and APAC-centric strategies are simply means to achieve that goal, with Korea at the strategic core.Sugino concluded, “BMS exists to discover, develop, and deliver innovation. For these values to be properly realized, we need an environment where new therapies are approved and reimbursed in a timely manner.“Ensuring innovation reaches patients worldwide, including those in Korea, rather than remaining confined to specific countries—that is the challenge BMS must address.”