- LOGIN

- MemberShip

- 2025-12-21 14:56:00

- Company

- SK Bioscience will start a global trial for its mRNA vaccine

- by Cha, Jihyun Feb 26, 2025 06:29am

- SK Bioscience's messenger ribonucleic acid (mRNA) vaccine has entered full-scale clinical trials. SK Bioscience announced on the 25th that it has begun Phase I/II global clinical trials of GBP560, a Japanese encephalitis mRNA vaccine candidate. The Phase I/II clinical trial will involve 402 healthy adults living in Australia and New Zealand. It will be conducted to evaluate the immunogenicity and safety of the vaccine after vaccination. In the first stage, the tolerability and immunogenicity of the subjects will be checked after administering low, medium, high, or control doses twice at 28-day intervals. In the second stage, the dosage and administration method will be set based on the results of the first stage, and the immunogenicity and safety will be evaluated by comparing it with the control group. SK Bioscience plans to secure interim results from the GBP 560 Phase I/II clinical trial next year. Previously, SK Bioscience confirmed the safety and immunogenicity of the candidate substance through repeated dose toxicity tests, safety pharmacology tests, animal efficacy tests, and immune-mediated attack tests in the GBP 560 non-clinical trial. The development of the Japanese encephalitis vaccine is part of the '100-day Mission' project to prepare for the next pandemic, which SK Bioscience is conducting with international organizations to establish an mRNA vaccine platform. The 100-day Mission aims to develop and mass-produce a vaccine within 100 days of the outbreak of an unknown infectious disease (Disease-X) to respond to the pandemic within 100 days. SK Bioscience signed an agreement with the Coalition for Epidemic Preparedness Innovations (CEPI) in 2022 to receive an initial research and development grant of USD 40 million and launched the project. When it enters the later development stage, CEPI will provide SK Bioscience with up to an additional USD 100 million. Through this project, SK Bioscience aims to secure mRNA vaccine platform technology that can respond to pandemics and various diseases, and establish a new pipeline to gain global competitiveness. Jae-Yong Ahn, President and Chief Executive Officer of SK Bioscience, said, “If the technology is expanded with the mRNA platform, we will be able to respond quickly to unknown diseases and ensure fair access to vaccines and sufficient supply. We will conduct clinical trials successfully to contribute to global public health and solidify our position as a vaccine R&D leader.”

- Company

- Celltrion tops KRW 1T in 2024 sales

- by Chon, Seung-Hyun Feb 26, 2025 06:29am

- Celltrion's sales and operating profit are reported to be the highest in history due to expanded sales of biosimilars. Its sales exceeded KRW 1 trillion in both North American and European markets. According to the Financial Supervisory Service (FSS), Celltrion's operating profit for last year was KRW 1.2110 trillion, up 89.7% from the previous year. The sales amounted to KRW 3.7092 trillion, up 98.0%. Both sales and operating profit are the largest in history. The company explained, "Existing products, including Remsima, Truxima, and Herzuma, have shown stable growth, and new products, including Remsima SC, Yuflyma, and Vegzelma, have generated a record high annual sales." Celltrion recorded KRW 1.0636 trillion in Q4 sales, up 178.0% Year-over-Year (YoY). The company's quarterly sales exceeded KRW 1 trillion for the first time. Celltrion's biological drug sales last year in both the North American market and the European market topped KRW 1 trillion for the first time. Celltrion Celltrion's sales of biological drugs in the North American market reached KRW 1.0453 trillion, a 66.1% increase from the previous year. Inflectra showed steady performance, and Truxima, Yuflyma, Zymfentra, and Vegzelma also showed sales growth. Biological drug sales in the European market increased from KRW 986 billion in 2023 to KRW 1.5468 trillion last year, an expansion of 56.9%. As the expansion of new drug sales accelerated, sales rose significantly. Annual sales of the intravenous (IV) formulation Remsima, a biosimilar to Remicade, alone exceeded KRW 1 trillion for the first time in history. According to market research firm IQVIA, Remsima's European market share is reported to be 62% as of Q3 of last year. Including Remsima SC, it showed high market share in major European countries: 88.8% in the U.K., 80% in France, 75.8% in Spain, and 73.8% in Germany. Guided by a pharmacy benefit manager (PBM), Remsima SC, sold as a new drug in the United States, has been listed on approximately 90% of formularies in the U.S. insurance market, and the production continues to increase significantly. Truxima, a biosimilar to the anticancer drug MabThera, is recording a market share of 30% range in Europe and the United States. Herzuma, a biosimilar to anticancer drug Herceptin, shows market share of 72% in Japan. Biosimilar version of autoimmune diseases treatment Humira is expanding its market share in both Europe and the United States. Last year's sales more than doubled compare to the previous year, recording KRW 349.1 billion. The 2024 global sales of Vegzelma, a biosimilar to the anticancer drug Avastin, expanded more than four-fold compared to the previous year, with KRW 221.2 billion. Based on the company's direct-sales marketing network and competitive production cost, Vegzelma showed fast growth, recording a market share of 29% in Euope and reaching No.1 in the list. Celltrion employee said, "This year, we will ensure the internal stability of the company by launching a new portfolio, improving production cost, and generating cost-effectiveness. We plan to continue company growth quantity-wise and quality-wise." He said, "This year's production cost rate will be improved quickly by depleting the remaining stock with high production costs, expanding Plant 3 production, and terminating compensation for the development cost of existing products.

