- LOGIN

- MemberShip

- 2025-12-23 19:12:32

- Company

- Competition for interleukin inhibitors heats up in Stelara

- by Kim, Jin-Gu Jun 08, 2023 05:34am

- Stelara, Cosentyx, Skyrizi, and Tremfya (clockwise from top left) The interleukin inhibitor market also grew rapidly in the first quarter. Compared to the first quarter of last year, the market size increased by 26% in one year. While Stelara, the market leader, posted sales of KRW 11.1 billion, up 9.8% YoY, generics are rapidly catching up. Skyrizi saw a 69.7% year-over-year increase in sales and Tremfya's 43.4%. In particular, as generics are scrambling to add new content and expand the scope of reimbursement, competition in this market is expected to intensify in the future. The interleukin inhibitor market increased by 26% in 1 year, and Stelara remains No. 1 in the market for 12 years According to IQVIA, a pharmaceutical market research institute on the 5th, the size of the interleukin inhibitor market in the first quarter was 36.4 billion won. Compared to 28.8 billion won in the first quarter of last year, it increased by 26.4% in one year. Interleukin inhibitors are primarily used to treat psoriasis. It is divided into the IL-17 family and the IL-23 family according to the pathway that inhibits interleukin (IL). Janssen Stellara, which is classified as a first-generation product, is a mechanism that inhibits IL-12/23. Second-generation products, Novartis Cosentyx and Lilly Taltz inhibit IL-17, while Janssen's Tremfya and AbbVie Skyrizi, two successors, inhibit IL-23. This market was formed in 2012 when Stelara was added to the health insurance coverage list. Since 2015, successor products have been added one after another, and it is growing very rapidly. The actual interleukin inhibitor market size was only 10.4 billion won in the first quarter of 2019, but it expanded 3.5 times in 4 years to 36.4 billion won in the first quarter of this year. Analysts say that while Stelara, the market leader, is in good health, generics contributed to the expansion of the market by rapidly increasing sales. Stelara recorded sales of 11.1 billion won in the first quarter of last year. It increased by 9.8% from 10.1 billion won in the first quarter of last year. However, it decreased compared to 12.4 billion won in the fourth quarter of last year, which is interpreted as a result of drug price cuts according to PVA at the end of last year. Since last November, the government has lowered the price of Stelara by 0.2-4.4% by content. 2nd-generation drugs such as Cosentyx, Tremfya, and Skyrizi, heating up competition to expand coverage. The second-generation products released following Stelara are fiercely competing as their sales have increased significantly. Tremfya, which Janssen launched as a successor to Stellara, saw a 43.4% increase in sales within a year. Sales increased from 5.8 billion won in the first quarter of last year to 8.4 billion won. Novartis Cosentyx increased by 13.3% from 7.5 billion won in the first quarter of last year to 8.5 billion won in the first quarter of this year. In particular, with the rapid growth of the competing product Tremfya, the gap between the two products narrowed from 1.7 billion won to 100 million won in one year. AbbVie's Skyrizi, which was the latest to enter the market, is seeing the steepest growth in sales. Skyrizi's sales in the first quarter of last year were 5.9 billion won, up 69.7% from 3.5 billion won in the first quarter of last year. AbbVie launched this product in the second quarter of 2020. Cosentyx, Trempier, and Skyrizi are scrambling to expand their ranges, foreseeing even fiercer competition in the future. For Cosentyx, the high-dose product, which was newly approved in November last year, was additionally applied as a benefit from last month. In addition to the existing 150mg dose, up to 300mg dose is applied as compensation, aiming to expand sales. Tremfya has been covered for palmar and plantar pustulosis since this month. Skyrizi's benefit was expanded in March. Previously, benefits were recognized only for psoriasis, but from March, benefits were applied to active and progressive psoriatic arthritis. Lilly Taltz saw a modest increase in sales from 1.8 billion won in the first quarter of last year to 2.4 billion won in the first quarter of this year.

- Company

- K-Bio appealed for its competitiveness in Bio USA

- by Hwang, Jin-joon Jun 08, 2023 05:33am

- Major domestic pharmaceutical bio companies participated in the '2023 Bio International Convention (Bio USA)', a global partnering event, and introduced their competitiveness. Samsung Biologics disclosed an advanced target operation time for Plant 5 and a plan to build an ADC-only production plant. Lotte Biologics has sought to win biopharmaceutical CMO contracts with major pharmaceutical bio companies at home and abroad. Celltrion's goal to participate in the event was to increase its brand value through strengthening partnering. We discovered partners and held discussions related to new drug development. Bridge Biotherapeutics, Onconic Therapeutics, Inventage Lab, Abion, Vigencell, and Genome & Company announced the competitiveness of their new drug development pipelines. According to the industry on the 7th, major domestic pharmaceutical bio companies participate in Bio USA and introduce their competitiveness. Bio USA was held in Boston, USA on the 5th (local time). It will be open until the 8th. BioUSA is a global event in the biofield held every year by the American Bio Association. About 15,000 biopharmaceutical companies will attend, display new technologies and biotechnology products, and hold business meetings. According to the American Bio Association, 289 major domestic pharmaceutical bio companies participated in Bio USA this year. Of these, 41 opened publicity booths. Samsung Biologics CEO John Rim announced that BioUSA would shorten the target operating period for Plant 5 from September 2025 to April of the same year. It is expected to advance construction by about a year compared to the 180,000-liter third plant of the same size. According to Samsung Biologics, the early operation of Plant 5 is a strategy to preemptively respond to growing CDMO demand. In addition, the fact that new contracts with customers and the volume of existing agreements are increasing also influenced the decision to operate early. Starting with the 5th factory's construction, the 2nd Bio Campus will begin in earnest. Additional production facilities and an open innovation center will be built on the 2nd Bio Campus. The total investment is 7.5 trillion won. CEO John Rim also announced that he would build a production facility exclusively for ADC biopharmaceuticals to participate in the ADC market, which has recently attracted attention. Considering the market growth potential, it plans to start production of ADC commercial products within 2024. Lotte Biologics promoted the Syracuse plant's manufacturing technology, process development service, and quality system. It also revealed plans to build a large-scale factory in Korea by 2030 by spending 3 trillion won. Lotte Biologics prepared a meeting table and a private meeting room inside the booth. We discuss partnering for biopharmaceutical CMOs with about 30 major domestic and foreign pharmaceutical companies and bio companies that have been coordinated in advance. Celltrion participated in Bio USA and set up a promotional booth. (Photo by Celltrion) Celltrion and other bio companies engaged in the development of new drugs have also started to discover partners and introduce pipelines. Celltrion promoted its technological competitiveness and brand to leap forward as a new drug development company. An open meeting space and a private meeting room were set up inside the booth to discuss business. Potential partners were also explored to discover new modalities and new drug candidates. In the future, discussions for joint development are also planned. An official from Bridge Biotherapeutics introduces their new drug pipeline. (Photo by Bridge Bio) Bridge Biotherapeutics presented its corporate competitiveness and pipeline to industry officials. Business Development Director Pavel Princeev introduced major clinical challenges in the field of lung cancer and fibrosis, which the company is strategically focusing on. The fourth-generation lung cancer drug candidate 'BBT-176' phase 1 clinical trial data and self-discovered BBT-207 were shared. Innovative diagnosis technology recently acquired was also disclosed. Onconic Therapeutics sought additional technology transfer for its major pipeline P-CAB-type gastroesophageal reflux disease drug candidate 'Zastaprazan'. In addition, it introduced follow-up pipelines such as 'OCN-201', a dual inhibitor target anti-cancer drug. We plan to discuss building partnerships with domestic and foreign pharmaceutical bio companies. Inventage Lab introduced pipelines 'IVL3001' and 'IVL3002' using the long-acting injectable platform technology 'IVL-Drug Fluidics'. Data on the Alzheimer's treatment candidate 'IVL3003', drug/alcohol addiction candidate 'IVL3004', and prostate cancer treatment candidates 'IVL3008' and 'IVL3016' were also announced. It also presented a blueprint to enter the lipid nanoparticle (LNP) CDMO business based on the gene therapy development platform technology 'IVL-Genefluidic'. Abion promoted the technology transfer of 'ABN401', a c-MET treatment for non-small cell lung cancer, which is undergoing global phase 2 clinical trials, and 'ABN501', a candidate material in the non-clinical stage. Participating in K-Bio Showcase, a side event of Bio USA, introduces the representative pipeline to global investors and industry officials. Genome & Company will unveil its microbiome immuno-oncology treatment pipeline. Through more than 20 meetings, it has started strengthening business partnerships with domestic and foreign pharmaceutical companies. We introduce the development status of GEN-001', a major pipeline, and new target immuno-anticancer drug candidates GENA-104 and GENA-111. In addition to technology transfer, meetings related to joint development will be held.