- Company

- Samsung Bioepis launches Stelara biosimilar Pyzchiva in US

- by Whang, byung-woo Feb 26, 2025 06:29am

- Pic of Pyzchiva Samsung Bioepis announced on the 25th that its autoimmune disease treatment Pyzchiva (ustekinumab) has been launched in the US through its marketing partner Sandoz. Stelara’s biosimilar Pyzchiva is Janssen’s treatment for autoimmune diseases such as psoriasis, psoriatic arthritis, Crohn's disease, and ulcerative colitis. Stelara’s annual global sales are about KRW 15 trillion (USD 10.361 billion), and its sales in the United States are about KRW 10 trillion (USD 6.72 billion). Pyzchiva is an autoimmune disease treatment that inhibits the activity of interleukin (IL)-12,23, a type of inflammatory cytokine involved in immune responses. With the launch of Pyzchiva, Samsung Bioepis has expanded its portfolio in the US market with the launch of its third autoimmune disease treatment, an interleukin inhibitor, following the launch of two existing autoimmune disease treatments that are tumor necrosis factor-alpha (TNF-a) inhibitors. This is the company's fifth product in the US market, including anticancer drugs and ophthalmic disease treatments. “With the launch of Pyzchiva in the US, we will be able to provide a variety of treatment options for patients with autoimmune diseases,“ said Linda Y. MacDonald, Executive Vice President and Head of Global Commercial Division at Samsung Bioepis. “Expanding treatment options will reduce medical costs and ultimately contribute to the establishment of a sustainable healthcare system.” ”We will continue to work to address unmet needs in the US pharmaceutical market,” she added. Meanwhile, Samsung Bioepis is also selling Pyzchiva through Sandoz in Europe and is ranked first in the biosimilar market with a 43% share of the European Stelara biosimilar market. In addition, in South Korea, Epyztek (the domestic brand name for Samsung Bioepis’s Stelara biosimilar) was launched and sold in July last year through a direct sales system at about 40% lower price than the original drug.

- Company

- Celltrion’s Actemra biosimilar Avtozma receives EU approval

- by Chon, Seung-Hyun Feb 25, 2025 05:56am

- Celltrion announced on the 24th that it has received approval from the European Commission (EC) for the marketing authorization of its ‘Avtozma, a biosimilar of the autoimmune disease treatment 'Actemra (tocilizumab).’ The final approval was granted 2 months after receiving a recommendation for approval from the Committee for Medicinal Products for Human Use (CHMP) under the European Medicines Agency (EMA) in December last year. The approval of Avtozma was granted for the main indications of the original drug such as rheumatoid arthritis (RA) and giant cell arteritis (GCA). Celltrion obtained approval for Avtozma in South Korea at the end of last year and in the United States last month. Actemra is an interleukin inhibitor that reduces inflammation by inhibiting the interleukin (IL)-6 protein, which is involved in the induction of inflammation in the body. In 2023, global sales of Actemra posted approximately CHF 2.63 billion (KRW 4 trillion). Celltrion has received approval for a total of four products this month alone, including Avtozma, Eydenzelt (Eylea biosimilar), Osenvelt, and Stoboclo (Prolia and Xgeva biosimilars). Celltrion plans to build a more enhanced product lineup in the autoimmune disease market and significantly expand its therapeutic areas, including bone and eye diseases, to expand product synergies in major countries, including Europe. “Through a series of product approvals in Europe, we have achieved our goal of 'building a product lineup of 11 products by 2025' without a hitch and once again demonstrated our ability to develop our own drugs in the market,” said a Celltrion official. ”We will do our best to accelerate our entry into the global market and speed up our growth by focusing on the remaining approval procedures and commercialization.”