- Company

- Commercialization of 3rd new P-CAB drug near

- by Kim, Jin-Gu Jun 08, 2023 05:33am

- The launch of the third product is imminent in the P-CAB (potassium competitive acid blocker) class gastroesophageal reflux disease treatment market that has grown to post sales of KRW 140 billion a year. With Onconic Therapeutics, a new drug development subsidiary of Jeil Pharmaceutical, filing an application for the marketing authorization approval of Zastaprazan, competition between this drug and the existing K-Cab (tegoprazan) and Fexclue (fexuprazan) is expected to intensify from next year at the earliest, triggering a 3-way race. The industry predicts that competition for indications between the three drugs will intensify along with the approval of Zastaprazan. P-CAB market nears sales of KRW 150 billion a year... 3rd drug applies for approval According to the pharmaceutical industry on the 7th, Onconic Therapeutics submitted a new drug application (NDA) for Zastaprazan to the Ministry of Food and Drug Safety. The company predicts the product will be approved next year. Therefore, the competition between drugs in this class could develop into a three-way race with HK Inno.n’s K-Cab and Daewoong Pharmaceutical’s Fexclue from next year at the earliest, P-CAB drugs have been showing explosive growth n the gastroesophageal reflux disease treatment market. According to UBIST, a pharmaceutical market research institute, outpatient prescriptions of P-CAB drugs in Korea last year recorded KRW 144.9 billion. This market was formed when HK Inno.N released K-Cab in Q1 2019. K-Cab, which posed KRW 30.4 billion in prescriptions that year, surpassed the KRW 100 billion mark in 2021, just 2 years later. Last year, the market expanded further with the addition of Daewoong Pharmaceutical’s Fexclue. Daewoong Pharmaceutical released the product in Q3 last year and recorded KRW 12.9 billion in prescriptions in the half year. In Q1 this year, K-Cab recorded KRW 35.7 billion and Fexclue recorded KRW 10.8 billion, respectively. If this trend continues, the market will expand to exceed KRW 150 billion by the end of the year. Quarterly sales of K-Cab and Fexclue (Unit: KRW 100 million, Data: UBIST) The industry predicts the P-CAB- market to continue its growth for a while even after Onconic's new product is added to the market. The expectations are that Zastaprazan’s sales will grow not by stealing the market share of K-Cab or Fexclue, but by replacing existing PPI (Proton Pump Inhibitor) drugs. K-Cab showed a 15% increase in prescriptions compared to the previous year, despite the rapid growth of Fexclue in Q1 this year. On the other hand, most of the PPI drugs show slower sales performance. Hanmi Pharmaceutical’s Esomezol (S-omeprazole), a representative PPI-type drug, recorded KRW 15.4 in prescriptions, up 5% from the previous year, and Nexium (esomeprazole) recorded KRW 8.7 billion, up 4% from the previous year. This is in contrast to the double-digit growth the drugs had made every year until the introduction of P-CAB drugs. The analysis is that P-CAB drugs replace existing PPI drugs with advantages such as faster drug expression and intake independent of meals. Competition to expand indications intensify… Zastaprazan plans to add gastric ulcer indication after erosive esophagitis The pharmaceutical industry predicts that the 3 drugs, including Zastaprazan, to compete more fiercely to expand their indications. Onconic plans to first receive approval as a treatment for erosive gastroesophageal reflux disease and then add indications for gastric ulcers. Onconic started a Phase III trial for gastric ulcer patients in May last year. An official from Onconic Therapeutics explained, “Clinical trials are underway to add indications to Zastaprazan.” Major indication extensions plans of P-CAB class drugs Currently, K-Cab has 5 indications: ▲erosive gastroesophageal reflux disease ▲non-erosive gastroesophageal reflux disease ▲gastric ulcer ▲antibiotic combination therapy for eradication of Helicobacter pylori ▲maintenance therapy after treatment of erosive gastroesophageal reflux disease (25mg). In addition, Phase III trials are underway as a preventive treatment for non-steroidal anti-inflammatory drug-induced gastric and duodenal ulcers. After first receiving approval as a ‘treatment for erosive gastroesophageal reflux disease', Fexuclue added an indication for 'improvement of gastric mucosal lesions in acute/chronic gastritis (10mg)'. Daewoong plans to secure 3 more indications for Fexuclu in the future. Phase III trials are already underway for the drug’s use as a 'maintenance treatment after treatment of erosive gastroesophageal reflux disease' and 'prevention of non-steroidal anti-inflammatory drug-induced gastric ulcer.’ In addition, the company plans to enter into clinical trials related to the eradication of Helicobacter pylori.

- Company

- Yuhan presents 4 studies at ASCO...builds reliability

- by Jung, Sae-Im Jun 08, 2023 05:33am

- Yuhan Corp’s EGFR-targeting anticancer drug ‘Leclaza’ has started to accumulate data for the international stage. At the ‘2023 ASCO Annual Meeting (ASCO 2023)’ that was held on the 2nd (local time), Yuhan Corp made 4 poster presentations on studies related to its Leclaza, including one long-term follow-up study. With the results of Janssen’s main MARIPOSA study expected to be released in the second half of this year, initial research results that give a glimpse of the MARIPOSA study have also been updated. Leclaza is a treatment for non-small-cell lung cancer that was approved as the 31st homegrown novel drug in January 2021. It is a 3rd generation EGFR TKI that inhibits the proliferation and growth of lung cancer cells. It is currently approved as a treatment for patients with locally advanced or metastatic NSCLC who developed resistance after being previously treated with 1st generation or 2nd generation EGFR-TKIs. The drug had raised KRW 25 billion in sales in only 2 years of release. The company is also awaiting to add a first-line indication to the drug. Supported by such domestic growth, the company seeks to further its presence with Leclaza in the global market. Janssen, which introduced Leclaza’s technology, is developing it as a combination therapy with Rybrevant, its EGFR bispecific antibody treatment. The results of the MARIPOSA Phase III study, which looks at the drug’s effect of combination therapy in the first line, are expected to be announced soon. Research data that provide a glimpse into the brain metastasis effect of Leclaza and the efficacy of Leclaza as a combination therapy were presented at this year’s ASCO. First, the long-term follow-up results of the Phase I CHRYSALIS trial, which used EGFR exon 20 mutation treatment Rybrevant with Leclaza in EGFR-mutated NSCLC, were presented as a poster. The CHRYSALIS trial was the first study to evaluate the efficacy of Rybrevant + Leclaza as a first-line treatment. Long-term follow-up of Leclaza+Rybrevan combo (Data: ASCO) After following 20 patients for 33.6 months, results showed that half of the patients were able to achieve progression-free survival. At that time point, key indicators such as overall survival, progression-free survival, and duration of response had not yet reached median values. Following the poster presentation, an oral presentation on the Cohort D data of the CHRYSALIS-2 study, which evaluated the safety of Leclaza + Rybrevant therapy or Leclaza monotherapy after treatment with Tagrisso, was made at the meeting. The presented data were the results of the additional analysis conducted on biomarkers from the data that had been announced in 2021. Subanalysis of Leclaza+Rybrevant combo according to presence of MET mutations (Data: ASCO) The effect of combination therapy was significantly higher in the MET expression group. The objective response rate (ORR) of the combination therapy in patients with MET mutations and amplification (28 patients) was 61%, which was higher than 14% in the MET-negative patient group (49 patients). The median duration of response and median progression-free survival were 10.8 months and 12.2 months in the MET-positive group, respectively, compared to 6.8 months and 4.2 months in the MET-negative patient group. A domestic phase 2 study that measured the effect of Leclaza in patients with brain metastasis after failure with existing first- and second-generation targeted anticancer drugs in EGFR-positive non-small cell lung cancer was also presented as a poster. 40 EGFR-positive patients with brain metastases after using first- and second-generation treatments were enrolled in the study to evaluate the intracranial activity of Leclaza in patients with asymptomatic or mild brain metastasis. Patients who failed with conventional treatment were divided according to the presence or absence of the T790M mutation. The primary evaluation index was intracranial objective response rate (iORR), and the secondary evaluation index was intracranial progression-free survival (iPFS). The intracranial objective response rate of 38 evaluable patients was 55.3%. 3 patients showed a complete response and 18 patients showed a partial response. There were only 5 T790M-positive patients, but 4 showed partial response, recording an intracranial response rate of 80%. Of the 33 T790M-negative patients, 3 showed complete responses and 14 partial responses, recording an objective response rate of 51.5%. The median overall progression-free survival and the progression-free survival in the T790M positive and negative groups were 15.2 months, 9.9 months, and 15.4 months, respectively. Intracranial progression-free survival was similar for T790M positive and negative patients, 15.2 months and 15.8 months, respectively. The research team said, “Leclaza showed significant intracranial activity regardless of the presence or absence of T790M mutation, and satisfied the primary evaluation index with an intracranial objective response rate of 55.3%." This indicates that patients that showed brain metastasis after treatment with targeted therapies may use lazertinib instead of topical treatment." In addition to this, studies that studied predictable biomarkers for the use of Rybrevant + Leclaza after Tagrisso were also announced at ASCO 2023.

- Company

- Novartis counterattacks against Celltrion / a patent lawsuit

- by Kim, Jin-Gu Jun 07, 2023 09:47pm

- Novartis is investigating Celltrion for patent infringement of its biosimilar Xolair, asthma, and urticaria treatment. According to the pharmaceutical industry on the 2nd, Novartis filed two claims against Celltrion on the 1st. A proactive trial to confirm the scope of rights is to ask the Intellectual Property Trial and Appeals Board to accurately determine the scope of patent validity to see if the patent holder has been infringed. This case is interpreted as a situation in which Novartis is claiming Celltrion's patent infringement. In other words, Celltrion is claiming that the Xolair biosimilar, which is being developed, has infringed on two pharmaceutical patents it owns. Xolaire's material patent has already expired, and only the formulation patent remains. In Korea, the formulation patent expires in March 2024. Celltrion is developing 'CT-P39' as a Xolair biosimilar. It is evaluated that it is close to commercialization, such as announcing the interim results of the global phase 3 clinical trial in April. It has already applied for product approval in Europe and plans to apply for approval within the year in Korea. Analysts say that if the Intellectual Property Trial and Appeals Board upholds Novartis, the original company, in an active trial to confirm the scope of rights, setbacks in Celltrion's plan to release the Xolair biosimilar in Korea are inevitable. Xolair is a biopharmaceutical developed by Genentech and Novartis. It is used to treat allergic asthma, chronic urticaria, and chronic rhinosinusitis. According to IQVIA, a pharmaceutical market research institute, Xolair's domestic sales in the first quarter were 4.6 billion won. It increased by 34% from 3.4 billion won in the first quarter of last year. Last year, it posted sales of 15.7 billion won in Korea.