- Company

- Antibody drugs, AI, and platform companies go public

- by Cha, Jihyun Feb 25, 2025 05:56am

- Domestic pharmaceutical, bio, and healthcare companies are floating IPOs one after another. Organoid Sciences is the first to challenge the market with its gap technology. IntoCell plans to submit a securities report as early as next month. Companies in various fields, including biotech companies that develop new drugs, medical artificial intelligence (AI) companies, and drug platform developers, are also preparing their listings on KOSDAQ. According to the Financial Supervisory Service on the 24th, Neurophet submitted a preliminary application for a special case for technology and growth listing to the Korea Exchange on the 21st. Last August, the company received an A rating from the Korea Technology Finance Corporation, and a BBB rating from the Korea Technology Credit Evaluation, both exchange-designated evaluation agencies, about six months after passing technology evaluations. Neurophet is a developer of AI solutions for imaging brain diseases. Its flagship products include Neurophet Aqua AD, a software that monitors the therapeutic effects and side effects of dementia drugs, and Neurophet Aqua, an imaging analysis software for brain nerve degeneration. Neurophet Aqua AD provides all the brain imaging analysis functions required for the administration of dementia drugs by quantitatively analyzing magnetic resonance imaging (MRI) and positron emission tomography (PET) images. It selects the patient groups who will benefit from the anti-amyloid drug before administration and analyzes the side effects and effects of the treatment process. From the patient's point of view, it can reduce the risk of treatment side effects, and from the medical staff's point of view, it can reduce the burden of reading images. As the effectiveness of the treatment can be analyzed, the possibility of successfully developing new drugs and the efficiency of clinical operations can be dramatically improved. Neurophet Aqua AD was launched in the second half of last year. Based on this, the company is also continuing to grow its external profile. In 2023, the company generated sales of KRW 1.6 billion on a separate basis, an increase of 141% from the previous year. The company is growing rapidly every year, with KRW 45 million in 2020, KRW 100 million in 2021, and KRW 600 million in 2022. The company explained that the more prescriptions for amyloidosis treatments are made, the more Neurophet products will be used. Neurophet plans to list a total of 11,476,035 shares, including 2 million shares to be offered to the public. Mirae Asset Securities is the listing sponsor. As a result, 3 pharmaceutical, biotech, and healthcare companies have applied for preliminary listing this year alone. On the 24th of last month, Novelty Nobility submitted a preliminary listing application to the Korea Exchange. The company received an A grade from two exchange-designated evaluation agencies in July of last year. Novelty Nobility is an antibody drug development company established in 2017. It is conducting R&D on anticancer drugs, eye diseases, and autoimmune diseases using the “one-source multi-use” strategy, which applies a single antibody to various modalities. It has a fully human antibody platform, PREXISE-D, using humanized mice, and a third-generation linker technology, PREXISE-L. Novelty Nobility plans to list a total of 16,914,564 shares, including 2,208,000 shares to be offered to the public, through this IPO. The listing sponsor is Shinhan Investment Corp. G2GBio, a developer of long-acting injectable drugs, also applied for preliminary listing on the KOSDAQ on the 18th. G2GBio received an A grade from both NICE D&B and Korea Rating & Data in August last year, thus clearing the first hurdle to be listed on the KOSDAQ as a special case for technology and growth. G2GBio owns the technology to manufacture microparticles as small as micrometers (㎛) called 'InnoLAMP'. This is a technology that can quickly produce uniform microparticles in large quantities. This has enabled CJ to secure a pipeline of products including GB-5001/GB-5112, a drug for the treatment of dementia, GB-6002, a drug for the treatment of pain after surgery, and GB-7001, a drug for the treatment of diabetes. G2GBio is listing a total of 5.128836 million shares, including 665,000 shares to be offered to the public. Mirae Asset Securities is the listing sponsor. There are also companies that have begun their IPO process in earnest. Organoid Sciences will conduct a demand forecast for institutional investors for 5 business days starting on the 7th of next month. Afterwards, the final offering price will be confirmed on the 17th of the same month, and subscriptions from institutional and general investors will be conducted for 2 days from the 19th to the 20th. Organoid Sciences has set out to be the first company to be listed with the super gap technology special case. The Super gap technology special exemption system was newly established by the financial authorities last year, which allows companies in the fields of advanced and strategic technologies that need to be fostered at the national level, such as deep tech and deep science, to be evaluated for technological excellence based on their growth potential in the market. A company can pass the technology evaluation by receiving an A grade from only one professional evaluation agency designated by the Korea Exchange. Organoid Sciences Organoid Sciences was established in 2018 with the goal of using organoid technology to overcome the shortage of organs in real life. Organoid is a compound word of 'organ' and the suffix 'oid'. Stem cells