- Company

- Kwangdong wins patent lawsuit against Ibrance in reverse

- by Kim, Jin-Gu Jun 07, 2023 05:38am

- Ibrance As Kwangdong Pharmaceutical succeeded in reversing the second trial of the patent lawsuit against Ibrance, it boarded the last train for generic exclusivity. As a result, Ibrance's generic for exclusivity is owned by three companies, including Daewoong Pharmaceutical and Shinpoong Pharmaceutical, which won in the first trial, and Kwangdong Pharmaceutical. According to the pharmaceutical industry on the 3rd, the Patent Court ruled in favor of the plaintiff on the 2nd in the patent trial cancellation lawsuit filed by Kwangdong Pharmaceutical against Pfizer. Kwangdong Pharmaceutical, which was defeated in the first trial, succeeded in reversing in the second trial. A total of five companies have challenged the Ibrance patent. These are Kwangdong Pharmaceutical, Shinpoong Pharmaceutical, Daewoong Pharmaceutical, Boryung, and Samyang Holdings. They requested a passive trial to confirm the scope of rights to the Ibrance crystalline patent, which expires in February 2034. Their plan was to avoid crystalline patents and release generics early in time for substance patents to expire in 2027. In the first trial, the decision was mixed. The Intellectual Property Trial and Appeal Board rendered a victory decision for Daewoong Pharmaceutical and Shinpoong Pharmaceutical, and a defeat decision for Kwangdong Pharmaceutical, Boryung, and Samyang Holdings. With the first trial victory, Daewoong Pharmaceutical and Shinpoong Pharmaceutical acquired Ibrance generic for exclusivity. Kwangdong Pharmaceutical, Boryung, and Samyang Holdings, which lost in the first trial, appealed to the Patent Court. Among the three companies, the ruling of Kwangdong Pharmaceutical came out first. Kwangdong Pharmaceutical barely succeeded in obtaining generic exclusivity through a second trial victory. This is because the period for acquiring generic for exclusivity was about to expire. According to the current regulations, there are three requirements to receive generic for exclusivity. A patent trial must be requested for the first time, this trial or subsequent litigation must be won, and a generic license must be applied for the first time. At this time, one proviso clause is attached to the requirement that the judgment and lawsuit be won. The point is that a generic company must apply for generic exclusivity to the Ministry of Food and Drug Safety and obtain a winning trial decision or ruling within nine months from the date the original company is notified of this fact. Kwangdong Pharmaceutical applied for a generic for the exclusivity of Ibrance on August 29 last year. In early September, it is expected that this fact will be notified to Pfizer. In other words, if Kwangdong Pharmaceutical did not win the case by early this month, even generic for exclusivity would be useless. As Kwangdong Pharmaceutical's second trial proceeded quickly, it succeeded in winning the case in early June, and generic exclusivity was eventually made possible. Kwangdong Pharmaceutical is the only company that has even obtained product approval among patent challengers. Kwangdong Pharmaceutical received approval for Alency as a generic version of Ibrance in March of this year. On the other hand, it is analyzed that Boryung and Samyang Holdings, which appealed in the second trial along with Kwangdong Pharm, are highly unlikely to receive generic for exclusivity. The hearing date for Boryung and Samyang Holdings was set for July. Ibrance is a hormone receptor (HR) positive or human epidermal growth factor receptor 2 (HER2) negative treatment for advanced and metastatic breast cancer. According to IQVIA, a pharmaceutical market research institute, Ibrance posted sales of 56.2 billion won in Korea last year. In the first quarter of this year, it was 12.6 billion won, down 13% from the same period last year.

- Company

- Sales of anti-cancer drug 'Taxol' increases by 53%

- by Kim, Jin-Gu Jun 07, 2023 05:38am

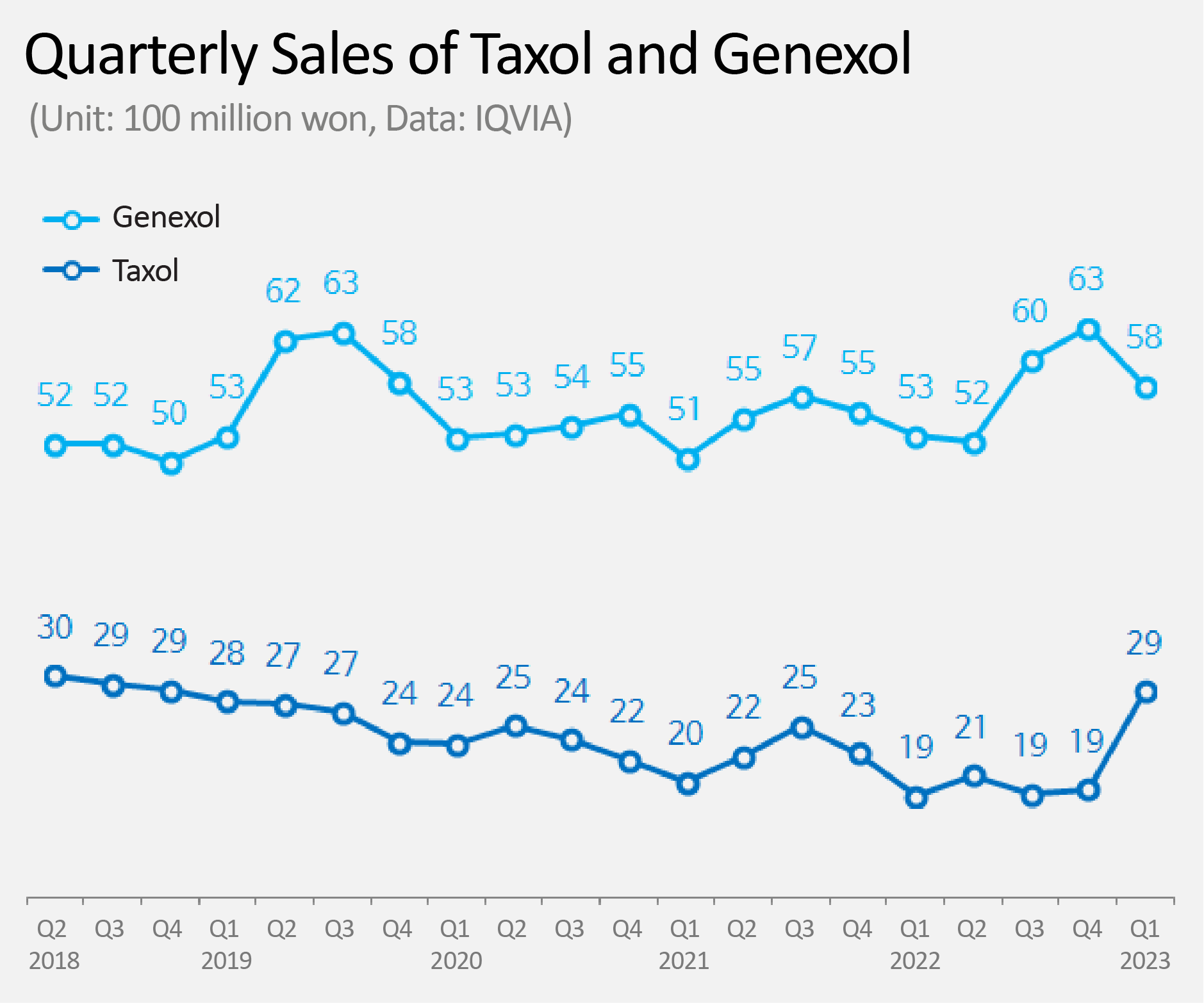

- Product Photos of Taxol (LT) and Genexol (RT) Sales of the original Paclitaxel anti-cancer drug 'Taxol' increased 53% in one year. This change has seemed to have occurred as Boryung took over domestic sales from the beginning of this year. According to IQVIA, a pharmaceutical market research institute, on the 2nd, Taxol's sales in the first quarter was KRW 2.9 billion. This is a 53% increase from KRW 1.9 billion in the first quarter of last year. Taxol is a paclitaxel-based cytotoxic anti-cancer drug, and is widely used in various types of cancer such as ovarian cancer, breast cancer, lung cancer, and stomach cancer. Despite having been nearly 30 years since it was approved in Korea in 1996, and is still widely used. Until last year, sales of Taxol had been on a steady decline. The downhill started in the second quarter of 2018 from KRW 3 billion, declining to KRW 1.9 billion in quarterly sales last year. The pharmaceutical industry cites Boryung as the reason for Taxol's successful rebound. Boryung has been in charge of sales of Taxol since the first quarter of this year. It is analyzed that Boryung brought rebound in sales of Taxol through its already-established solid sales grounds in the field of anti-cancer drugs. Quarterly Sales of Taxol and Genexol (Unit: 100m million won, Data: IQVIA) Boryung's past actions are quite interesting. From 2008 to 2015, Boryung jointly sold Taxol with BMS for 8 years. From 2016 up to last year, Boryung jointly sold Genexol, a competing product of Taxol, with Samyang Holdings (formerly Samyang Biopharmaceuticals Corp.). From this year onwards, Boryung has taken charge of the sales of Taxol again. While Boryung was in charge of sales of Genexol, Genexol surpassed its original product Taxol and rose to no.1 in the market. For Boryung, a situation unfolded in which it now has to compete with the product that it had put on the top of the market. Genexol, which was previously sold by Boryung, is now being sold by HK inno.N from this year. Genexol's first quarter sales were KRW 5.8 billion, which is a 9% increase from the first quarter of last year, KRW 5.3 billion. HK inno.N has jointly sold Genexol from 2001, when Samyang Holdings first developed the product as a generic Paclitaxel drug, to 2013. The joint sales agreement reunited the two companies after 10 years. The pharmaceutical industry's attention is focused on whether Boryung, which has again taken charge of the sales of Taxol, will be able to catch up with Genexol by maintaining the same upward trend as in the first quarter. For HK inno.N and Samyang Holdings, on the other hand, the key is how firmly they maintain the market share of Genexol.