or organ-based cells are cultured or recombined into structures similar to organs. As of the end of last year, Cha Biotech holds a 9.27% stake in Organoidis. Organoid Sciences is creating a revenue base by commercializing its self-developed platform. Following the launch of its spatial biology-based genetic analysis platform 'Odyssey' at the end of 2022, it launched 'Organoid' last year, a researcher-oriented organoid culture service. It is also selling a drug evaluation platform 'ADIO' to pharmaceutical companies. As a result, the company's consolidated sales, which were around KRW 300 million in 2021, are expected to increase to KRW 1.6 billion by 2023. Organoid Sciences plans to list a total of 6,494,950 shares, including 1.2 million shares to be offered to the public. The listing sponsor is Korea Investment Securities. The offering structure is 100% new shares. The IPO proceeds will be used to advance the company's technology and global expansion. IntoCell, a biotech company specializing in antibody-drug conjugates (ADCs), plans to file an IPO registration statement by the end of next month at the earliest. IntoCell received preliminary approval for listing at the end of August last year and obtained preliminary approval for listing last month. It took 98 business days from the submission of the preliminary approval for listing to the results of the preliminary review for listing on the Korean exchange. IntoCell was founded in 2015 by Taekyo Park, co-founder of LigaChem Biosciences. Park is a bio expert who earned a Bachelor's and Master's degree in Chemistry from Seoul National University and a doctorate in Chemistry from the Massachusetts Institute of Technology (MIT). He is one of the 7 co-founders of Ligachem Bio, having worked at the LG Life Sciences Research Institute. As Chief Technology Officer (CTO), he is also the person who laid the foundation for the LigaChem Biosciences’ ADC platform. IntoCell has strengths in the linker, one of the three elements of ADC: antibody, linker, and drug (payload). It presents its in-house developed linker platform, OHPAS, as its core competitive advantage. Linkers are divided into left linkers that attach antibodies and right linkers that attach drugs, and the company has technology specialized in the right linker. In addition, 'PMT' (Payload Modification Technology) is also a core platform of IntoCell. It is a technology that minimizes the penetration of highly toxic drugs into normal cells by coating them with a membrane. This increases the therapeutic index (TI), which is the difference between the dose at which the drug begins to show efficacy and the dose at which side effects appear. CEO Park completed the development in 2021. IntoCell The main pipeline is the ADC candidate 'B7-H3' based on the Opus and PMT platforms. It is expected to secure final preclinical data within this month. The goal is to submit an IND for Phase I clinical trials in the first half of this year and enter clinical trials within the year. In addition, IntoCell has a total of 10 pipelines, including lead optimization candidates such as Trop2-ADC, HER2 ISAC, and HER3 ADC. IntoCell is also making tangible achievements. Following the technology export of its platform to Swiss ADC Therapeutics in early 2023, it signed a research collaboration agreement (RCA) with Samsung Bioepis at the end of the same year. The main goal is to develop ADC new drug candidates using the IntoCell platform technology for up to 5 targets. Samsung Bioepis has received a lot of attention from the industry as it was selected as the first new drug development partner. In addition, ▲ImmunOncia, ▲Genosco ▲GC Genome ▲Proteina, etc. are awaiting the results of the examination after submitting a preliminary prospectus to the Korea Exchange. ImmunOncia and Genosco are also bio-ventures that are highly sought after by investors. ImmunOncia, a company specializing in the development of immunotherapeutics, is a joint venture established in 2016 by Yuhan Corp and Sorrento Therapeutics of the United States. At the end of 2023, Yuhan Corp acquired all of Sorrento's shares, holding a 67% stake. ImmunOncia filed a preliminary listing request in October last year after passing the technical evaluation in April last year. Genosco filed a preliminary hearing request for a technical special listing in October last year. Genosco is famous as the original developer of Leclaza, the 31st domestically produced new drug and the first domestically produced new anticancer drug approved by the US Food and Drug Administration (FDA). In early 2010, the company developed a candidate substance with its parent company, Oscotec, and in 2015, it exported the technology to Yuhan Corp at the pre-clinical stage. In April last year, Genosco passed the technical evaluation by receiving an AA rating from two professional evaluation agencies. Genosco is the only new drug developer to have received the highest rating (AA·AA) in the technical evaluation. Even if the scope is expanded to the pharmaceutical, bio, and healthcare industries, there is only one company, Lunit, a medical artificial intelligence (AI) company. GC Genome, a genomics analysis subsidiary of the GC Group, submitted a preliminary review request for listing on the KOSDAQ exchange at the end of last year. It plans to list a total of 22.5 million shares, including 2,944,445 shares to be offered to the public. Proteina, a protein-protein interaction (PPI) big data analysis company, also applied for a preliminary injunction in November last year. Proteina is a bio-venture company established in 2015 that uses its own big data technology to help domestic and foreign pharmaceutical companies develop new drugs.