- Company

- Pfizer's ADC Mylotarg can be prescribed by Big 5

- by Eo, Yun-Ho Jun 07, 2023 05:38am

- Pfizer's new ADC drug, Mylotarg, has settled in a Big 5 general hospital. According to the related industry, Pfizer Korea's acute myeloid leukemia (AML) Mylotarg is a drug for medical institutions such as SMC, SNUH, Seoul St. Mary's Hospital, AMC, Shinchon Severance Hospital, as well as advanced general hospitals such as the National Cancer Center and Hwasun Chonnam National University Hospital. passed the committee. Mylotarg is an antibody-drug conjugate that can be used for the first-line treatment of adult patients with newly diagnosed CD33-positive AML. However, Mylotarg has not yet received insurance benefits. This drug was presented to HIRA in May of last year, but it was judged that the reimbursement standard was not set. Mylotarg, which was approved in Korea in December 2021, is an ADC composed of a CD33-targeting monoclonal antibody and a cytotoxic drug, calicheamicin, and acts on cells expressing the CD33 antigen, which is seen in 90% of all AML patients. This blocks cancer cell growth and induces apoptosis. The approval of Mylotarg was based on a clinical study conducted on 271 newly diagnosed AML patients with no treatment experience before the age of 50 to 70 years. The clinical trial was an open-label, randomized, multicenter phase 3 clinical trial for ALFA-0701. The existing anticancer chemotherapy, daunorubicin or cytarabine combination therapy, and Mylotarg, daunorubicin, and Cytarabine combination therapy were compared and evaluated. As a result, the Milotac + Daunorubicin + Cytarabine combination administration group had a median event-free survival (EFS) of 17.3 months, which was about 7.8 months longer than the Daunorubicin + Cytarabine combination administration group's 9.5 months. seemed It reduced the risk of induction failure, relapse, or death by approximately 44%. The median relapse-free survival (RFS) was 28.0 months for the Milotac + Daunorubicin + Cytarabine combination group and 11.4 months for the Daunorubicin + Cytarabine combination group, showing a significant difference of about 16.6 months. The median overall survival was 27.5 months for the Mylotarg + Daunorubicin + Cytarabine combination group and 21.8 months for the Daunorubicin + Cytarabine combination group, showing no statistically significant difference.

- Company

- 'Saxenda' continues to dominate weight-loss market

- by Kim, Jin-Gu Jun 07, 2023 05:38am

- Product Photos of Saxenda (LT) and Qsymia (RT) 'Saxenda (Liraglutide)' is further strengthening its dominance in the obesity treatment market. In the first quarter, it recorded sales of KRW 15.9 billion, 53% increase from the previous year, more than doubling the gap with the runner-up product, 'Qsymia (Phentermine+Topiramate).' However, it remains to be seen how much longer Saxenda's dominance will last, as release of promising products such as 'Wegovy (Semaglutide)' and 'Mounjaro (Tirzepatide)' are imminent in the obesity treatment market. The pharmaceutical industry predicts that the two products which have proven their marketability in the global market will be released in Korea as early as this year. Saxenda grows 53% in 1 year... more than doubles the gap with Qsymia According to IQVIA, a pharmaceutical market research institute, on the 5th, Novo Nordisk's Saxenda recorded sales of KRW 15.9 billion in the first quarter. This is a 53% increase in 1 year, compared to KRW 10.4 billion in the first quarter of 2022. Saxenda is the world's first obesity treatment approved as a glucagon-like peptide-1 (GLP-1) analog. It has the same ingredients as the type-2 diabetes treatment 'Victoza,' but with different usage and dosage. Saxenda has grown rapidly since its domestic release in the second quarter of 2018. In 2019, the second year after its release, Saxenda dominated the obesity treatment market with sales of KRW 42.6 billion. Saxenda, unlike existing obesity treatments, is not a psychotropic drug, and therefore gained explosive popularity because it is relatively safe and can be taken over a long period. The sales of Saxenda have somewhat slowed down due to the impact of COVID-19 in 2020 and 2021. However, as outdoor activities have become revitalized again from last year, demand for obesity treatments regained its place, and Saxenda's sales soared up to KRW 58.9 billion. Quarterly Sales of Saxenda and Qsymia (Unit: 100 million won, Data: IQVIA) Qsymia, the runner-up product in the market, marked sales of KRW 7.7 billion in the first quarter. Compared to KRW 6.3 billion in the first quarter of last year, sales has increased by 21%. It is analyzed that Qsymia was also affected by the recovery of the obesity treatment market. Qsymia is a combination drug of 'Phentermine' and 'Topiramate,' which Alvogen Korea secured domestic sales right from the US pharmaceutical company Vivus in 2017. Alvogen Korea started domestic sales with Chong Kun Dang at the end of 2019. In addition to the advantage that the content of psychotropic ingredient is relatively low even though it is an oral drug, Chong Kun Dang's sales power generated synergy and quickly penetrated the market despite being a latecomer. However, the gap with Saxenda has widened. Although Qsymia chased Saxenda's sales up to about 90% with KRW 5.9 billion in the first quarter of 2021, the gap is widening again as the obesity treatment market is recovering. In the first quarter of this year, the gap between to two products widened by 2.4 times. Some in the pharmaceutical industry predicts that the gap between the two products will widen further in the future. This is because obesity treatments containing Phentermine and Phendimetrazine, including Qsymia, were included in the 'list of narcotics and drugs of concern for misuse and abuse' as the non-face-to-face treatment pilot project was implemented. The government urged caution in prescibing psychotropic drugs such as Qsymia through non-face-to-face treatment. Saxenda has not been included in the list. In addition, treatments such as Daewoong Pharmaceutical's Dietamin, Korea Prime Pharm's Phendimen, Huons's Hutermin, etc. recorded sales of more than KRW 1 billion in the first quarter. In case of Phendimen, its sales, which recorded just KRW 300 million in the first quarter of last year, increased about 6 times to KRW 1.8 billion in one year, showing remarkable growth. Wegovy and Mounjaro's impending release... Saxenda's domination coming to an end It remains to be seen how much longer Saxenda's dominance will last. Two mega-sized products that have proven their competitiveness in the global market are waiting to be released. In the pharmaceutical industry, the prevailing view is that Saxenda's dominance will come to an end with the advent of next-generation products such as Wegovy and Mounjaro. Product Photos of Wegovy (LT) and Mounjaro (RT) In April, the Ministry of Food and Drug Safety approved Novo Nordisk's Wegovy. Wegovy is a GLP-1 analog, just like Saxenda. Novo Nordisk improved its Saxenda, which was administered daily, to weekly administration. In the US market, in which Wegovy was released earlier, demand for the product soared, with shortages occurring. In particular, due to its popularity, shortage of Ozempic, a diabetes treatment with the same ingredients and usage, has also occurred. Even now, there is still a lack of supply of Wegovy in the US. Due to the circumstances, the official release of Wegovy is being delayed in Korea even after product approval. The pharmaceutical industry predicts that domestic supply will be possible at the end of this year or early next year. The domestic release of Eli Lilly's Mounjaro, which is considered a strong competitor of Wegovy, is also imminent. The Ministry of Food and Drug Safety recently completed a safety and efficacy review on Mounjaro. Completing the review means that the product approval process will soon begin. Mounjaro is a GLP-1 analog, just like Saxenda and Wegovy. After obtaining approval as a type-2 diabetes treatment, Lilly is trying to expand its indications for obesity. In the case of the Mounjaro, in addition to the mechanism acting on the GLP-1 analog, its mechanism also acts on the glucose-dependent insulinotropic polypeptide (GIP). Due to this, Mounjaro's weight loss effect was better than that of Wegovy in each drugs' clinical trials. Lilly also entered a phase 3 clinical trial comparing the effects of Mounjaro and Wegovy on a one-to-one basis.

- Company

- Interleukin inhibitors Cosentyx·Tremfya busy extending reim

- by Eo, Yun-Ho Jun 05, 2023 05:37am

- News of reimbursement extensions granted for interleukin inhibitors is continuing in Korea. According to industry sources, the scope of reimbursement for Novartis Korea's IL-17A inhibitor 'Cosentyx UnoReady Pen' 300mg/2mL, and Janssen Korea's IL-23 inhibitor ‘Tremfya (guselkumab)' have been extended since last month, and the 1st of this month, respectively. As with the other doses of Cosentyx, its 300mg dose can also be prescribed to patients with moderate-to-severe plaque psoriasis, active and psoriatic arthritis (PsA), adults with active ankylosing spondylitis (AS), adults with severe ankylosing spondylitis, etc. In Korea, Cosentyx is reimbursed for patients with chronic severe plaque psoriasis that lasts for more than 6 months, and ▲10% of the total skin area has been affected, ▲has a PASI 10 or higher, ▲has shown no response to methotrexate (MTX) or cyclosporine when administered for more than 3 months or cannot continue treatment due to side effects, or ▲has shown no response to PUVA or UVB therapy when treated for more than 3 months or cannot continue treatment due to side effects. The reimbursement approval was made based on the MATURE trial. The trial results showed that 95.1%/75.6%/43.9% of patients that received Cosentyx 30mg reached PASI 75/90/100 each, and demonstrated better efficacy over its placebo. In the case of Tremfya, the drug will be granted reimbursement for palmoplantar pustulosis from this month. Under the new reimbursement standards, the drug may be used with insurance benefits from June 1st in patients aged 18 and older with moderate-to-severe palmoplantar pustulosis, ▲whose PPPASI is 12 or higher and has shown no response to therapeutic doses of acitretin, methotrexate, or cyclosporin when administered for more than 3 months or cannot continue treatment due to side effects, or ▲who has shown no response to phototherapy when treated for more than 3 months or cannot continue treatment due to side effects. Palmoplantar pustulosis is characterized by pustular blisters accompanied by erythema on the skin of the palms and soles that turn into brown scales, and then become dry, thick, and cracked. When the condition persists, the patient’s nails may be deformed and even fall out. The condition interferes with the patient's daily life because the condition causes severe itching and pain. As it is difficult to distinguish palmoplantar pustulosis from other skin diseases such as fungal infections, accurate differential analysis between the two is necessary. Cosentyx 300mg was approved on November 1st, 2022 to treat ▲plaque psoriasis patients and ▲psoriatic arthritis (PsA) patients who have accompanying moderate-to-severe plaque psoriasis or have not adequately responded to an anti-TNAα treatment before. Meanwhile, Tremfya was approved as a treatment for adult patients with plague psoriasis in April 2018 and as a treatment for adult patients with palmoplantar pustulosis in May 2019, and the indications applied for insurance benefit in September 2018 and May 2021 respectively.