- Company

- Will overcoming CDRC review lead to reimb for 'Besremi'?

- by Eo, Yun-Ho Feb 25, 2025 05:56am

- Product photo of Besremi Whether 'Besremi,' used to treat polycythemia vera, will be added to the National Health Insurance reimbursement list has gained attention. According to the industry sources, PharmaEssentia's Besremi (ropeginterferon alfa-2b) is awaiting to be considered for the Health Insurance Review and Assessment Service (HIRA)'s Drug Reimbursement Evaluation Committee (DREC) review. It is expected to be considered for the DREC review in March. It is Besremi's second attempt at obtaining reimbursement. The company proceeded with the reimbursement process in March 2023 for the treatment of hydroxyurea-refractory/resistant polycythemia vera. The drug did not overcome the Cancer Disease Review Committee (CDRC) hurdle. At the time, the CDRC determined that Besremi lacked evidence for clinical utility as a second-line treatment. After that, PharmaEssentia added Besremi's domestic clinical documents, supplemented efficacy evidence as a second-line treatment, and re-submitted the reimbursement application in March last year. In the same year, it passed the CDRC in July. The CDRC established a reimbursement standard for Besremi as a 'treatment of polycythemia vera in low-risk (exclusively to patients who need cell depletion therapies) or high-risk patient groups without accompanying enlarged spleen.' Likewise, it is to be closely watched whether Besremi, with multiple attempts, will achieve success this year. Besremi is a next-generation interferon designed to selectively eliminate Janus kinase 2 (JAK2) gene, which causes polycythemia vera. With the improvement made to purity and tolerability of the previous interferon agents, this drug was designed to be taken once every 2 weeks for the initial 1.5 years, then once every 4 weeks. Besremi is now recommended by the National Comprehensive Cancer Network (NCCN) and the European LeukemiaNet (ELN) as treatment for polycythemia vera regardless of previous therapy history. Meanwhile, polycythemia vera is a rare blood cancer where somatic cell mutation in bone marrow causes abnormal activation of bone marrow function, resulting in the overproduction of red blood cells. According to the HIRA resources, the number of patients in Korea with the disease is about 5,000, and hydroxyurea is used in most patients. However, polycythemia vera is a disease with high unmet needs because the current drugs that are covered by reimbursement cannot treat the underlying causes of the disease, and no alternative treatment options exist when patients fail hydroxyurea treatment.

- Company

- "Increasing role of Kisqali in breast cancer therapy"

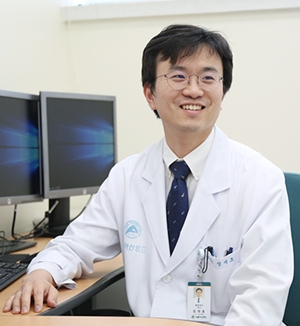

- by Whang, byung-woo Feb 24, 2025 05:51am

- The introduction of CDK 4/6 inhibitors has changed the treatment paradigm for metastatic breast cancer, addressing previously unmet needs. The introduction of a new treatment option has been positively evaluated because the existing endocrine therapy, which is used as first-line treatment for HR+/HER2 advanced and metastatic breast cancer, accompanies specific adverse responses, such as thrombosis and musculoskeletal adverse reactions associated with estrogen deprivation. Dr. Jae Ho Jeong, Professor of the Department of Oncology at Asan Medical Center located in SeoulAs CDK4/6 inhibitors have been approved in South Korea, the impact of new treatment options is gradually expanding. During the meeting with Daily Pharm, Dr. Jae Ho Jeong, Professor of the Department of Oncology at Asan Medical Center located in Seoul, stressed the importance of strengthening new drug access to improve treatment settings for HR+/HER2- advanced∙metastatic breast cancer in South Korea. The number of breast cancer patients in South Korea has been increasing for the past five years, from 2018 to 2023. HR+/HER2- breast cancer type accounts for approximately 60-70% of all metastatic breast cancer. Currently, the five-year survival rate of patients with early breast cancer is high, at over 90%, but the survival rate of patients with metastatic breast cancer is reported to be very low. Dr. Jeong said, "Despite the high overall survival rate for breast cancer, the five-year survival rate is only 32% when diagnosed as advanced‧metastatic breast cancer." Adding, "Difficult-to-treat cases often include existing multiple metastasis from diagnosis. When patients show resistance to first-line treatment, cancer progression becomes rapid, and patients have poor prognosis." "Advanced‧metastatic breast cancer has difficult remission and can easily relapse. Thus, the treatment goal is to consider the tumor characteristics, minimize side effects, and extend the progression-free survival (PFS) and overall survival," Dr. Jeong Said. "When establishing a treatment strategy, menopause, cancer progression, internal organ metastasis, and patient's overall health status must be considered." According to Dr. Jeong, the global guidelines (NCCN, ASCO, ESMO) recommend combination therapy containing endocrine therapy and CDK4/6 inhibitor as a first-line treatment for HR+/HER2- advanced breast cancer. A therapy with CDK4/6 inhibitor is recommended first instead of a cytotoxic anticancer agent for aggressive disease type." "The introduction of CDK4/6 inhibitors changed a paradigm for HR+/HER2- breast cancer" Data on CDK4/6 inhibitors for HR+/HER2- breast cancer have been competitively presented. Kisqali (ribociclib)'s 'RIGHT Choic subgroup study' results presented at the San Antonio Breast Cancer Symposium (SAVCS 2024) have gained attention. Based on the RIGHT Choice clinical study and the subgroup study, the clinical utility of Kisqali has been confirmed for HR+/HER2- breast cancer patients with internal organ metastasis and aggressive characteristics. In the study, endocrine therapy in combination with Kisqali demonstrated improved the median progression-free survival (mPFS) in various subtypes of HR+/HER2- advanced metastatic‧breast cancer than a combination therapy with chemotherapy. Dr. Jeong mentioned regarding this, "When a disease shows aggressive characteristics, chemotherapy, rather than endocrine therapy, is typically widely used in clinical practices. Thus, the results of the RIGHT Choice study hold significant importance." "Breast cancer is not a single type of disease and includes different tumors with various clinical characteristics and show different responses to disease progression and treatments. Depending on these groups, the analysis of the RIGHT Choice study showed that long PFS in the Kisqali combination therapy group," Dr. Jeong said. Dr. Jeong believes that more studies like these will enable customized treatments, allowing patients to receive appropriate treatment. Based on three Phase 3 clinical studies, including the NALEESA-2,3,7 study, Kisqali was confirmed to have consistent improvement to overall survival regardless of menopause status, treatment number, and combined treatment in advanced‧metastasis breast cancer patients. These study results will likely yield synergy. "Kisqali demonstrated benefits in OS survival through three clinical studies, where the quality of life was maintained and improved, regardless of the existence of combined treatments, the number of treatments, menopause status, metastasis location and number," Dr. Jeong said. "The effectiveness of Kisqali was confirmed in premenopausal patients, extending the treatment paradigm." "Changes to breast cancer treatment option…time to consider patient access" In addition to the global clinical study, the efficacy result of Kisqali from the real-world setting in South Korea was presented at the 2024 ESMO ASIA. Likewise, Kisqali's effect has been demonstrated in clinical settings. Dr. Jeong explains that no significant safety-related issues have not been reported for Kisqali, other than general side effects like fatigue and rashes, when prescribed. Compared to clinical studies, these side effects are manageable. "Considering a high percentage of premenopausal patients, Kisqali offers a benefit for use regardless of the menopause status. Effects and safety of Kisqali were demonstrated in these patient groups, and it has become a new standard therapy," Dr. Jeong said. "Furthermore, Kisqali has the advantage of increasing patient adherence because it offers convenience in dosage changes and administration guidance," Dr. Jeong said. "It is possible to change the dosage with the same formulation by changing the number of tablets. Given that a system to reduce re-purchase burden when changing a dosage has been introduced, the drug is gaining a positive review in clinical settings." However, Dr. Jeong says that expanded reimbursement standard is crucial to ensure patients to benefit from these new drugs. The introduction of CDK4/6 inhibitors has robustly changed the treatment paradigm for HR+/HER2- advanced‧metastatic breast cancer treatment. Thus, it is necessary to strengthen new drug access. Dr. Jeong said, "As better treatment options are available for not only HR+/HER2- metastatic breast cancer but also other types of metastatic breast cancer, positive changes have been brought. To improve treatment settings for HR+/HER2- advanced‧ metastatic breast cancer in South Korea, expanded National Health Insurance reimbursement standard and strengthened new drug access are needed." Ultimately, Dr. Jeong said, "It is important to improve patient access to new treatment options through securing medical facilities and expanding clinical study participation." "Accumulating clinical data that reflects the characteristics of Korean patients is important for establishing a foundation that can influence global guidelines."

- Company

- Will Prevnar 20 be included in NIP in 1H 2025?

- by Whang, byung-woo Feb 24, 2025 05:51am

- Pfizer is seeking to release Pfizer’s new pneumococcal vaccine, Prevenar 20, in the first half of this year with its inclusion in the National Immunization Program (NIP) for children. Pic of Prevnar20 According to industry sources, the Korea Disease Control and Prevention Agency and Pfizer have made progress in discussions on whether Prevnar20 should be included in the NIP. Prevenar 20 is a new pneumococcal vaccine that Pfizer has introduced in 14 years, and it is a vaccine that adds 7 serotypes (serotypes 8, 10A, 11A, 12F, 15B, 22F, and 33F) to the previously supplied Prevenar13. It can be administered to infants, children, and adolescents aged 6 weeks to 18 years and adults aged 18 years or older, according to the indications set by the Ministry of Food and Drug Safety. Initially, it was widely believed that the entry of Prevenar 20 into the NIP would be delayed until next year. This is because, in January, the Public Procurement Service announced a plan to execute a tender for the purchase of goods worth approximately KRW 120.2 billion, for a total of 163 cases, including the demand of the Korea Disease Control and Prevention Agency for “13-valent pneumococcal conjugate vaccine for children (PCV13) in 2024.” With the current situation where Prevenar 13 has entered the NIP, there is no reason for the KDCA to rush to include Prevnar20 into the NIP, and with the Public Procurement Service announcing its bidding plan, the industry expected Prevnar20’s inclusion into the NIP will be further delayed. However, as discussions on the NIP for Prevenar 20 have progressed since then, it is expected that it will be included in the NIP as early as the first half of this year. In this process, the view that Pfizer has found a compromise for Prevnar20’s price with the government. Nevertheless, there are still many processes to go through, including discussions with the Korea Expert Committee on Immunization Practices. If there is an issue, the is whether the NIP for Prevenar13 will be maintained and administered simultaneously with Prevnar20, or whether it will be completely switched to Prevnar20, and whether there will be cross-inoculation with Vaxneuvance, a vaccine that entered the NIP last year. However, considering how Prevnar20 is already recommended in major guidelines overseas, there is no major hurdle to Prevnar20's entry into the NIP if there is no cost issue. The infant and child sales for Prevnar20 will be maintained by Korea Vaccine, which was previously in charge of the sales of Prevenar13. In January, Pfizer Korea and Korea Vaccine signed a new strategic partnership for Prevnar20, which will be launched in Korea, following the partnership they signed in 2013. Prevnar20 is expected to be launched in Korea as early as April. As with Vaxneuvance, it will be able to take advantage of the favorable conditions of entering the NIP as soon as it is launched, depending on the results of the NIP discussion. In this case, Prevnar20 will likely be used as a sales strategy to naturally absorb the share of Prevenar13. A Pfizer official said, “We are doing our best internally to ensure that Prevnar20 is quickly introduced into NIP. We are working closely with relevant departments to prepare the necessary procedures.”

- Company

- Primary biliary cholangitis drug Iqirvo to land in Korea

- by Eo, Yun-Ho Feb 24, 2025 05:51am

- The new drug for primary biliary cholangitis Iqirvo may soon be launched in Korea. According to industry sources, Ipssen Korea is in the process of obtaining marketing authorization from the Ministry of Food and Drug Safety for Iqirvo (elafibranor), a dual peroxisome proliferator-activated receptor (PPAR) alpha/delta (PPAR α, δ) agonist. The drug was also designated as a rare drug in Korea in June last year. Iqirvo obtained accelerated approval from the US FDA in June last year for the indication of primary biliary cholangitis. Specifically, the drug is indicated for the treatment of adult patients with primary biliary cholangitis (PBC) who have shown an insufficient response to ursodeoxycholic acid (UDCA) or who cannot use UDCA monotherapy due to tolerability issues. The FDA's accelerated approval was based on the Phase III ELATIVE study's alkaline phosphatase (ALP) reduction data, and it has not been proven to improve survival or prevent liver function deterioration. Ipssen is currently conducting the confirmatory clinical trial, ELFIDENCE. The results of this trial will determine whether the drug’s approval will stand further. In the study, elafibranor demonstrated that it is an effective second-line treatment for PBC that has favorable benefit and risk data. Meanwhile, at last year's European Association for the Study of the Liver Annual Meeting (EASL 2024), two additional analyses of the Phase III ELATIVE clinical trial, which is evaluating the safety and efficacy of elafibranor in 161 patients with primary biliary cholangitis who do not respond adequately to ursodeoxycholic acid (UDCA) or are intolerant of it, were released in one after another. Additionally, the results of the open-label study were analyzed at week 72, and 30 of the 108 patients (28%) were assigned to the elafibranor group and 13 of the 53 patients (25%) were assigned to the placebo group maintained treatment through week 72.

- Company

- Pricing negotiations for Vocabria+Rekambys combo complete

- by Eo, Yun-Ho Feb 24, 2025 05:51am

- The long-acting HIV drug Vocabria+Rekambys combination therapy is on the verge of being reimbursed in Korea, 2 years after its approval. According to industry sources, GSK Korea recently concluded drug price negotiations with the National Health Insurance Service for the combination therapy of the new HIV drugs Vocabria (cabotegravir) and Rekambys (rilpivirine). Rekambys is Janssen Korea’s product, and GSK was responsible for its reimbursement process. Accordingly, the combination therapy of the 2 drugs is expected to be reimbursed soon if it passes the Health Insurance Policy Deliberation Committee review. The two drugs were approved by the Ministry of Food and Drug Safety in February 2022 as a combination therapy for the treatment of HIV-1 infection in adult patients who are virologically suppressed, have no history of virological failure, and have no known or suspected resistance to cabotegravir or rilpivirine. The advantage of this combination therapy is undoubtedly its convenience in administration. While existing HIV treatments require patients to take a tablet formulation once a day, the two injectable drugs will reduce the frequency of administration to once a month or once every two months with intramuscular injections, increasing satisfaction and reducing the burden on patients. The 2 drugs were originally developed as oral medications and then were developed into injectable drugs. While this long-acting injectable drug cannot cure HIV infection, it is a treatment that targets white blood cells to help lower and maintain the level of the AIDS virus. Meanwhile, the efficacy and safety of the Vocabria+Rekambys combination therapy was demonstrated in clinical trials in groups that received the drug once every four weeks or once every eight weeks. The combination was approved in Europe in December 2020. In the clinical trial, the most frequently observed adverse reactions in the group that received the Vocabria+Rekambys combination were injection site reactions, headache, fever, nausea, fatigue, asthenia, and myalgia. In addition, the indication for combination therapy has been expanded to include adolescent patients in Europe.